Cermati Invest Weekly Update 26 Januari 2026

Ulasan Pasar

| INDONESIA | W (-/+) % | HARGA |

|---|---|---|

| IHSG | -1.37% | 8,951.01 |

| ISSI | -0.09% | 224.72 |

| IDX30 | -0.78% | 448.96 |

| FTSE Indonesia | -1.75% | 3,177.52 |

| MSCI Indonesia | -3.11% | 6,336.29 |

| Dolar Amerika | -0.41% | 16,815 |

Provided by Cermati Invest, last update 23 January 2026

IHSG & Saham Pekan Ini

Indeks, berdasarkan data Bursa Efek Indonesia (BEI) pekan lalu, IHSG turun 1.37% dari 9075.40 menjadi 8951.01 menutup support gap 8956.727. IHSG tidak mampu mempertahankan tren positif usai mencapai level tertinggi baru (ATH) 9174.474 pada penutupan Selasa (20/1/2026). Diprediksikan pekan ini IHSG bergerak menuju 8776.97 (support) - 9028.839 (resistance).

Meski pasar tengah bergejolak, fondasi makroekonomi Indonesia dinilai masih relatif solid. Bank Indonesia memproyeksikan pertumbuhan ekonomi 2026 berada di kisaran 4.90% - 5.70%, sementara untuk 2025 diperkirakan sebesar 4.70% - 5.50%.

Pekan ini rapat Federal Open Market Committee (FOMC) dijadwalkan berlangsung pada 28–29 Januari 2026, hasilnya akan menjadi penentu utama arah risk appetite pasar global, khususnya bagi negara berkembang, serta memengaruhi pergerakan imbal hasil dolar AS yang berdampak langsung pada rupiah dan IHSG. Arah IHSG ke depan akan lebih ditentukan oleh stabilisasi rupiah dan potensi pembalikan foreign flow.

Sejak awal 2026 IHSG bergerak naik +3.52%. Sektor yang paling tertekan sepanjang pekan lalu antara lain Transportasi dan Industri, ditambah dengan Teknologi dan Energi.

Saham, beberapa saham yang jadi pilihan antara lain: TLDN, DAYA, EXCL, AADI, ASGR, TKIM, MDKA, SMAR, DSSA, INKP, AALI, PTBA.

Pergerakan Rupiah

Pekan lalu nilai tukar 1 dolar Amerika terhadap rupiah sempat menyentuh rekor tertinggi sepanjang sejarah (ATH) Rp17.015. Jika rupiah tidak segera menguat kembali, ke depannya akan tembus ke atas Rp17.400 per 1 dolar Amerika. Sejak awal 2026 nilai tukar 1 dolar Amerika terhadap rupiah naik 0.71%.

| KOMODITAS | W (-/+) % | HARGA |

|---|---|---|

| Emas | 8.44% | 4,982.91 |

| Perak | 14.45% | 101.33 |

| Platina | 18.82% | 2,772.45 |

| Nikel | 5.04% | 18,562.13 |

| Timah | 7.92% | 51,743 |

| Alumunium | 1.10% | 3,175.35 |

| Minyak Mentah | 2.74% | 61.07 |

| Minyak Sawit | - | 4,480 |

| Gas | 70.00% | 5.28 |

| Batu Bara | 0.14% | 109.00 |

| Tembaga | 2.85% | 13,171.90 |

Provided by Cermati Invest, last update 23 January 2026

Emas & Kripto

Menunjukkan tren kenaikan signifikan di berbagai pasar, baik global maupun domestik. Harga emas dunia bahkan mencatatkan angka tertinggi baru (ATH) di US$4990.12 per troy ounce. Kondisi pasar emas saat ini dipengaruhi oleh spekulasi pemangkasan suku bunga sebesar 25 basis poin oleh bank sentral AS, Federal Reserve (The Fed), serta ketegangan geopolitik yang berkelanjutan. Faktor-faktor ini secara kolektif mendorong harga emas naik ke level yang belum pernah terjadi sebelumnya (ATH). Dolar Amerika Serikat yang melemah terhadap mata uang utama dunia juga turut menjadikan emas lebih menarik. Walaupun ada support gap di US$4619.075 tetapi kenaikan harga emas yang luar biasa ini dapat menuju resisten US$5347.14 dalam waktu singkat.

Di Indonesia, harga emas murni bervariasi antara Rp2.750.000—Rp2.950.000 per gramnya, sedangkan harga emas fisik atau emas batangan berkisar Rp3.050.000 — Rp3.650.000 per gram, lebih mahal karena ada biaya cetak dan garansi keaslian yang diakui dunia.

Sejak awal 2026, harga emas dunia naik +15.38%, perak +44.30%, dan platinum +34.94%. Sedangkan emas domestik naik +16.23%.

Kripto,

| KRIPTO | W (-/+) % | HARGA |

|---|---|---|

| Bitcoin | -5.79% | 89,600 |

| Etherium | -10.47% | 2,956.95 |

| Solana | -11.51% | 127.08 |

Provided by Cermati Invest, last update 23 January 2026

Pasar kripto masih dalam masa konsolidasi, bergerak sideways dan belum ada tren, seimbang antara permintaan dan penawaran.

Bitcoin (BTC), sideways dalam kisaran US$84476 - US$99000. Pekan ini menentukan, apakah cenderung turun menuju US$80522 atau rebound kembali. Sejak awal 2026, BTC turun 1.25%.

Ethereum (ETH), sideways dalam kisaran US$2796 - US$3445. Cenderung turun menuju US$2620. Sejak awal 2026, ETH turun 5.28%.

Investor disarankan tetap berhati-hati, menghindari spekulasi berlebihan, serta melakukan diversifikasi dan menggunakan stablecoin untuk mengelola risiko volatilitas.

| REGIONAL | W (-/+) % | HARGA |

|---|---|---|

| Dow Jones | -0.53% | 49,098.71 |

| S&P 500 | -0.35% | 6,915.61 |

| FTSE 100 | -0.90% | 10,143.44 |

| DAX | -1.57% | 24,900.71 |

| Nikkei 225 | -0.17% | 53,846.87 |

| Hang Seng | -0.36% | 26,749.51 |

| CSI 300 | -0.62% | 4,702.50 |

| KOSPI | 3.08% | 4,990.07 |

Provided by Cermati Invest, last update 23 January 2026

Reksa Dana

Reksa dana pekan ini berdasarkan performa terbaik sejak awal tahun, berikut pilihannya:

- Reksa Dana Pasar Uang: SAM Dana Kas.

- Reksa Dana Pendapatan Tetap: HPAM Pendapatan Tetap Prima dan SAM Sukuk Syariah Sejahtera.

- Reksa Dana Campuran: Trim Syariah Berimbang.

- Reksa Dana Saham: Trim Syariah Saham dan Cipta Saham Unggulan Syariah.

- Reksa Dana Mata Uang Dolar Amerika: Eastspring Syariah Equity Islamic Asia Pacific USD Kelas A dan Eastspring Syariah Greater China Equity USD Kelas A.

Bingung cari investasi reksa dana yang aman dan menguntungkan? Cermati Invest solusinya!

Surat Berharga

Pelemahan rupiah diiringi meningkatnya persepsi risiko, khususnya terkait kredibilitas kebijakan ekonomi nasional. Isu seputar disiplin fiskal serta independensi bank sentral dinilai investor telah mendorong kenaikan risk premium aset Indonesia, yang pada akhirnya menekan pasar saham dan obligasi.

Pasar Keuangan Beragam di Tengah Tekanan Fiskal dan Penantian Kebijakan Bank Sentral Amerika

Pasar keuangan Indonesia ditutup bervariasi pada akhir pekan lalu. IHSG tercatat melemah, sementara rupiah justru menguat terhadap dolar AS setelah sebelumnya hampir menyentuh level Rp17.000 per dolar AS. Dari dalam negeri, tekanan pasar berasal dari meningkatnya kekhawatiran terhadap kondisi fiskal pemerintah. Hal ini tercermin dari naiknya premi risiko serta sikap investor yang semakin berhati-hati. Prospek pelebaran defisit membuat pemerintah diperkirakan akan menambah penerbitan SBN, sehingga investor menuntut imbal hasil yang lebih tinggi. Arus keluar dana asing juga turut menekan pasar obligasi dan nilai tukar. Pelemahan rupiah memperbesar persepsi risiko, terutama pada instrumen dengan tenor menengah hingga panjang. Oleh sebab itu, konsistensi kebijakan fiskal, sinergi antara otoritas, serta pengelolaan likuiditas menjadi kunci untuk menjaga stabilitas pasar. Dari sisi global, perhatian pasar tertuju pada keputusan suku bunga The Fed yang akan diumumkan Kamis (29/1/2026) dini hari, di tengah meningkatnya ketegangan geopolitik dan ketidakpastian ekonomi global.

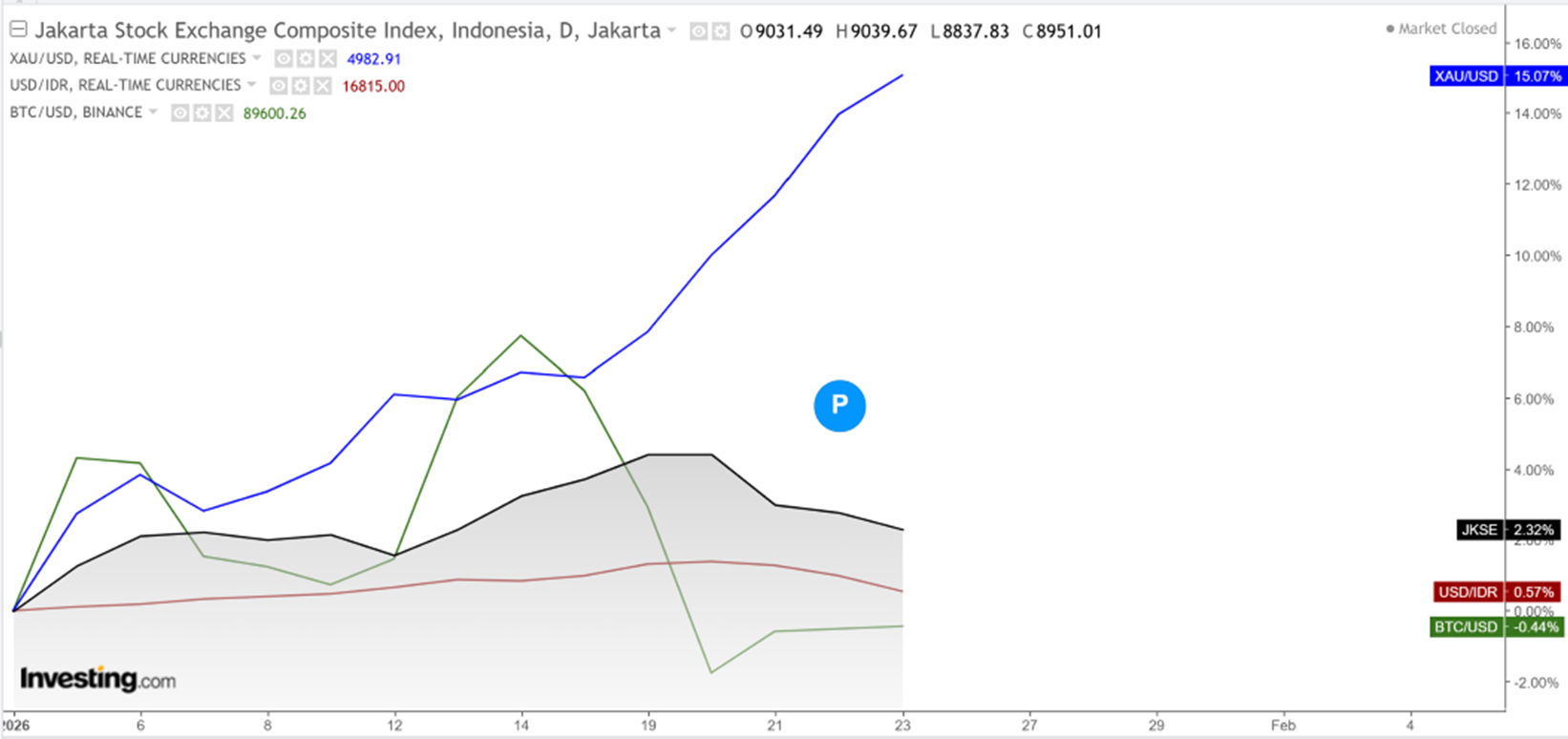

Performa IHSG (JKSE),EMAS (XAU/USD),BITCOIN (BTC/USD) & Dolar Amerika (XAU/USD) Tahun 2026

Reksa Dana

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana PASAR UANG | NAV | 1Bln | 3Bln | 6Bln | YTD | 1Th | 3Th | % | Tanggal | AUM |

| SAM Dana Kas | 1510.93 | 0.52% | 1.20% | 2.85% | 0.35% | 5.56% | 14.49% | 51.09% | 10 Feb 2017 | 55.99 M |

| BNI-AM Dana Likuid Kelas A | 2003.85 | 0.45% | 1.13% | 2.51% | 0.27% | 5.22% | 14.10% | 100.39% | 27 Dec 2012 | 502.39 M |

| Setiabudi Dana Pasar Uang | 1592.01 | 0.42% | 1.27% | 2.63% | 0.29% | 5.46% | 16.64% | 59.20% | 23 Dec 2016 | 544.42 M |

| BRI Seruni Pasar Uang III | 1856.58 | 0.41% | 1.16% | 2.53% | 0.28% | 5.27% | 15.69% | 85.66% | 16 Feb 2010 | 3.55 T |

| BRI Seruni Pasar Uang Syariah | 1405.47 | 0.41% | 1.15% | 2.49% | 0.27% | 5.27% | 16.26% | 40.55% | 19 Jul 2018 | 1.83 T |

| HPAM Ultima Money Market | 1703.22 | 0.41% | 1.31% | 2.79% | 0.27% | 5.50% | 16.08% | 70.32% | 10 Jun 2015 | 965.08 M |

| Insight Money Syariah | 1735.28 | 0.41% | 1.33% | 2.88% | 0.29% | 5.97% | 18.05% | 73.53% | 30 Sep 2015 | 187.11 M |

| Cipta Dana Cash | 1813.55 | 0.40% | 1.18% | 2.80% | 0.27% | 5.76% | 17.02% | 81.36% | 8 Jun 2015 | 547.10 M |

| Insight Retail Cash Fund | 1680.15 | 0.39% | 1.30% | 2.72% | 0.28% | 6.14% | 17.23% | 68.01% | 13 Apr 2018 | 225.80 M |

| Trimegah Kas Syariah | 1504.56 | 0.39% | 1.19% | 2.48% | 0.25% | 5.19% | 15.75% | 50.46% | 30 Dec 2016 | 1.73 T |

| Bahana Likuid Syariah Kelas G | 1270.84 | 0.38% | 1.19% | 2.47% | 0.25% | 5.15% | 15.42% | 27.08% | 12 Jul 2016 | 515.80 M |

| Danakita Stabil Pasar Uang | 1697.24 | 0.38% | 1.15% | 2.54% | 0.25% | 5.10% | 15.34% | 69.72% | 10 Sep 2015 | 66.76 M |

| Syailendra Dana Kas | 1778.08 | 0.38% | 1.23% | 2.63% | 0.24% | 5.28% | 15.31% | 77.81% | 12 Jun 2015 | 2.99 T |

| TRIM Kas 2 Kelas A | 2002.39 | 0.37% | 1.16% | 2.44% | 0.25% | 5.24% | 15.63% | 100.24% | 8 Apr 2008 | 8.17 T |

Provided by Cermati Invest, last update 23 January 2026

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana PENDAPATAN TETAP | NAV | 1Bln | 3Bln | 6Bln | YTD | 1Th | 3Th | % | Tanggal | AUM |

| HPAM Pendapatan Tetap Prima | 1098.38 | 0.65% | 1.85% | 4.65% | 1.58% | 8.33% | 22.65% | 15.13% | 29 Oct 2018 | 778.37 M |

| Syailendra Pendapatan Tetap Premium Kelas A | 1960.75 | 0.62% | 1.41% | 4.43% | 0.37% | 7.85% | 18.67% | 96.08% | 27 Mar 2017 | 2.48 T |

| Insight Haji Syariah | 5573.49 | 0.46% | 1.49% | 4.71% | 0.33% | 9.69% | 25.79% | 457.35% | 13 Jan 2005 | 2.55 T |

| Insight Renewable Energy Fund | 2523.17 | 0.46% | 1.56% | 5.12% | 0.33% | 9.66% | 24.86% | 152.32% | 22 Jun 2011 | 1.70 T |

| Bahana Mes Syariah Fund Kelas G | 1610.98 | 0.26% | 0.63% | 3.51% | -0.27% | 5.72% | 12.62% | 61.10% | 11 Nov 2016 | 125.07 M |

| UOBAM Inovasi Obligasi Nasional | 1106.36 | 0.18% | 0.86% | 4.57% | 0.41% | 7.24% | 16.72% | 10.64% | 12 Jan 2021 | 85.27 M |

| BRI Melati Pendapatan Utama | 2021.21 | 0.12% | 0.47% | 4.38% | -0.24% | 9.29% | 16.77% | 104.58% | 27 Sep 2012 | 186.72 M |

| SAM Sukuk Syariah Sejahtera | 2471.16 | 0.08% | 0.45% | 4.21% | 1.22% | 7.96% | 15.38% | 160.18% | 29 Oct 1997 | 50.63 M |

| BNI-AM Short Duration Bonds Index Kelas R1 | 1107.99 | 0.04% | -0.15% | 3.16% | -0.40% | 8.79% | 18.51% | 15.21% | 1 Sep 2022 | 218.76 M |

| BNI-AM Pendapatan Tetap Quality Long Duration Fund | 1670.28 | -0.43% | -0.67% | 2.91% | -0.93% | 8.13% | 14.43% | 73.06% | 16 Jun 2016 | 20.30 M |

| Syailendra Fixed Income Fund Kelas A | 2785.00 | -0.43% | -0.75% | 2.65% | -0.91% | 8.25% | 16.26% | 178.50% | 8 Dec 2011 | 191.08 M |

| Eastspring IDR Fixed Income Fund Kelas A | 1875.74 | -0.46% | -0.62% | 3.15% | -0.86% | 8.71% | 15.69% | 87.57% | 16 Mar 2015 | 192.59 M |

| Principal Total Return Bond Fund | 2689.78 | -0.56% | -0.73% | 3.10% | -0.88% | 8.66% | 12.70% | 176.56% | 21 Aug 2008 | 13.91 M |

| Eastspring Investments IDR High Grade Kelas A | 1665.18 | -0.68% | -0.89% | 2.66% | -1.13% | 8.55% | 16.01% | 76.37% | 9 Jan 2013 | 10.09 T |

| BRI Brawijaya Abadi Pendapatan Tetap | 1504.36 | -0.94% | -1.13% | 3.33% | -1.46% | 11.10% | 17.07% | 50.44% | 25 Feb 2019 | 120.60 M |

| HPAM Government Bond | 1665.11 | -1.08% | -1.42% | 2.38% | -1.51% | 8.71% | 18.63% | 74.01% | 18 May 2016 | 29.04 M |

Provided by Cermati Invest, last update 23 January 2026

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana CAMPURAN | NAV | 1Bln | 3Bln | 6Bln | YTD | 1Th | 3Th | % | Tanggal | AUM |

| TRIM Syariah Berimbang | 4545.75 | 12.83% | 22.04% | 29.03% | 9.40% | 39.07% | 53.85% | 354.58% | 27 Dec 2006 | 80.47 M |

| TRIM Kombinasi 2 | 3718.41 | 11.44% | 19.48% | 26.26% | 7.68% | 37.64% | 48.27% | 271.84% | 10 Nov 2006 | 50.85 M |

| Trimegah Balanced Absolute Strategy Kelas A | 2426.13 | 10.42% | 15.74% | 23.66% | 6.81% | 36.49% | 50.56% | 142.61% | 28 Dec 2018 | 565.67 M |

| Syailendra Balanced Opportunity Fund | 4946.35 | 9.50% | 19.41% | 43.23% | 7.88% | 49.35% | 58.06% | 394.64% | 22 Apr 2008 | 263.78 M |

| Setiabudi Dana Campuran | 1732.36 | 5.48% | 5.85% | 14.29% | 4.36% | 19.95% | 36.11% | 73.24% | 25 Sep 2017 | 71.40 M |

| Sequis Balance Ultima | 1322.93 | 3.94% | 4.72% | 8.88% | 2.76% | 7.45% | 12.53% | 32.29% | 8 Sep 2016 | 49.35 M |

| Batavia Dana Dinamis | 9218.76 | 3.52% | 4.01% | 5.39% | 3.04% | 2.11% | 2.55% | 821.88% | 3 Jun 2002 | 19.88 M |

| SAM Mutiara Nusantara Nusa Campuran Kelas A | 1705.53 | 2.10% | 1.18% | 5.32% | 0.65% | 2.67% | -3.27% | 70.55% | 21 Dec 2017 | 13.10 M |

| Danakita Investasi Fleksibel | 1484.03 | 1.18% | 1.66% | 2.88% | 1.04% | 2.72% | 7.84% | 48.40% | 8 Jun 2017 | 9.81 M |

| HPAM Flexi Indonesia Sehat Kelas A | 2499.02 | -1.53% | 1.45% | 12.79% | -2.12% | 28.45% | 54.43% | 149.90% | 2 Mar 2011 | 101.83 M |

Provided by Cermati Invest, last update 23 January 2026

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana SAHAM | NAV | 1Bln | 3Bln | 6Bln | YTD | 1Th | 3Th | % | Tanggal | AUM |

| TRIM Syariah Saham | 2620.00 | 14.91% | 23.82% | 34.37% | 11.25% | 47.04% | 41.83% | 162% | 27 Dec 2006 | 130.63 M |

| SAM Indonesian Equity Fund | 2984.57 | 10.72% | 21.01% | 47.57% | 5.50% | 44.67% | 70.87% | 255.43% | 18 Oct 2011 | 918.50 M |

| Principal Islamic Equity Growth Syariah | 1500.03 | 10.29% | 10.77% | 21.59% | 8.01% | 33.40% | 21.54% | 50% | 10 Sep 2007 | 73.04 M |

| Batavia Dana Saham Syariah | 1818.73 | 9.62% | 10.37% | 13.36% | 8.79% | 15.14% | -0.91% | 81.87% | 19 Jul 2007 | 37.90 M |

| Cipta Saham Unggulan Syariah | 2724.78 | 9.60% | 11.85% | 13.03% | 9.25% | 24.59% | 17.22% | 172.48% | 5 Sep 2018 | 15.49 M |

| BRI Syariah Saham | 951.90 | 8.91% | 16.65% | 28.90% | 5.98% | 36.72% | 10.12% | -4.81% | 18 Sep 2014 | 15.35 M |

| Bahana Primavera 99 Kelas G | 1447.60 | 7.68% | 15.21% | 18.02% | 4.56% | 18.74% | 11.87% | 44.76% | 5 Sep 2014 | 22.70 M |

| Principal Total Return Equity Fund Kelas O | 3863.27 | 6.65% | 9.29% | 17.56% | 4.74% | 25.40% | 13.11% | 286.33% | 1 Jul 2005 | 23.59 M |

| TRIM Kapital Plus | 5249.94 | 6.63% | 7.71% | 16.98% | 4.79% | 15.65% | 34.70% | 424.99% | 18 Apr 2008 | 504.57 M |

| Bahana Primavera Plus | 15342.00 | 6.38% | 20.07% | 23.47% | 5.23% | 34.10% | 8.51% | 1434.20% | 27 May 1997 | 84.90 M |

| BRI Mawar Konsumer 10 Kelas A | 1620.83 | 6.32% | 12.70% | 16.98% | 2.69% | 9.54% | 2.04% | 62.08% | 16 Feb 2011 | 184.17 M |

| UOBAM Sustainable Equity Indonesia | 1059.61 | 5.90% | 9.62% | 16.50% | 2.43% | 15.16% | 6.33% | 5.96% | 4 Aug 2021 | 41.11 M |

| Cipta Saham Unggulan | 3281.42 | 5.47% | 8.40% | 11.95% | 5.10% | 14.68% | 19.65% | 228.14% | 4 Dec 2018 | 30.85 M |

| TRIM Kapital | 12173.72 | 4.64% | 4.94% | 12.92% | 3.45% | 12.21% | 10.89% | 1117.37% | 19 Mar 1997 | 302.96 M |

| HPAM Ekuitas Syariah Berkah Kelas A | 2630.72 | 4.35% | 5.29% | 5.75% | 1.02% | 40.91% | 92.67% | 163.07% | 20 Jan 2020 | 1.33 T |

| BNI-AM Indeks IDX Growth30 Kelas R1 | 1187.33 | 4.33% | 7.83% | 11.47% | 3.63% | 7.65% | 7.26% | 18.73% | 27 Jan 2022 | 2.10 M |

| BNI-AM Inspiring Equity Fund | 1030.95 | 4.22% | 6.82% | 16.10% | 2.80% | 14.20% | 1.63% | 3.10% | 7 Apr 2014 | 1.27 T |

| Eastspring Investments Value Discovery Kelas A | 1364.77 | 4.19% | 7.41% | 14.19% | 2.30% | 8.87% | 3.11% | 36.48% | 29 May 2013 | 230.06 M |

| Danakita Saham Prioritas | 1212.57 | 3.99% | 5.15% | 8.75% | 3.30% | 7.96% | 10.13% | 21.26% | 17 Oct 2018 | 6.97 M |

| Principal Indo Domestic Equity Fund | 806.69 | 3.64% | 4.52% | 11.94% | 2.64% | 12.09% | -0.33% | -19.33% | 11 Apr 2013 | 17.71 M |

| Principal Index IDX30 Kelas O | 1341.36 | 3.55% | 4.14% | 9.77% | 2.45% | 8.19% | 3.41% | 34.14% | 7 Dec 2012 | 47.91 M |

| BNI-AM Indeks IDX30 | 803.99 | 3.54% | 4.32% | 9.99% | 2.44% | 8.46% | 3.84% | -17.10% | 28 Dec 2017 | 1.00 T |

| HPAM Ultima Ekuitas 1 Kelas A | 3796.55 | 3.31% | 11.99% | 14.48% | -0.06% | 34.92% | 50.26% | 279.66% | 2 Nov 2009 | 531.79 M |

| UOBAM Indeks Bisnis-27 | 1426.79 | 2.55% | 3.72% | 10.91% | 1.47% | 10.19% | 4.43% | 42.68% | 15 Aug 2012 | 183.15 M |

| Syailendra Equity Opportunity Fund | 4986.88 | 2.35% | 4.20% | 23.23% | 1.48% | 19.41% | 29.69% | 398.69% | 7 Jun 2007 | 259.94 M |

Provided by Cermati Invest, last update 23 January 2026

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana USD | NAV | 1Bln | 3Bln | 6Bln | YTD | 1Th | 3Th | % | Tanggal | AUM |

| Eastspring Syariah Equity Islamic Asia Pacific USD Kelas A | 1.6964 | 7.87% | 13.13% | 40.34% | 2.97% | 78.31% | 61.95% | 69.64% | 28 Oct 2016 | 2.88 Jt |

| Eastspring Syariah Greater China Equity USD Kelas A | 0.7805 | 6.31% | 4.09% | 15.58% | 3.92% | 27.87% | 0.03% | -21.95% | 15 Jun 2020 | 7.81 Jt |

| BRI G20 Sharia Equity Fund Dollar | 1.2992 | 2.94% | 2.80% | 5.57% | 2.01% | 5.68% | 24.67% | 29.92% | 3 Dec 2019 | 1.16 Jt |

| Batavia Global ESG Sharia Equity USD | 1.3136 | 2.22% | 4.12% | 8.99% | 2.73% | 10.46% | 31.87% | 31.36% | 27 Jan 2021 | 10.63 Jt |

| Batavia Technology Sharia Equity USD | 1.3189 | 1.13% | 1.85% | 9.09% | 0.86% | 6.78% | 79.76% | 31.89% | 16 Feb 2022 | 107.61 Jt |

| STAR Fixed Income Dollar | 1.0757 | 0.31% | 0.95% | 2.41% | 0.20% | 4.34% | 16.92% | 7.57% | 10 Jul 2017 | 14.08 Jt |

| Eastspring Syariah Fixed Income USD Kelas A | 0.9668 | -0.03% | -0.03% | 0.91% | -0.08% | 3.65% | 8.23% | -0.35% | 8 Mar 2021 | 11.79 Jt |

| Batavia USD Bond Fund | 1.0674 | -0.07% | -0.22% | 1.11% | -0.11% | 3.96% | 3.84% | 6.74% | 18 Oct 2022 | 29.49 Jt |

| BRI Melati Premium Dollar | 1.4536 | -0.70% | -1.13% | 1.99% | -0.74% | 6.12% | 6.34% | 45.36% | 19 Feb 2007 | 1.95 Jt |

Provided by Cermati Invest, last update 23 January 2026

| INDIKASI | ||||||||

|---|---|---|---|---|---|---|---|---|

| NAMA OBLIGASI | ISIN | MATA UANG | KUPON | JATUH TEMPO | HARGA BELI | HARGA JUAL | YIELD | RATING |

| FR0103 | IDG000024506 | IDR | 6.75% | 15-Jul-35 | 103 | 102 | 6.32% | BBB |

| FR0088 | IDG000018201 | IDR | 6.25% | 15-Jun-36 | 100.4 | 99.4 | 6.20% | BBB |

| PBS005 | IDP000001505 | IDR | 6.75% | 15-Apr-43 | 101.75 | 100.75 | 6.58% | BBB |

| BWPT01BCN2 | IDA0001522B2 | IDR | 11.00% | 26-Feb-28 | 101 | 100 | 10.56% | idA- |

| INKP05BCN1 | IDA0001485B2 | IDR | 10.75% | 4-Oct-29 | 101.25 | 100.25 | 10.38% | idA+ |

Provided by Cermati Invest, last update 23 January 2026

| Monday, 26 January 2026 | Previous | Consensus |

Forecast

|

||

| 4:00 PM | DE | Ifo Business Climate JAN | 87.6 | 88.1 | 88.4 |

| 8:30 PM | US | Durable Goods Orders MoM NOV | -2.2% | 0.5% | 1.1% |

| 10:30 PM | US | Dallas Fed Manufacturing Index JAN | -10.9 | -6 | |

| Tuesday, 27 January 2026 | Previous | Consensus |

Forecast

|

||

| 8:15 PM | US | ADP Employment Change Weekly | 8.0K | ||

| 9:00 PM | US | S&P/Case-Shiller Home Price YoY NOV | 1.3% | 1.2% | 1.2% |

| 10:00 PM | US | CB Consumer Confidence JAN | 89.1 | 90.1 | 88 |

| Wednesday, 28 January 2026 | Previous | Consensus |

Forecast

|

||

| 4:30 AM | US | API Crude Oil Stock Change JAN/23 | 3.04M | -0.7M | |

| 6:50 AM | JP |

BoJ Monetary Policy Meeting Minutes

|

|||

| 2:00 PM | DE | GfK Consumer Confidence FEB | -26.9 | -25.5 | -26 |

| 5:30 PM | IN | Industrial Production YoY DEC | 6.7% | 2.8% | |

| 5:30 PM | IN | Manufacturing Production YoY DEC | 8.0% | 3.2% | |

| 7:00 PM | US | MBA 30-Year Mortgage Rate JAN/23 | 6.2% | ||

| 10:30 PM | US | EIA Crude Oil Stocks Change JAN/23 | 3.602M | ||

| 10:30 PM | US | EIA Gasoline Stocks Change JAN/23 | 5.977M | ||

| Thursday, 29 January 2026 | Previous | Consensus |

Forecast

|

||

| 2:00 AM | US | Fed Interest Rate Decision | 3.75% | 3.75% | 3.75% |

| 2:30 AM | US | Fed Press Conference | |||

| 12:00 PM | JP | Consumer Confidence JAN | 37.2 | 38.0 | 37.6 |

| 8:30 PM | US | Balance of Trade NOV | $-29.4B | $-44.6B | $-37.0B |

| 8:30 PM | US | Exports NOV | $302B |

$303.0B

|

|

| 8:30 PM | US | Imports NOV | $331.4B |

$340.0B

|

|

| 8:30 PM | US | Initial Jobless Claims JAN/24 | 200K | 205K | 205.0K |

| 10:00 PM | US | Factory Orders MoM NOV | -1.3% | 0.5% | 0.4% |

| Friday, 30 January 2026 | Previous | Consensus |

Forecast

|

||

| 6:30 AM | JP | Unemployment Rate DEC | 2.6% | 2.6% | 2.6% |

| 6:50 AM | JP | Industrial Production MoM Prel DEC | -2.7% | -0.4% | 1.0% |

| 6:50 AM | JP | Retail Sales YoY DEC | 1.0% | 0.7% | 1.4% |

| 12:00 PM | JP | Housing Starts YoY DEC | -8.5% | -4.1% | -4.4% |

| 2:00 PM | GB | Nationwide Housing Prices MoM JAN | -0.4% | 0.6% | |

| 3:55 PM | DE | Unemployed Persons JAN | 2.977M | 2.984M | |

| 4:00 PM | DE | GDP Growth Rate QoQ Flash Q4 | - | 0.2% | 0.2% |

| 4:00 PM | DE | GDP Growth Rate YoY Flash Q4 | 0.3% | 0.3% | 0.5% |

| 4:30 PM | GB | BoE Consumer Credit DEC | £2.077B | £1.9B | |

| 4:30 PM | GB | Mortgage Approvals DEC | 64.53K | 64.4K | |

| 4:30 PM | GB | Mortgage Lending DEC | £4.49B | £4.6B | |

| 8:00 PM | DE | Inflation Rate YoY Prel JAN | 1.8% | 2.2% | 1.9% |

| 8:00 PM | DE | Inflation Rate MoM Prel JAN | - | -0.1% | |

| 8:30 PM | US | PPI MoM DEC | 0.2% | 0.2% | 0.2% |

| 8:30 PM | US | Core PPI MoM DEC | - | 0.3% | 0.1% |

| 9:45 PM | US | Chicago PMI JAN | 43.5 | 43 | 45 |

| Saturday, 31 January 2026 | Previous | Consensus |

Forecast

|

||

| 5:00 AM | US | Fed Bowman Speech | |||

| 8:30 AM | CN | NBS Manufacturing PMI JAN | 50.1 | 50.2 | 50.4 |

| 8:30 AM | CN | NBS Non Manufacturing PMI JAN | 50.2 | 50.3 | |

Disclaimer:

Dokumen ini dibuat hanya untuk memberikan informasi. Isi dokumen ini tidak boleh ditafsirkan sebagai suatu bentuk penawaran untuk membeli/menjual/dijadikan dasar dari atau yang dapat dijadikan pedoman sehubungan dengan suatu perjanjian atau komitmen apa pun atau suatu nasehat investasi.

Baca Juga Cermati Invest Weekly Update Sebelumnya: