Cermati Invest Weekly Update 18 Februari 2026

Ulasan Pasar

| INDONESIA | W (-/+) % | HARGA |

| IHSG | 3.49% | 8,212.27 |

| ISSI | 5.89% | 209.84 |

| IDX30 | 1.32% | 431.88 |

| FTSE Indonesia | 0.78% | 3,043.06 |

| MSCI Indonesia | 0.41% | 6,084.30 |

| Dolar Amerika | -0.14% | 16,830 |

Provided by Cermati Invest, last update 13 February 2026

IHSG & Saham Pekan Ini

Indeks, pekan lalu IHSG tutup di 8212.27 naik 3.49%. Sebelumnya, di bulan Januari 2026 IHSG sempat mencatatkan angka tertinggi sepanjang sejarah (ATH) di 9174.47 sebelum kemudian ambruk ke 77481.98. IHSG turun (–)5.03% secara Year to Date (YtD).

Diharapkan IHSG mampu bergerak di atas 8337.048 (Pivot Q1) yang merupakan kekuatan IHSG di kuartal 1 ini. Jadi, bila IHSG masih di bawah angka itu, pergerakan harga saham Bearish.

Rata-rata sejak awal tahun 2026, indeks konstituen walaupun performanya turun dan masih minus, tetapi indeks Perbankan, Investor33 dan Sri-Kehati, performanya masih lebih baik dari performa IHSG. Sementara performa paling buruk adalah Indeks Saham Syariah Indonesia (ISSI) yaitu (–)6.36% sejak awal tahun.

Saham, menjelang Ramadan dan Idulfitri 2026, pasar modal Indonesia biasanya mengalami kenaikan akibat pola musiman, seperti meningkatnya konsumsi rumah tangga dan perputaran uang.

Sektor yang diperkirakan memiliki momentum positif termasuk: Komoditas (emas, batu bara, nikel), Konsumsi Domestik, Telekomunikasi, dan Perbankan.

Pergerakan Rupiah

Cuti bersama Imlek 2026 ini, rupiah diperkirakan bergerak dalam area Rp16.780 — Rp17.015 (ATH) per 1 dolar Amerika. Sejak awal 2026, rupiah melemah 0.72% terhadap dolar Amerika.

| KOMODITAS | W (-/+) % | HARGA |

| Emas | 0.14% | 5,043.11 |

| Perak | -2.12% | 77.96 |

| Platina | -3.84% | 2,067.50 |

| Nikel | -0.66% | 17,008.88 |

| Timah | 6.29% | 49,468 |

| Alumunium | -0.51% | 3,095.75 |

| Minyak Mentah | -0.32% | 62.75 |

| Minyak Sawit | - | 4,480 |

| Gas | 1.00% | 3.24 |

| Batu Bara | 0.95% | 116.70 |

| Tembaga | -1.00% | 12,921.00 |

Provided by Cermati Invest, last update 13 February 2026

Emas & Kripto

Pekan ini harga emas dunia bergerak sideways dalam area US$4879 (support) — US$5119 (resistance) per troy ounce. Sementara itu, secara garis besar, long term harga emas bergerak dalam area US$4333.72 (support gap) — US$5503 (resistance gap).

Sebagai catatan, harga emas dunia all time high di US$5602, perak di US$121.67, dan platinum di US$2882.366.

Sama seperti pergerakan emas dunia, libur Imlek akan membuat harga emas domestik juga akan bergerak sideways. Pekan ini berkisar antara Rp2.540.000 — Rp2.880.000 per gram. Ambil posisi beli bertahap di kisaran support-nya dan jangan lupa gunakan promonya.

Sejak awal 2026, performa harga emas dunia naik (+)16.20%, perak (+)7.7%, dan platinum (+)0.4%. Sedangkan, emas domestik naik (+)16.85%.

Kripto,

| KRIPTO | W (-/+) % | HARGA |

| Bitcoin | -2.35% | 68,232 |

| Etherium | -5.55% | 1,938.40 |

| Solana | -0.54% | 85.77 |

Provided by Cermati Invest, last update 13 February 2026

Trend turun sepanjang 2026 dan kisaran saat ini adalah yang terendah sepanjang 1 tahun terakhir. Beberapa kali terlihat akan rebound, tetapi kembali turun, seperti yang terlihat, pasar kripto sideways sudah 3 minggu terakhir.

Bitcoin (BTC), sejak awal 2026 turun tajam sampai US$59900 terendah dalam 12 bulan terakhir. Pekan ini sideways dalam area US$60421 (support) — US$74393 (resistance).

Sejak awal 2026, BTC turun (–)21.38%.

Ethereum (ETH), dari awal 2026 turun tajam menyentuh US$1743 terendah dalam 12 bulan terakhir. Pekan ini sideways dalam area US$1844 (support) — US$2299 (resistance).

Sejak awal 2026, ETH turun (–)33.15%.

Investor disarankan tetap berhati-hati, menghindari spekulasi berlebihan, serta melakukan diversifikasi dan menggunakan stablecoin untuk mengelola risiko volatilitas.

| REGIONAL | W (-/+) % | HARGA |

| Dow Jones | -1.23% | 49,500.93 |

| S&P 500 | -1.39% | 6,836.17 |

| FTSE 100 | 0.74% | 10,446.35 |

| DAX | 0.78% | 24,914.88 |

| Nikkei 225 | -1.20% | 56,941.97 |

| Hang Seng | 0.03% | 26,567.12 |

| CSI 300 | 0.36% | 4,660.41 |

| KOSPI | 8.21% | 5,507.01 |

Provided by Cermati Invest, last update 13 February 2026

Reksa Dana

Reksa dana pekan ini berdasarkan performa terbaik sejak awal tahun, berikut pilihannya:

- Reksa Dana Pasar Uang: Insight Money Syariah.

- Reksa Dana Pendapatan Tetap: HPAM Pendapatan Tetap Prima.

- Reksa Dana Campuran: Syailendra Balanced Opportunity Fund Kelas A.

- Reksa Dana Saham: Cipta Saham Unggulan Syariah.

- Reksa Dana Mata Uang Dolar Amerika: Eastspring Syariah Equity Islamic Asia Pacific USD Kelas A.

Kinerja reksa dana di masa lalu bukan jaminan kinerja reksa dana di masa depan, jadi pilih yang terbaik dan sesuai dengan karakteristik dan tujuan investasi Anda.

Bingung cari investasi reksa dana yang aman dan menguntungkan? Cermati Invest solusinya!

Surat Berharga

Yield SBN 10 tahun turun ke 6.38% (sumber BI, 13 Feb 2026). Memasuki Ramadan 2026, surat berharga negara menghadapi tekanan dari sentimen negatif Moody’s, yang mendorong kenaikan yield dan volatilitas. Moody’s tetap mempertahankan rating sovereign Indonesia Baa2, outlook negatif ini memicu kekhawatiran terhadap kredibilitas kebijakan fiskal dan makro ekonomi. Efek jangka pendek terlihat dari koreksi harga obligasi dan peningkatan volatilitas, sedangkan arah jangka menengah tergantung pada stabilitas ekonomi domestik, dinamika global, serta kebijakan pemerintah dan respons pasar.

Bursa Libur Imlek, IHSG Tutup Pekan Lalu dengan Senyuman! Cek Kabar Terbarunya di Sini!

Pasar saham domestik menutup pekan lalu dengan performa impresif setelah IHSG menguat 3.49% ke level 8.212, yang didorong oleh lonjakan volume transaksi harian meskipun investor asing masih mencatatkan aksi jual bersih. Secara global, sentimen mulai beralih ke arah stabilisasi setelah rilis data inflasi AS (CPI) bulan Januari menunjukkan kenaikan 0.2% (lebih rendah dari estimasi), yang memberikan angin segar bagi peluang pemangkasan suku bunga The Fed di masa depan meskipun pasar tenaga kerja AS tetap solid.

Untuk pekan ini, aktivitas pasar diperkirakan akan lebih tenang dan cenderung terbatas karena adanya libur panjang Tahun Baru Imlek di kawasan Asia (termasuk Bursa Efek Indonesia pada 16–17 Februari) serta libur Presidents' Day di Amerika Serikat, sehingga fokus investor akan beralih pada rilis risalah rapat The Fed dan data manufaktur global untuk menentukan arah investasi selanjutnya.

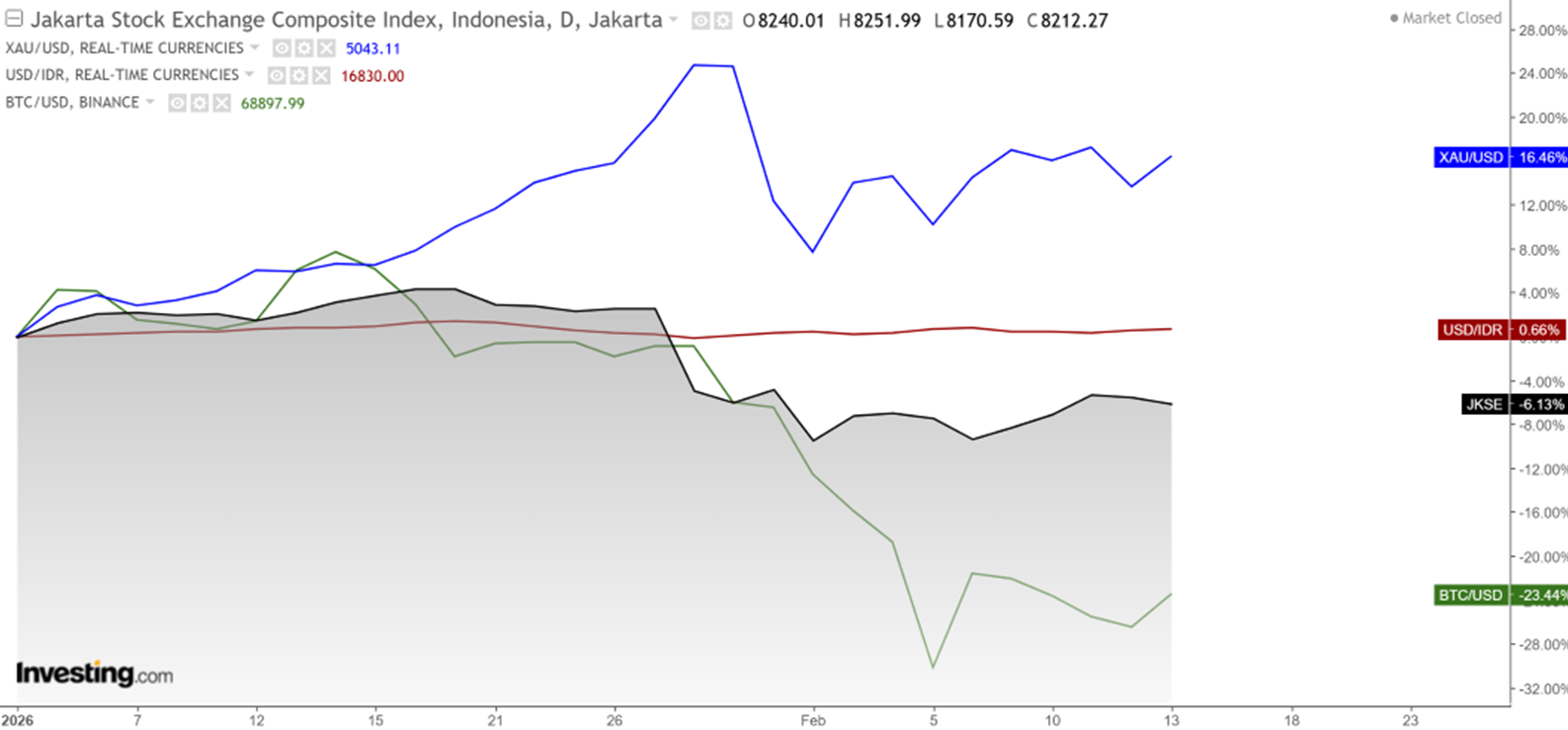

Performa IHSG (JKSE),EMAS (XAU/USD),BITCOIN (BTC/USD) & Dolar Amerika (XAU/USD) Tahun 2026

Reksa Dana

| Inception | ||||||||||

| Reksa Dana PASAR UANG | NAV | 1Bln | 3Bln | 6Bln | YTD | 1Th | 3Th | % | Tanggal | AUM |

| Insight Money Syariah | 1740.571 | 0.45% | 1.31% | 2.83% | 0.60% | 5.96% | 18.06% | 74.06% | 30 Sep 2015 | 202.00 M |

| Setiabudi Dana Pasar Uang | 1596.5557 | 0.42% | 1.27% | 2.61% | 0.58% | 5.43% | 16.66% | 59.66% | 23 Dec 2016 | 552.29 M |

| Insight Retail Cash Fund | 1685.0342 | 0.43% | 1.26% | 2.73% | 0.57% | 6.13% | 17.28% | 68.50% | 13 Apr 2018 | 230.89 M |

| Henan Ultima Money Market | 1707.5997 | 0.38% | 1.25% | 2.77% | 0.53% | 5.46% | 16.04% | 70.76% | 10 Jun 2015 | 879.49 M |

| BRI Seruni Pasar Uang III | 1860.7797 | 0.36% | 1.09% | 2.45% | 0.50% | 5.18% | 15.67% | 86.08% | 16 Feb 2010 | 3.70 T |

| Bahana Likuid Syariah Kelas G | 1273.87 | 0.36% | 1.14% | 2.42% | 0.49% | 5.09% | 15.40% | 27.39% | 12 Jul 2016 | 528.94 M |

| SAM Dana Kas | 1512.9332 | 0.30% | 1.01% | 2.57% | 0.49% | 5.31% | 14.35% | 51.29% | 10 Feb 2017 | 253.73 M |

| TRIM Kas 2 Kelas A | 2007.187 | 0.36% | 1.12% | 2.38% | 0.49% | 5.15% | 15.61% | 100.72% | 8 Apr 2008 | 9.01 T |

| Trimegah Kas Syariah | 1508.1931 | 0.36% | 1.15% | 2.42% | 0.49% | 5.13% | 15.72% | 50.82% | 30 Dec 2016 | 1.69 T |

| BRI Seruni Pasar Uang Syariah | 1408.4705 | 0.34% | 1.04% | 2.36% | 0.48% | 5.17% | 16.21% | 40.85% | 19 Jul 2018 | 2.08 T |

| Cipta Dana Cash | 1817.27 | 0.34% | 1.06% | 2.63% | 0.48% | 5.58% | 16.85% | 81.73% | 8 Jun 2015 | 577.80 M |

| Danakita Stabil Pasar Uang | 1700.93 | 0.34% | 1.09% | 2.43% | 0.47% | 5.02% | 15.27% | 70.09% | 10 Sep 2015 | 67.80 M |

| Syailendra Dana Kas | 1781.7915 | 0.30% | 1.14% | 2.53% | 0.45% | 5.19% | 15.24% | 78.18% | 12 Jun 2015 | 3.46 T |

| BNI-AM Dana Likuid Kelas A | 2007.25 | 0.31% | 1.03% | 2.35% | 0.44% | 5.11% | 14.06% | 100.73% | 27 Dec 2012 | 495.66 M |

Provided by Cermati Invest, last update 13 February 2026

| Inception | ||||||||||

| Reksa Dana PENDAPATAN TETAP | NAV | 1Bln | 3Bln | 6Bln | YTD | 1Th | 3Th | % | Tanggal | AUM |

| HPAM Pendapatan Tetap Prima | 1102.0269 | 0.50% | 1.72% | 4.34% | 1.91% | 8.25% | 22.52% | 15.50% | 29 Oct 2018 | 821.71 M |

| SAM Sukuk Syariah Sejahtera | 2483.9549 | 0.35% | 0.83% | 4.15% | 1.74% | 7.58% | 15.31% | 161.46% | 29 Oct 1997 | 49.58 M |

| Insight Renewable Energy Fund | 2531.7768 | 0.51% | 1.50% | 4.48% | 0.68% | 9.60% | 25.01% | 153.18% | 22 Jun 2011 | 1.62 T |

| Insight Haji Syariah | 5592.3757 | 0.51% | 1.42% | 4.30% | 0.67% | 9.49% | 25.61% | 459.24% | 13 Jan 2005 | 2.41 T |

| Syailendra Pendapatan Tetap Premium Kelas A | 1961.3117 | 0.23% | 1.16% | 3.85% | 0.40% | 7.59% | 18.19% | 96.13% | 27 Mar 2017 | 2.52 T |

| BNI-AM Short Duration Bonds Index Kelas R1 | 1111.29 | 0.12% | 0.09% | 2.70% | -0.11% | 7.84% | 18.96% | 15.54% | 1 Sep 2022 | 246.21 M |

| BRI Melati Pendapatan Utama | 2022.618 | -0.10% | 0.57% | 3.63% | -0.17% | 8.12% | 16.71% | 104.72% | 27 Sep 2012 | 269.53 M |

| BRI Brawijaya Abadi Pendapatan Tetap | 1510.9332 | -0.53% | -0.41% | 3.09% | -1.03% | 8.49% | 17.59% | 51.09% | 25 Feb 2019 | 122.98 M |

Provided by Cermati Invest, last update 13 February 2026

| Inception | ||||||||||

| Reksa Dana CAMPURAN | NAV | 1Bln | 3Bln | 6Bln | YTD | 1Th | 3Th | % | Tanggal | AUM |

| Syailendra Balanced Opportunity Fund Kelas A | 4943.12 | 2.97% | 14.67% | 40.40% | 7.81% | 58.10% | 59.30% | 394.31% | 22 Apr 2008 | 1.32 T |

| Setiabudi Dana Campuran | 1716.7961 | 0.69% | 4.52% | 8.96% | 3.42% | 24.35% | 35.33% | 71.68% | 25 Sep 2017 | 71.41 M |

| TRIM Syariah Berimbang | 4218.86 | -3.08% | 9.10% | 20.98% | 1.53% | 34.43% | 40.77% | 321.89% | 27 Dec 2006 | 114.21 M |

| TRIM Kombinasi 2 | 3415.15 | -4.73% | 7.16% | 16.53% | -1.11% | 32.44% | 34.37% | 241.52% | 10 Nov 2006 | 84.34 M |

| Trimegah Balanced Absolute Strategy Kelas A | 2240.48 | -4.24% | 4.58% | 14.71% | -1.36% | 31.33% | 36.89% | 124.05% | 28 Dec 2018 | 568.10 M |

| HPAM Flexi Indonesia Sehat Kelas A | 2420.3457 | -4.32% | -2.85% | 8.11% | -5.20% | 28.12% | 46.52% | 142.03% | 2 Mar 2011 | 103.38 M |

Provided by Cermati Invest, last update 13 February 2026

| Inception | ||||||||||

| Reksa Dana SAHAM | NAV | 1Bln | 3Bln | 6Bln | YTD | 1Th | 3Th | % | Tanggal | AUM |

| Cipta Saham Unggulan Syariah | 2781.91 | 12.07% | 7.65% | 11.47% | 11.54% | 31.90% | 19.76% | 178.19% | 5 Sep 2018 | 15.56 M |

| Cipta Saham Unggulan | 3345.74 | 6.44% | 5.25% | 9.76% | 7.16% | 21.43% | 19.85% | 234.57% | 4 Dec 2018 | 31.06 M |

| Batavia Dana Saham Syariah | 1739.12 | -1.24% | 3.09% | 7.02% | 4.03% | 15.79% | -4.98% | 73.91% | 19 Jul 2007 | 37.24 M |

| Cipta Rencana Cerdas | 17256.86 | 2.33% | 2.06% | 1.72% | 3.29% | 10.22% | -0.07% | 1625.69% | 9 Jul 1999 | 57.36 M |

| Batavia Dana Saham | 57660.41 | -0.39% | 1.20% | 1.14% | 2.40% | 1.59% | -7.62% | 5666.04% | 16 Dec 1996 | 1.30 T |

| TRIM Kapital Plus | 5027.87 | -3.49% | 2.55% | 8.63% | 0.36% | 21.18% | 26.16% | 402.79% | 18 Apr 2008 | 797.59 M |

| TRIM Syariah Saham | 2358.07 | -6.67% | 6.56% | 21.82% | 0.12% | 42.36% | 26.08% | 135.81% | 27 Dec 2006 | 322.63 M |

| Principal Islamic Equity Growth Syariah | 1384.81 | -5.83% | 2.66% | 10.37% | -0.29% | 28.99% | 12.29% | 38.48% | 10 Sep 2007 | 74.56 M |

| Syailendra Equity Opportunity Fund | 4868.59 | -0.90% | -0.37% | 15.84% | -0.93% | 29.07% | 25.27% | 386.86% | 7 Jun 2007 | 230.24 M |

| BRI Syariah Saham | 888.7572 | -5.49% | 5.96% | 18.35% | -1.05% | 35.57% | 5.49% | -11.12% | 18 Sep 2014 | 15.50 M |

| TRIM Kapital | 11622.47 | -3.34% | -0.46% | 4.57% | -1.23% | 14.94% | 3.28% | 1062.25% | 19 Mar 1997 | 418.29 M |

| BNI-AM Inspiring Equity Fund | 989.1979 | -3.96% | 0.76% | 6.70% | -1.37% | 19.54% | -2.15% | -1.08% | 7 Apr 2014 | 1.24 T |

| BNI AM IDX Pefindo Prime Bank Kelas R1 | 768.28 | -2.01% | -2.99% | -7.66% | -1.72% | -3.07% | - | -23.17% | 2 Apr 2024 | 184.10 M |

| BRI Mawar Konsumer 10 Kelas A | 1538.7476 | -5.15% | 5.07% | 8.83% | -2.51% | 12.19% | -4.63% | 53.87% | 16 Feb 2011 | 175.18 M |

| Principal Total Return Equity Fund Kelas O | 3566.29 | -6.85% | 1.13% | 7.01% | -3.31% | 22.41% | 2.93% | 256.63% | 1 Jul 2005 | 21.12 M |

| Bahana Primavera Plus | 14086.94 | -6.31% | 2.07% | 14.22% | -3.38% | 31.48% | 0.82% | 1308.69% | 27 May 1997 | 49.43 M |

| UOBAM Sustainable Equity Indonesia | 995.14 | -5.94% | 2.39% | 5.93% | -3.81% | 17.45% | -1.61% | -0.49% | 4 Aug 2021 | 52.94 M |

| HPAM Ekuitas Syariah Berkah Kelas A | 2483.4996 | -7.19% | -0.75% | 2.65% | -4.63% | 40.62% | 81.43% | 148.35% | 20 Jan 2020 | 1.26 T |

| HPAM Ultima Ekuitas 1 Kelas A | 3550.0944 | -8.51% | 4.76% | 3.95% | -6.55% | 38.66% | 38.17% | 255.01% | 2 Nov 2009 | 381.09 M |

| SAM Indonesian Equity Fund - With Dividend | 3161.226954 | -10.78% | 4.62% | 19.90% | -8.40% | 41.22% | 54.00% | 216.12% | 18 Oct 2011 | 829.74 M |

| HPAM Tactical Equity | 1737.7666 | -12.36% | -11.90% | 2.77% | -12.80% | 39.35% | 74.06% | 73.78% | 12 May 2020 | 160.90 M |

Provided by Cermati Invest, last update 13 February 2026

| Inception | ||||||||||

| Reksa Dana USD | NAV | 1Bln | 3Bln | 6Bln | YTD | 1Th | 3Th | % | Tanggal | AUM |

| Eastspring Syariah Equity Islamic Asia Pacific USD Kelas A | 1.776497 | 5.84% | 16.04% | 41.02% | 7.84% | 87.16% | 72.20% | 77.65% | 28 Oct 2016 | 4.54 Jt |

| Eastspring Syariah Greater China Equity USD Kelas A | 0.801186 | 3.90% | 7.49% | 17.03% | 6.67% | 25.89% | 6.74% | -19.88% | 15 Jun 2020 | 6.98 Jt |

| BRI G20 Sharia Equity Fund Dollar | 1.3416 | 3.30% | 6.27% | 9.92% | 5.34% | 13.67% | 26.99% | 34.16% | 3 Dec 2019 | 1.16 Jt |

| Batavia Global ESG Sharia Equity USD | 1.3024 | -0.08% | 1.24% | 7.64% | 1.85% | 12.76% | 28.03% | 30.24% | 27 Jan 2021 | 8.99 Jt |

| STAR Fixed Income Dollar | 1.077904 | 0.29% | 0.94% | 2.25% | 0.40% | 4.33% | 16.73% | 7.79% | 10 Jul 2017 | 18.31 Jt |

| Batavia USD Bond Fund | 1.0694 | 0.08% | 0.17% | 0.95% | 0.07% | 4.03% | 4.72% | 6.94% | 18 Oct 2022 | 45.49 Jt |

| BRI Melati Premium Dollar | 1.455496 | -0.17% | -0.72% | 1.06% | -0.61% | 6.20% | 8.24% | 45.55% | 19 Feb 2007 | 2.05 Jt |

| Batavia Technology Sharia Equity USD | 1.2701 | -4.29% | -3.55% | 2.41% | -2.87% | 6.96% | 63.82% | 27.01% | 16 Feb 2022 | 76.44 Jt |

Provided by Cermati Invest, last update 13 February 2026

| NAMA OBLIGASI | ISIN | MATA UANG | KUPON | JATUH TEMPO | HARGA BELI | HARGA JUAL | YIELD | RATING |

| FR0103 | IDG000024506 | IDR | 6.75% | 15-Jul-35 | 102.3 | 101.3 | 6.42% | BBB |

| FR0088 | IDG000018201 | IDR | 6.25% | 15-Jun-36 | 100 | 99 | 6.25% | BBB |

| PBS005 | IDP000001505 | IDR | 6.75% | 15-Apr-43 | 101 | 100 | 6.65% | BBB |

| BWPT01BCN2 | IDA0001522B2 | IDR | 11.00% | 26-Feb-28 | 101.25 | 100.25 | 10.33% | idA- |

| INKP05BCN1 | IDA0001485B2 | IDR | 10.75% | 4-Oct-29 | 101.25 | 100.25 | 10.38% | idA+ |

Provided by Cermati Invest, last update 13 February 2026

| Monday, 16 February 2026 | Previous | Consensus | Forecast | ||

| 6:50 AM | JP | GDP Growth Rate QoQ Prel Q4 | -0.6% | 0.4% | 0.5% |

| 6:50 AM | JP | GDP Growth Annualized Prel Q4 | -2.3% | 1.6% | 2.0% |

| 8:25 PM | US | Fed Bowman Speech | |||

| CN | FDI (YTD) YoY JAN | -9.5% | -1.0% | ||

| IN | Balance of Trade JAN | $-25.04B | $-26.14B | $-27.0B | |

| Tuesday, 17 February 2026 | Previous | Consensus | Forecast | ||

| 2:00 PM | GB | Unemployment Rate DEC | 5.1% | 5.1% | 5.1% |

| 2:00 PM | GB | Average Earnings incl. Bonus (3Mo/Yr) DEC | 4.7% | 4.6% | 4.4% |

| 2:00 PM | GB | Employment Change DEC | 82K | -40.0K | |

| 5:00 PM | DE | ZEW Economic Sentiment Index FEB | 59.6 | 63.5 | 61 |

| 8:15 PM | US | ADP Employment Change Weekly | 6.5K | ||

| 8:30 PM | US | NY Empire State Manufacturing Index FEB | 7.7 | 7.1 | 3 |

| 10:00 PM | US | NAHB Housing Market Index FEB | 37 | 38 | 41 |

| Wednesday, 18 February 2026 | Previous | Consensus | Forecast | ||

| 12:45 AM | US | Fed Barr Speech | |||

| 2:30 AM | US | Fed Daly Speech | |||

| 6:50 AM | JP | Balance of Trade JAN | ¥105.7B | ¥-2142.1B | ¥-2500.0B |

| 6:50 AM | JP | Exports YoY JAN | 5.1% | 12.0% | |

| 2:00 PM | GB | Inflation Rate YoY JAN | 3.4% | 3.0% | 3.0% |

| 2:00 PM | GB | Core Inflation Rate YoY JAN | 3.2% | 3.1% | 3.0% |

| 2:00 PM | GB | Inflation Rate MoM JAN | 0.4% | -0.1% | |

| 7:00 PM | US | MBA 30-Year Mortgage Rate FEB/13 | 6.2% | ||

| 8:30 PM | US | Building Permits Prel NOV | 1.411M | 1.36M | |

| 8:30 PM | US | Building Permits Prel DEC | 1.42M | 1.31M | |

| 8:30 PM | US | Durable Goods Orders MoM DEC | 5.3% | -1.8% | -3.4% |

| 8:30 PM | US | Housing Starts DEC | 1.33M | 1.29M | |

| 8:30 PM | US | Housing Starts NOV | 1.246M | 1.27M | |

| 8:30 PM | US | Durable Goods Orders Ex Transp MoM DEC | 0.5% | 0.3% | 0.3% |

| 9:15 PM | US | Industrial Production MoM JAN | 0.4% | 0.3% | 0.5% |

| Thursday, 19 February 2026 | Previous | Consensus | Forecast | ||

| 1:00 AM | US | Fed Bowman Speech | |||

| 2:00 AM | US | FOMC Minutes | |||

| 4:00 AM | US | Net Long-term TIC Flows DEC | $220.2B | ||

| 4:30 AM | US | API Crude Oil Stock Change FEB/13 | 13.4M | ||

| 6:50 AM | JP | Machinery Orders MoM DEC | -11.0% | 4.5% | 8.5% |

| 6:50 AM | JP | Machinery Orders YoY DEC | -6.4% | 3.9% | 2.0% |

| 2:30 PM | ID | Interest Rate Decision | 4.75% | 4.75% | |

| 6:00 PM | GB | CBI Industrial Trends Orders FEB | -30 | -28 | -25 |

| 8:20 PM | US | Fed Bostic Speech | |||

| 8:30 PM | US | Balance of Trade DEC | $-56.8B | $-55.5B | $-58.0B |

| 8:30 PM | US | Exports DEC | $292.1B | $289.0B | |

| 8:30 PM | US | Fed Bowman Speech | |||

| 8:30 PM | US | Goods Trade Balance Adv DEC | $-86.0B | $-85.2B | $-82.0B |

| 8:30 PM | US | Imports DEC | $348.9B | $347.0B | |

| 8:30 PM | US | Initial Jobless Claims FEB/14 | 227K | 225K | 229.0K |

| 8:30 PM | US | Philadelphia Fed Manufacturing Index FEB | 12.6 | 10 | 7 |

| 9:00 PM | US | Fed Kashkari Speech | |||

| 10:00 PM | US | Pending Home Sales MoM JAN | -9.3% | 2.6% | 6.5% |

| 10:00 PM | US | Pending Home Sales YoY JAN | -3.0% | 2.4% | |

| Friday, 20 February 2026 | Previous | Consensus | Forecast | ||

| 12:00 AM | US | EIA Crude Oil Stocks Change FEB/13 | 8.53M | ||

| 12:00 AM | US | EIA Gasoline Stocks Change FEB/13 | 1.16M | ||

| 6:30 AM | JP | Inflation Rate YoY JAN | 2.1% | 1.9% | |

| 6:30 AM | JP | Core Inflation Rate YoY JAN | 2.4% | 2.0% | 2.3% |

| 2:00 PM | DE | PPI YoY JAN | -2.5% | -2.2% | -2.3% |

| 2:00 PM | GB | Retail Sales MoM JAN | 0.4% | 0.2% | 0.3% |

| 2:00 PM | GB | Retail Sales YoY JAN | 2.5% | 2.1% | |

| 3:30 PM | DE | HCOB Manufacturing PMI Flash FEB | 49.1 | 49.5 | 49.8 |

| 3:30 PM | DE | HCOB Composite PMI Flash FEB | 52.1 | 51.9 | |

| 3:30 PM | DE | HCOB Services PMI Flash FEB | 52.4 | 52.2 | 52.3 |

| 4:30 PM | GB | S&P Global Manufacturing PMI Flash FEB | 51.8 | 51.8 | 51.9 |

| 4:30 PM | GB | S&P Global Services PMI Flash FEB | 54 | 53.5 | 53.6 |

| 8:30 PM | US | Core PCE Price Index MoM DEC | 0.2% | 0.4% | 0.2% |

| 8:30 PM | US | GDP Growth Rate QoQ Adv Q4 | 4.4% | 3.0% | 3.5% |

| 8:30 PM | US | Personal Income MoM DEC | 0.3% | 0.3% | 0.1% |

| 8:30 PM | US | Personal Spending MoM DEC | 0.5% | 0.4% | 0.0% |

| 8:30 PM | US | GDP Price Index QoQ Adv Q4 | 3.7% | 3.2% | 3.6% |

| 10:00 PM | US | New Home Sales DEC | 0.735M | 0.69M | |

| 10:00 PM | US | New Home Sales NOV | 0.737M | 0.71M | |

| CN | Loan Prime Rate 1Y | 3.0% | 3.0% | ||

| CN | Loan Prime Rate 5Y FEB | 3.5% | 3.5% | ||

Disclaimer:

Dokumen ini dibuat hanya untuk memberikan informasi. Isi dokumen ini tidak boleh ditafsirkan sebagai suatu bentuk penawaran untuk membeli/menjual/dijadikan dasar dari atau yang dapat dijadikan pedoman sehubungan dengan suatu perjanjian atau komitmen apa pun atau suatu nasehat investasi.

Baca Juga Cermati Invest Weekly Update Sebelumnya: