Cermati Invest Weekly Update 19 Januari 2026

Ulasan Pasar

| INDONESIA | W (-/+) % | HARGA |

| IHSG | 1.55% | 9,075.41 |

| ISSI | 1.88% | 224.91 |

| IDX30 | 2.95% | 452.48 |

| FTSE Indonesia | 2.03% | 3,234.04 |

| MSCI Indonesia | 1.73% | 6,539.69 |

| Dolar Amerika | 0.51% | 16,885 |

Provided by Cermati Invest, last update 15 January 2026

IHSG & Saham Pekan Ini

Indeks, sentimen positif bagi pasar Indonesia membuat IHSG sempat mencatatkan All Time High (ATH) di 9100.825, walau akhirnya tutup di 9075.41 atau naik 1.55% dalam sepekan. Selain itu transaksi beli yang dilakukan oleh investor asing di seluruh pasar atau papan perdagangan sebesar 4.46T net sepanjang pekan lalu dan 6.35T net sejak awal tahun 2026. Hal ini mencerminkan optimisme para investor dalam dan luar negeri terhadap kondisi ekonomi Indonesia yang dianggap kuat.

Beberapa sektor yang mendominasi perdagangan sejak awal tahun 2026 adalah Industri, Infrastruktur, Cyclicals, Properti, Energi, dan Basic-Industry.

Hati-hati dengan kenaikan semu, karena rupiah semakin lemah, tetapi pasar saham terus mencatatkan kenaikan. Bahkan, IHSG kembali mencatatkan angka tertinggi baru, padahal momen “January Effect” harusnya sudah usai.

Beberapa kali IHSG meninggalkan jejak berupa “Gap Up” yang akan menjadi support ketika IHSG terkoreksi. Support gap terdekat 8956.727. Pekan ini IHSG diprediksikan bergerak antara 8932.62 (support)—9163.82 (resistance).

Sejak awal 2026 IHSG bergerak naik (+)4.96%.

Saham, pekan ini cermati: CUAN, JPFA, BMRI, BRIS, BBNI, CPIN, ELPI, ARCI, BRMS, APLN.

Pergerakan Rupiah

Rupiah cenderung melemah terhadap dolar Amerika, pergerakannya Rp16.836—Rp17.015. Jika rupiah tidak segera menguat kembali, ke depannya akan tembus ke atas Rp17.400 per 1 dolar Amerika.

Sejak awal 2026 nilai tukar 1 dolar Amerika terhadap rupiah naik 0.96%.

| KOMODITAS | W (-/+) % | HARGA |

| Emas | 1.88% | 4,595.03 |

| Perak | 11.59% | 88.54 |

| Platina | 2.41% | 2,333.20 |

| Nikel | -0.25% | 17,671.38 |

| Timah | 14.07% | 51,921 |

| Alumunium | -0.23% | 3,140.70 |

| Minyak Mentah | 0.54% | 59.44 |

| Minyak Sawit | 0.00% | 4,480 |

| Gas | -2.08% | 3.10 |

| Batu Bara | 1.44% | 108.85 |

| Tembaga | -1.34% | 12,806.85 |

Provided by Cermati Invest, last update 15 January 2026

Emas & Kripto

Emas,

Pembukaan awal pekan ini, emas dunia langsung mencatatkan angka tertinggi baru (ATH) di US$4690.94. Kondisi politik dan ekonomi global yang tidak baik-baik saja menyebabkan harga logam melonjak drastis sepanjang tahun 2025 dan berlanjut rallies tanpa jeda sampai saat ini, meninggalkan banyak sekali support gap (4642.975, 4517.25, 4333,725).

Harga emas pekan ini bergerak dalam area US$4517.25 (S) - US$4720.95 (R) per troy ounce. Resisten berikutnya US$4826.27.

Nilai tukar rupiah yang melemah terhadap dolar Amerika dan harga emas dunia yang terus naik, menyebabkan harga emas dalam rupiah bergerak naik lebih tinggi menuju Rp2.610.000 per gramnya. Emas fisik (emas batangan) berkisar Rp2.710.000—Rp2.810.000 per gram.

Harga emas, perak, dan platinum mencatatkan level tertinggi sepanjang sejarah. Sejak awal 2026 harga emas dunia naik (+)7.71%, perak (+)29.45%, dan platinum (+)14.37%. Sedangkan emas dalam negeri naik (+)8.88%.

Kripto,

| KRIPTO | W (-/+) % | HARGA |

| Bitcoin | 5.10% | 95,184 |

| Etherium | 6.88% | 3,300.35 |

| Solana | 5.93% | 143.92 |

Provided by Cermati Invest, last update 15 January 2026

Sejak awal tahun, pasar kripto mulai bergerak naik meski masih dalam fase konsolidasi. Jika harga berhasil menembus level resistance terdekat, pasar kripto berpeluang kembali menguat.

Bitcoin (BTC), saat ini bergerak di kisaran US$84.476–US$99.000. Jika mampu menembus batas atas tersebut, Bitcoin berpotensi melanjutkan kenaikan menuju US$107.957. Sejak awal 2026, BTC telah naik 4.48%.

Ethereum (ETH), bergerak di kisaran US$3.032–US$3.445. Jika berhasil menembus level atasnya, ETH berpeluang naik bertahap menuju US$4.295. Sejak awal 2026, ETH naik 8.07%.

Investor disarankan tetap berhati-hati, menghindari spekulasi berlebihan, serta melakukan diversifikasi dan menggunakan stablecoin untuk mengelola risiko volatilitas.

| REGIONAL | W (-/+) % | HARGA |

| Dow Jones | -0.29% | 49,359.33 |

| S&P 500 | -0.38% | 6,940.01 |

| FTSE 100 | 1.09% | 10,235.29 |

| DAX | 0.14% | 25,297.13 |

| Nikkei 225 | 3.84% | 53,936.17 |

| Hang Seng | 2.34% | 26,844.96 |

| CSI 300 | -0.57% | 4,731.87 |

| KOSPI | 5.55% | 4,840.74 |

Provided by Cermati Invest, last update 15 January 2026

Reksa Dana

Mengawali tahun 2026, pilihan reksa dananya berdasarkan performa terbaik sejak awal tahun, pilihan terbaik untuk:

- Reksa Dana Pasar Uang: HPAM Ultima Money Market dan SAM Dana Kas.

- Reksa Dana Pendapatan Tetap: UOBAM Inovasi Obligasi Nasional.

- Reksa Dana Campuran: Trim Syariah Berimbang dan Syailendra Balanced Opportunity Fund.

- Reksa Dana Saham: Trim Syariah Saham.

- Reksa Dana Mata Uang Dolar Amerika: Eastspring Syariah Equity Islamic Asia Pacific USD Kelas A dan Eastspring Syariah Greater China Equity USD Kelas A.

Bingung cari investasi reksa dana yang aman dan menguntungkan? Cermati Invest solusinya!

Surat Berharga

Prospek pasar Surat Berharga Negara (SBN) dan obligasi korporasi pada 2026 diproyeksikan tetap positif, seiring berlanjutnya siklus pelonggaran moneter global yang dipicu potensi pemangkasan suku bunga The Fed dan bank sentral utama dunia. Beberapa pilihan surat berharga dapat dicermati pada tabel.

IHSG Cetak Rekor, Rupiah Tertekan di Tengah Geopolitik dan Arus Modal Asing

Pasar keuangan Indonesia bergerak beragam pada akhir pekan lalu. Indeks Harga Saham Gabungan (IHSG) mencetak rekor tertinggi, sementara rupiah melemah hingga menyentuh level terendah sepanjang masa terhadap dolar AS. Pelemahan rupiah dipicu arus keluar dana asing, terutama dari pasar Surat Utang Negara (SUN).

Dari sisi global, ketidakpastian geopolitik—mulai dari konflik AS–Venezuela, Rusia–Ukraina, hingga meningkatnya tensi China–Taiwan—mendorong investor bersikap defensif dan kembali memburu dolar AS sebagai aset aman.

Dari dalam negeri, perhatian pasar tertuju pada Rapat Dewan Gubernur (RDG) Bank Indonesia. Di tengah perlambatan China dan kuatnya ekonomi AS, BI diperkirakan mempertahankan BI Rate di level 4.75% pada RDG pekan ini. Sementara itu, ekonomi AS sebelumnya tumbuh kuat 4.3% pada kuartal III-2025, didorong konsumsi masyarakat yang solid.

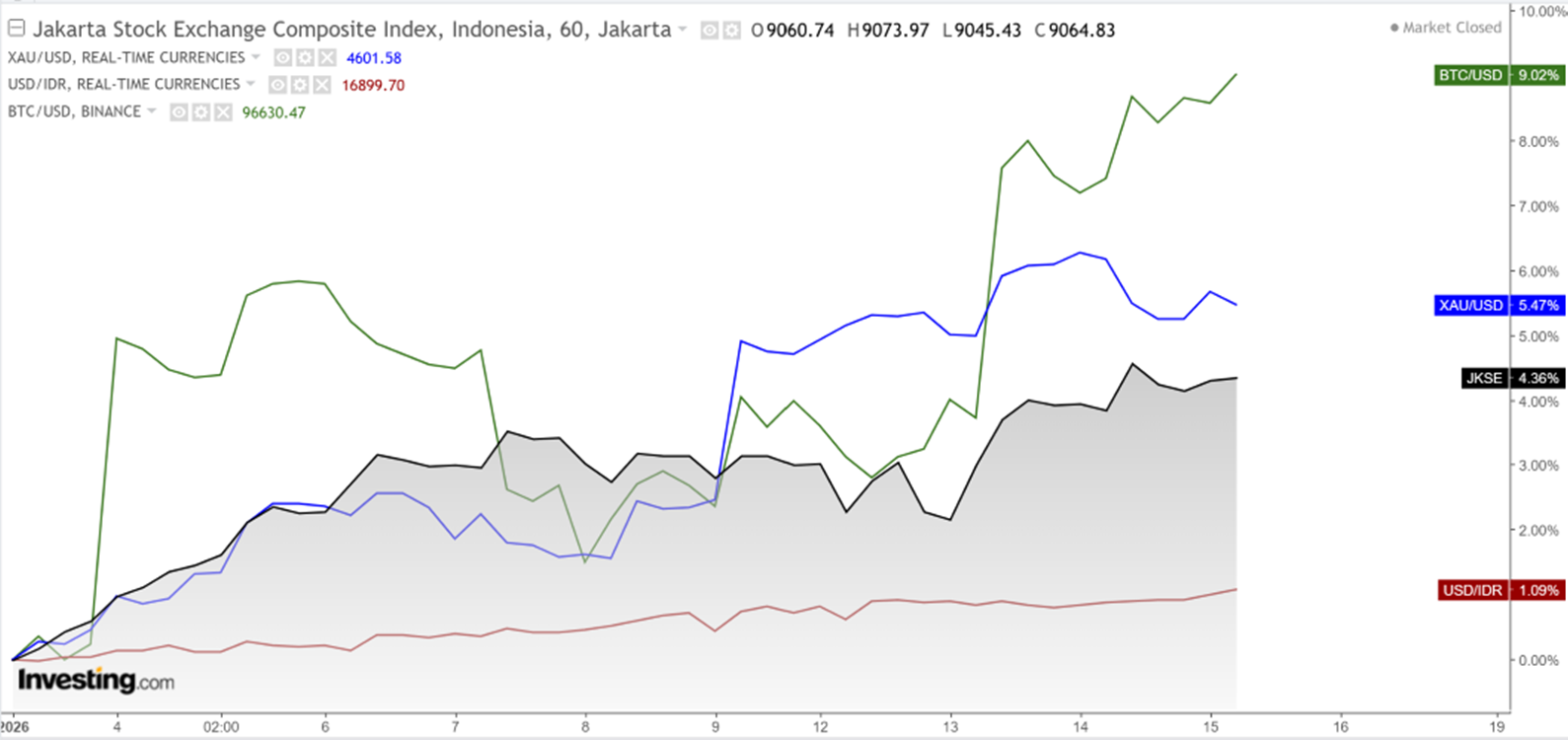

Performance IHSG, XAUUSD (Gold), BTCUSD (Bitcoin) & USDIDR since Jan 2025 (YtD)

Reksa Dana

| Inception | ||||||||||

| Reksa Dana PASAR UANG | NAV | 1Bln | 3Bln | 6Bln | YTD | 1Th | 3Th | % | Tanggal | AUM |

| HPAM Ultima Money Market | 1701.5256 | 0.50% | 1.34% | 2.78% | 0.17% | 5.51% | 16.06% | 70.15% | 10 Jun 2015 | 965.08 M |

| SAM Dana Kas | 1509.1131 | 0.50% | 1.24% | 2.92% | 0.23% | 5.67% | 14.48% | 50.91% | 10 Feb 2017 | 55.99 M |

| BNI-AM Dana Likuid Kelas A | 2001.61 | 0.43% | 1.14% | 2.55% | 0.16% | 5.23% | 14.05% | 100.16% | 27 Dec 2012 | 502.39 M |

| Setiabudi Dana Pasar Uang | 1590.244 | 0.42% | 1.28% | 2.64% | 0.18% | 5.47% | 16.61% | 59.02% | 23 Dec 2016 | 544.42 M |

| Syailendra Dana Kas | 1776.8221 | 0.42% | 1.27% | 2.69% | 0.17% | 5.33% | 15.30% | 77.68% | 12 Jun 2015 | 2.99 T |

| BRI Seruni Pasar Uang Syariah | 1404.1083 | 0.41% | 1.16% | 2.54% | 0.17% | 5.34% | 16.25% | 40.41% | 19 Jul 2018 | 1.83 T |

| Insight Money Syariah | 1733.2659 | 0.41% | 1.34% | 2.90% | 0.18% | 5.97% | 18.01% | 73.33% | 30 Sep 2015 | 187.11 M |

| BRI Seruni Pasar Uang III | 1854.6571 | 0.40% | 1.19% | 2.56% | 0.17% | 5.30% | 15.67% | 85.47% | 16 Feb 2010 | 3.55 T |

| Cipta Dana Cash | 1811.6 | 0.40% | 1.22% | 2.86% | 0.16% | 5.83% | 17.03% | 81.16% | 8 Jun 2015 | 547.10 M |

| Trimegah Kas Syariah | 1503.1581 | 0.40% | 1.21% | 2.51% | 0.15% | 5.21% | 15.73% | 50.32% | 30 Dec 2016 | 1.73 T |

| Danakita Stabil Pasar Uang | 1695.68 | 0.39% | 1.18% | 2.58% | 0.16% | 5.14% | 15.32% | 69.57% | 10 Sep 2015 | 66.76 M |

| Insight Retail Cash Fund | 1678.3425 | 0.39% | 1.31% | 2.73% | 0.17% | 6.14% | 17.17% | 67.83% | 13 Apr 2018 | 225.80 M |

| Bahana Likuid Syariah Kelas G | 1269.61 | 0.38% | 1.22% | 2.49% | 0.16% | 5.18% | 15.40% | 26.96% | 12 Jul 2016 | 515.80 M |

| TRIM Kas 2 Kelas A | 2000.528 | 0.37% | 1.18% | 2.46% | 0.15% | 5.27% | 15.61% | 100.05% | 8 Apr 2008 | 8.17 T |

Provided by Cermati Invest, last update 15 January 2026

| Inception | ||||||||||

| Reksa Dana PENDAPATAN TETAP | NAV | 1Bln | 3Bln | 6Bln | YTD | 1Th | 3Th | % | Tanggal | AUM |

| UOBAM Inovasi Obligasi Nasional | 1109.371 | 1.23% | 1.91% | 5.51% | 0.68% | 9.17% | 16.91% | 10.94% | 12 Jan 2021 | 85.27 M |

| Insight Renewable Energy Fund | 2519.7617 | 0.46% | 1.58% | 5.37% | 0.20% | 9.67% | 24.84% | 151.98% | 22 Jun 2011 | 1.70 T |

| BRI Melati Pendapatan Utama | 2048.1346 | 0.44% | 0.88% | 5.04% | -0.13% | 10.44% | 17.02% | 104.81% | 27 Sep 2012 | 186.72 M |

| Insight Haji Syariah | 5566.0817 | 0.44% | 1.51% | 5.06% | 0.20% | 9.71% | 25.78% | 456.61% | 13 Jan 2005 | 2.55 T |

| BNI-AM Short Duration Bonds Index Kelas R1 | 1110.15 | 0.36% | -0.13% | 3.82% | -0.21% | 9.87% | 18.61% | 15.42% | 1 Sep 2022 | 218.76 M |

| BNI-AM Pendapatan Tetap Quality Long Duration Fund | 1680.34 | 0.35% | 0.53% | 4.06% | -0.33% | 9.72% | 15.32% | 74.07% | 16 Jun 2016 | 20.30 M |

| Sequis Bond Optima | 1600.7154 | 0.23% | -0.02% | 3.65% | -0.40% | 9.45% | 14.40% | 60.07% | 8 Sep 2016 | 55.67 M |

| Eastspring IDR Fixed Income Fund Kelas A | 1885.5 | 0.19% | 0.24% | 4.16% | -0.34% | 10.43% | 16.47% | 88.55% | 16 Mar 2015 | 192.59 M |

| Principal Total Return Bond Fund | 2704.03 | 0.16% | 0.26% | 4.13% | -0.36% | 10.60% | 13.21% | 177.99% | 21 Aug 2008 | 13.91 M |

| Eastspring Investments IDR High Grade Kelas A | 1683.9 | 0.04% | -0.08% | 3.74% | -0.57% | 10.36% | 16.71% | 77.33% | 9 Jan 2013 | 10.09 T |

| Syailendra Fixed Income Fund Kelas A | 2794.48 | 0.04% | -0.47% | 3.77% | -0.58% | 9.60% | 16.94% | 179.45% | 8 Dec 2011 | 191.08 M |

| Cipta Bond | 1936.29 | 0.03% | 0.26% | 3.06% | -0.63% | 9.12% | 15.46% | 93.63% | 2 Jan 2019 | 111.39 M |

| BRI Brawijaya Abadi Pendapatan Tetap | 1515.2225 | -0.03% | 0.25% | 4.93% | -0.75% | 13.26% | 17.71% | 51.52% | 25 Feb 2019 | 120.60 M |

| HPAM Government Bond | 1675.855 | -0.35% | -0.58% | 3.70% | -0.88% | 10.82% | 19.39% | 75.09% | 18 May 2016 | 29.04 M |

Provided by Cermati Invest, last update 15 January 2026

| Inception | ||||||||||

| Reksa Dana CAMPURAN | NAV | 1Bln | 3Bln | 6Bln | YTD | 1Th | 3Th | % | Tanggal | AUM |

| TRIM Syariah Berimbang | 4402.86 | 10.00% | 18.35% | 28.84% | 5.96% | 33.62% | 49.99% | 340.29% | 27 Dec 2006 | 80.47 M |

| Syailendra Balanced Opportunity Fund | 4879.94 | 9.19% | 19.19% | 42.93% | 6.43% | 49.50% | 58.67% | 387.99% | 22 Apr 2008 | 263.78 M |

| TRIM Kombinasi 2 | 3636.51 | 8.42% | 15.74% | 27.03% | 5.30% | 34.30% | 46.79% | 263.65% | 10 Nov 2006 | 50.85 M |

| Setiabudi Dana Campuran | 1716.9813 | 5.48% | 9.90% | 15.55% | 3.43% | 18.89% | 38.49% | 71.70% | 25 Sep 2017 | 71.40 M |

| Trimegah Balanced Absolute Strategy Kelas A | 2378.11 | 5.25% | 12.36% | 24.95% | 4.70% | 33.46% | 49.67% | 137.81% | 28 Dec 2018 | 565.67 M |

| HPAM Flexi Indonesia Sehat Kelas A | 2555.3705 | 0.70% | 5.20% | 18.14% | 0.08% | 33.13% | 60.03% | 155.54% | 2 Mar 2011 | 101.83 M |

Provided by Cermati Invest, last update 15 January 2026

| Inception | ||||||||||

| Reksa Dana SAHAM | NAV | 1Bln | 3Bln | 6Bln | YTD | 1Th | 3Th | % | Tanggal | AUM |

| SAM Indonesian Equity Fund | 2955.98 | 27.39% | 17.88% | 51.99% | 4.49% | 48.22% | 77.22% | 252.57% | 18 Oct 2011 | 918.50 M |

| TRIM Syariah Saham | 2552.14 | 12.43% | 20.45% | 35.44% | 8.36% | 41.62% | 39.73% | 155.21% | 27 Dec 2006 | 130.63 M |

| BRI Syariah Saham | 948.3266 | 9.83% | 17.94% | 30.96% | 5.58% | 35.10% | 12.15% | -5.17% | 18 Sep 2014 | 15.35 M |

| Principal Islamic Equity Growth Syariah | 1479.35 | 9.28% | 11.89% | 25.24% | 6.52% | 30.52% | 22.44% | 47.94% | 10 Sep 2007 | 73.04 M |

| Bahana Primavera 99 Kelas G | 1453.22 | 8.86% | 21.48% | 21.35% | 4.97% | 20.47% | 16.98% | 45.32% | 5 Sep 2014 | 22.70 M |

| BRI Mawar Konsumer 10 Kelas A | 1647.9135 | 7.69% | 17.09% | 20.44% | 4.41% | 12.32% | 7.44% | 64.79% | 16 Feb 2011 | 184.17 M |

| SAM Indonesian Equity Fund | 2955.98 | 6.81% | -1.17% | 27.43% | 4.49% | 24.27% | 46.35% | 195.60% | 18 Oct 2011 | 918.50 M |

| Principal Total Return Equity Fund Kelas O | 3862.81 | 6.48% | 14.30% | 22.54% | 4.72% | 23.73% | 16.99% | 286.28% | 1 Jul 2005 | 23.59 M |

| HPAM Ultima Ekuitas 1 Kelas A | 3982.0659 | 6.28% | 18.78% | 22.04% | 4.82% | 45.44% | 64.29% | 298.21% | 2 Nov 2009 | 531.79 M |

| HPAM Ekuitas Syariah Berkah Kelas A | 2683.3187 | 5.62% | 7.86% | 9.12% | 3.04% | 43.02% | 100.61% | 168.33% | 20 Jan 2020 | 1.33 T |

| TRIM Kapital Plus | 5292.13 | 5.55% | 12.11% | 19.65% | 5.64% | 19.37% | 40.09% | 429.21% | 18 Apr 2008 | 504.57 M |

| UOBAM Sustainable Equity Indonesia | 1062.57 | 5.43% | 10.96% | 19.52% | 2.71% | 14.91% | 10.85% | 6.26% | 4 Aug 2021 | 41.11 M |

| BNI-AM Inspiring Equity Fund | 1037.5854 | 4.23% | 13.48% | 19.30% | 3.46% | 15.79% | 5.72% | 3.76% | 7 Apr 2014 | 1.27 T |

| TRIM Kapital | 12190.91 | 3.69% | 7.20% | 14.81% | 3.60% | 14.13% | 14.41% | 1119.09% | 19 Mar 1997 | 302.96 M |

| UOBAM Indeks Bisnis-27 | 1442.1977 | 3.30% | 12.56% | 14.09% | 2.56% | 13.41% | 9.67% | 44.22% | 15 Aug 2012 | 183.15 M |

| Bahana Primavera Plus | 15184.82 | 2.72% | 19.45% | 27.96% | 4.15% | 32.04% | 10.60% | 1418.48% | 27 May 1997 | 84.90 M |

| Syailendra Equity Opportunity Fund | 5011.94 | 1.26% | 5.18% | 23.49% | 1.99% | 22.21% | 34.66% | 401.19% | 7 Jun 2007 | 259.94 M |

| Cipta Saham Unggulan Syariah | 2481.23 | -1.49% | 4.72% | 3.85% | -0.51% | 12.68% | 9.90% | 148.12% | 5 Sep 2018 | 15.49 M |

Provided by Cermati Invest, last update 15 January 2026

| Inception | ||||||||||

| Reksa Dana USD | NAV | 1Bln | 3Bln | 6Bln | YTD | 1Th | 3Th | % | Tanggal | AUM |

| Eastspring Syariah Equity Islamic Asia Pacific USD Kelas A | 1.690564 | 7.19% | 16.29% | 44.69% | 2.62% | 82.77% | 63.30% | 69.06% | 28 Oct 2016 | 2.88 Jt |

| Eastspring Syariah Greater China Equity USD Kelas A | 0.778686 | 4.76% | 6.23% | 19.09% | 3.68% | 31.45% | 0.98% | -22.13% | 15 Jun 2020 | 7.81 Jt |

| BRI G20 Sharia Equity Fund Dollar | 1.298 | 3.10% | 3.78% | 5.41% | 1.92% | 9.11% | 24.20% | 29.80% | 3 Dec 2019 | 1.16 Jt |

| Batavia Global ESG Sharia Equity USD | 1.3025 | 2.00% | 4.58% | 8.43% | 1.86% | 13.61% | 30.84% | 30.25% | 27 Jan 2021 | 10.63 Jt |

| Batavia Technology Sharia Equity USD | 1.2996 | 1.18% | 1.02% | 8.09% | -0.61% | 12.12% | 79.73% | 29.96% | 16 Feb 2022 | 107.61 Jt |

| STAR Fixed Income Dollar | 1.07495 | 0.32% | 0.97% | 2.45% | 0.13% | 4.36% | 16.97% | 7.50% | 10 Jul 2017 | 14.08 Jt |

| Eastspring Syariah Fixed Income USD Kelas A | 0.968002 | 0.24% | 0.29% | 1.10% | 0.04% | 4.81% | 8.44% | -0.23% | 8 Mar 2021 | 11.79 Jt |

| Batavia USD Bond Fund | 1.069 | 0.21% | 0.27% | 1.40% | 0.04% | 5.09% | 4.15% | 6.90% | 18 Oct 2022 | 29.49 Jt |

| BRI Melati Premium Dollar | 1.458121 | -0.22% | -0.03% | 2.70% | -0.43% | 7.96% | 8.15% | 45.81% | 19 Feb 2007 | 1.95 Jt |

Provided by Cermati Invest, last update 15 January 2026

Surat Utang/Obligasi

| NAMA OBLIGASI | ISIN | MATA UANG | KUPON | TANGGAL JATUH TEMPO | INDIKASI HARGA BELI | INDIKASI HARGA JUAL | INDIKASI YIELD | RATING |

| FR0103 | IDG000024506 | IDR | 6.75% | 15-Jul-35 | 103.5 | 102.5 | 6.19% | BBB |

| FR0088 | IDG000018201 | IDR | 6.25% | 15-Jun-36 | 100.6 | 99.6 | 6.17% | BBB |

| PBS005 | IDP000001505 | IDR | 6.75% | 15-Apr-43 | 101.75 | 100.75 | 6.58% | BBB |

| BWPT01BCN2 | IDA0001522B2 | IDR | 11.00% | 26-Feb-28 | 101 | 100 | 10.56% | idA- |

| INKP05BCN1 | IDA0001485B2 | IDR | 10.75% | 4-Oct-29 | 101.25 | 100.25 | 10.38% | idA+ |

| Monday, 19 January 2026 | Previous | Consensus |

Forecast

|

||

| 8:30 AM | CN | House Price Index YoY DEC | -2.4% | -2.6% | |

| 9:00 AM | CN | GDP Growth Rate YoY Q4 | 4.8% | 4.4% | 4.6% |

| 9:00 AM | CN | Industrial Production YoY DEC | 4.8% | 5.0% | 5.4% |

| 9:00 AM | CN | Retail Sales YoY DEC | 1.3% | 1.2% | 1.4% |

| 9:00 AM | CN | Fixed Asset Investment (YTD) YoY DEC | -2.6% | -3.0% | -2.8% |

| 9:00 AM | CN | GDP Growth Rate QoQ Q4 | 1.1% | 1.0% | 1.2% |

| CN | FDI (YTD) YoY DEC | -7.5% | -6.8% | ||

| Tuesday, 20 January 2026 | Previous | Consensus |

Forecast

|

||

| 8:15 AM | CN | Loan Prime Rate 1Y | 3.0% | 3.0% | 3.0% |

| 8:15 AM | CN | Loan Prime Rate 5Y JAN | 3.5% | 3.5% | 3.5% |

| 2:00 PM | DE | PPI YoY DEC | -2.3% | -2.4% | -2.1% |

| 5:00 PM | DE | ZEW Economic Sentiment Index JAN | 45.8 | 49 | 42 |

| 8:15 PM | US | ADP Employment Change Weekly | 11.75K | ||

| Wednesday, 21 January 2026 | Previous | Consensus |

Forecast

|

||

| 4:30 AM | US | API Crude Oil Stock Change JAN/16 | 5.27M | ||

| 2:00 PM | GB | Inflation Rate YoY DEC | 3.2% | 3.3% | 3.1% |

| 2:00 PM | GB | Core Inflation Rate YoY DEC | 3.2% | 3.3% | 3.1% |

| 2:00 PM | GB | Inflation Rate MoM DEC | -0.2% | 0.2% | |

| 2:30 PM | ID | Interest Rate Decision | 4.8% | 4.8% | |

| 6:00 PM | GB | CBI Business Optimism Index Q1 | -31 | -27 | |

| 6:00 PM | GB | CBI Industrial Trends Orders JAN | -32 | -33 | -28 |

| 7:00 PM | US | MBA 30-Year Mortgage Rate JAN/16 | 6.2% | ||

| 10:00 PM | US | Pending Home Sales MoM DEC | 3.3% | 1.4% | |

| 10:00 PM | US | Pending Home Sales YoY DEC | 2.6% | 0.2% | |

| Thursday, 22 January 2026 | Previous | Consensus |

Forecast

|

||

| 6:50 AM | JP | Balance of Trade DEC | ¥316.7B | ¥357B | ¥ -400B |

| 6:50 AM | JP | Exports YoY DEC | 6.1% | 6.1% | |

| 6:00 PM | GB | CBI Distributive Trades JAN | -44 | -35 | -57 |

| 8:30 PM | US | Initial Jobless Claims JAN/17 | 198K | 205K | 195.0K |

| Friday, 23 January 2026 | Previous | Consensus |

Forecast

|

||

| 12:00 AM | US | EIA Crude Oil Stocks Change JAN/16 | 3.391M | ||

| 12:00 AM | US | EIA Gasoline Stocks Change JAN/16 | 8.977M | ||

| 6:30 AM | JP | Inflation Rate YoY DEC | 2.9% | 2.7% | |

| 6:30 AM | JP | Core Inflation Rate YoY DEC | 3.0% | 2.4% | 2.8% |

| 7:01 AM | GB | Gfk Consumer Confidence JAN | -17 | -16 | -17 |

| 7:30 AM | JP | S&P Global Manufacturing PMI Flash JAN | 50 | 50 | 50.3 |

| 7:30 AM | JP | S&P Global Services PMI Flash JAN | 51.6 | 51.5 | |

| 10:00 AM | JP | BoJ Interest Rate Decision | 0.75% | 0.75% | 0.75% |

| 10:00 AM | JP | BoJ Quarterly Outlook Report | |||

| 2:00 PM | GB | Retail Sales MoM DEC | -0.1% | -0.1% | -0.2% |

| 2:00 PM | GB | Retail Sales YoY DEC | 0.6% | 0.9% | 0.8% |

| 3:30 PM | DE | HCOB Manufacturing PMI Flash JAN | 47 | 48 | 48.5 |

| 3:30 PM | DE | HCOB Composite PMI Flash JAN | 51.3 | 52.2 | |

| 3:30 PM | DE | HCOB Services PMI Flash JAN | 52.7 | 53 | 52.9 |

| 4:30 PM | GB | S&P Global Manufacturing PMI Flash JAN | 50.6 | 50.7 | 50.8 |

| 4:30 PM | GB | S&P Global Services PMI Flash JAN | 51.4 | 51.7 | 51.5 |

| 9:45 PM | US | S&P Global Composite PMI Flash JAN | 52.7 | 52.8 | |

| 9:45 PM | US | S&P Global Manufacturing PMI Flash JAN | 51.8 | 52.1 | 52 |

| 9:45 PM | US | S&P Global Services PMI Flash JAN | 52.5 | 52.8 | 52.3 |

| 10:00 PM | US | Michigan Consumer Sentiment Final JAN | 52.9 | 54 | 54 |

Disclaimer:

Dokumen ini dibuat hanya untuk memberikan informasi. Isi dokumen ini tidak boleh ditafsirkan sebagai suatu bentuk penawaran untuk membeli/menjual/dijadikan dasar dari atau yang dapat dijadikan pedoman sehubungan dengan suatu perjanjian atau komitmen apa pun atau suatu nasehat investasi.

Baca Juga Cermati Invest Weekly Update Sebelumnya: