Cermati Invest Weekly Update 12 Januari 2026

Ulasan Pasar

| INDONESIA | W (-/+) % | HARGA |

| IHSG | 2.16% | 8,936.75 |

| ISSI | 2.44% | 220.76 |

| IDX30 | 0.15% | 439.51 |

| FTSE Indonesia | 0.98% | 3,169.55 |

| MSCI Indonesia | 0.39% | 6,428.32 |

| Dolar Amerika | 0.44% | 16,793.30 |

Provided by Cermati Invest, last update 9 January 2026

IHSG & Saham Pekan Ini

Indeks, pekan lalu IHSG ditutup 8936.75 menguat 2.16% ditopang sentimen domestik dan global. Sektor Non-Cyclicals, Basic-Industry, dan Property mendominasi pasar. Rupiah melemah nyaris ke Rp16.900, sehingga diprediksikan IHSG akan konsolidasi turun sejenak dalam area 8845 (support) — 9028 (resistance). All time high IHSG 9002.92 (8 Jan 2026).

Pekan ini indeks konstituen yang menopang pergerakan IHSG masih Indeks Syariah dengan sektor penggeraknya Consumer Cyclicals, Industri, Basic-Industry, Energi, dan Transportasi. Sejak awal 2026 IHSG bergerak naik (+)3.48%.

Saham, yang dapat diamati: MIRA, NINE, VIVA, ASSA, DSSA, SIDO, DMAS.

Pergerakan Rupiah

Rupiah masih melemah terhadap dolar Amerika, pergerakannya Rp16.770—Rp17.015. Sejak awal 2026, rupiah melemah (-)0.72% terhadap dolar Amerika.

| KOMODITAS | W (-/+) % | HARGA |

| Emas | 4.16% | 4,510.45 |

| Perak | 11.72% | 79.34 |

| Platina | 6.07% | 2,278.35 |

| Nikel | 5.73% | 17,715.75 |

| Timah | 8.27% | 43,694.00 |

| Alumunium | 4.13% | 3,147.85 |

| Minyak Mentah | 2.83% | 58.94 |

| Minyak Sawit | 0.00% | 4,480.00 |

| Gas | -12.41% | 3.17 |

| Batu Bara | 0.70% | 107.30 |

| Tembaga | 3.72% | 12,981.00 |

Provided by Cermati Invest, last update 9 January 2026

Emas & Kripto

Emas,

2026 emas all time high US$4601.695 diperkirakan akan naik lebih tinggi menuju US$4687.33 (R1) dan US$4876.441 (R2) per troy ounce.

Dengan nilai tukar rupiah yang melemah terhadap dolar Amerika dan harga emas dunia yang terus naik, maka diperkirakan harga emas di Indonesia akan segera naik lebih tinggi menuju Rp2.550.000—Rp2.611.000 per gramnya. Emas fisik (emas batangan) berkisar Rp2.750.000—Rp2.810.000 per gram.

Harga emas, perak, dan platinum mencatatkan level tertinggi sepanjang sejarah. Sejak awal 2026 harga emas dunia naik (+)5.82%, perak (+)17.71% dan platinum (+)15.6%. Sedangkan emas dalam negeri naik (+)6.69%.

Kripto,

| KRIPTO | W (-/+) % | HARGA |

| Bitcoin | -0.96% | 90,590 |

| Etherium | -0.93% | 3,112.10 |

Provided by Cermati Invest, last update 9 January 2026

Memasuki tahun 2026, walau masih konsolidasi, tetapi bila berhasil breakout resistan terdekatnya, pasar kripto diperkirakan akan bullish.

Bitcoin (BTC), sejak awal 2026 naik (+)4.48%. Pekan ini masih bergerak sideways dalam area US$87774 (support)—US$96016 (resistance).

Ethereum (ETH), sejak awal 2026 naik (+)6.25%. Pekan ini bergerak sideways dalam area US$2990 (support)—US$3280 (resistance).

Hindari spekulasi berlebihan, gunakan analisis cermat untuk dapat melihat arah minor dan mayor pergerakan kripto. Diversifikasi dan gunakan stablecoin untuk lindung nilai menghadapi volatilitas.

| REGIONAL | W (-/+) % | HARGA |

| Dow Jones | 2.32% | 49,504.07 |

| S&P 500 | 1.57% | 6,966.28 |

| FTSE 100 | 1.74% | 10,124.60 |

| DAX | 2.94% | 25,261.64 |

| Nikkei 225 | 1.46% | 51,939.89 |

| Hang Seng | -0.41% | 26,231.79 |

| CSI 300 | 2.79% | 4,758.92 |

| KOSPI | 6.42% | 4,586.32 |

Provided by Cermati Invest, last update 9 January 2026

Reksa Dana

Mengawali tahun 2026, pilihan reksa dananya berdasarkan performa terbaik sejak awal tahun, pilihan terbaik untuk:

- Reksa Dana Pasar Uang: HPAM Ultima Money Market dan SAM Dana Kas.

- Reksa Dana Pendapatan Tetap: Insight Renewable Energy Fund dan Insight Haji Syariah.

- Reksa Dana Campuran: Trim Kombinasi 2 dan Trim Syariah Berimbang.

- Reksa Dana Saham: Trim Syariah Saham.

- Reksa Dana Mata Uang Dolar Amerika: Eastspring Syariah Equity Islamic Asia Pacific USD Kelas A.

Bingung cari investasi reksa dana yang aman dan menguntungkan? Cermati Invest solusinya!

Surat Berharga

Prospek pasar Surat Berharga Negara (SBN) dan obligasi korporasi pada 2026 diproyeksikan tetap positif, seiring berlanjutnya siklus pelonggaran moneter global yang dipicu potensi pemangkasan suku bunga The Fed dan bank sentral utama dunia. Beberapa pilihan surat berharga dapat dicermati pada tabel.

Pekan Singkat Perdagangan, Pasar Keuangan RI Waspadai Dinamika Global

Pasar keuangan Indonesia pekan ini hanya beroperasi selama empat hari, yakni Senin hingga Kamis, seiring libur Isra Mikraj pada Jumat. Dengan waktu perdagangan yang relatif singkat, pelaku pasar perlu mencermati sejumlah sentimen baik dalam jangka pendek maupun sepekan ke depan.

Dari dalam negeri, sentimen pasar dipengaruhi oleh kondisi makroekonomi dan kebijakan. Data Badan Pusat Statistik (BPS) menunjukkan inflasi konsumen tetap terkendali, dengan inflasi bulanan Desember 2025 sebesar 0.64% dan inflasi tahunan tercatat 2.92%. Selain itu, neraca perdagangan Indonesia kembali membukukan surplus US$2,66 miliar pada November 2025, memperpanjang tren surplus sejak Mei 2020.

Dari sisi fiskal, pemerintah telah merilis APBN 2026 dengan target pendapatan Rp3.842,7 triliun dan belanja Rp3.153,6 triliun, sehingga defisit dirancang sebesar 2.68% terhadap PDB.

Sementara itu, Otoritas Jasa Keuangan (OJK) mengimbau lembaga keuangan untuk tetap mewaspadai potensi risiko dari konflik geopolitik global, meski sejauh ini belum terlihat dampak signifikan dalam jangka pendek. Dari kawasan regional, perhatian pelaku pasar juga tertuju pada meningkatnya ketidakpastian geopolitik serta sentimen yang dipengaruhi oleh rilis data inflasi Amerika Serikat pada pekan ini.

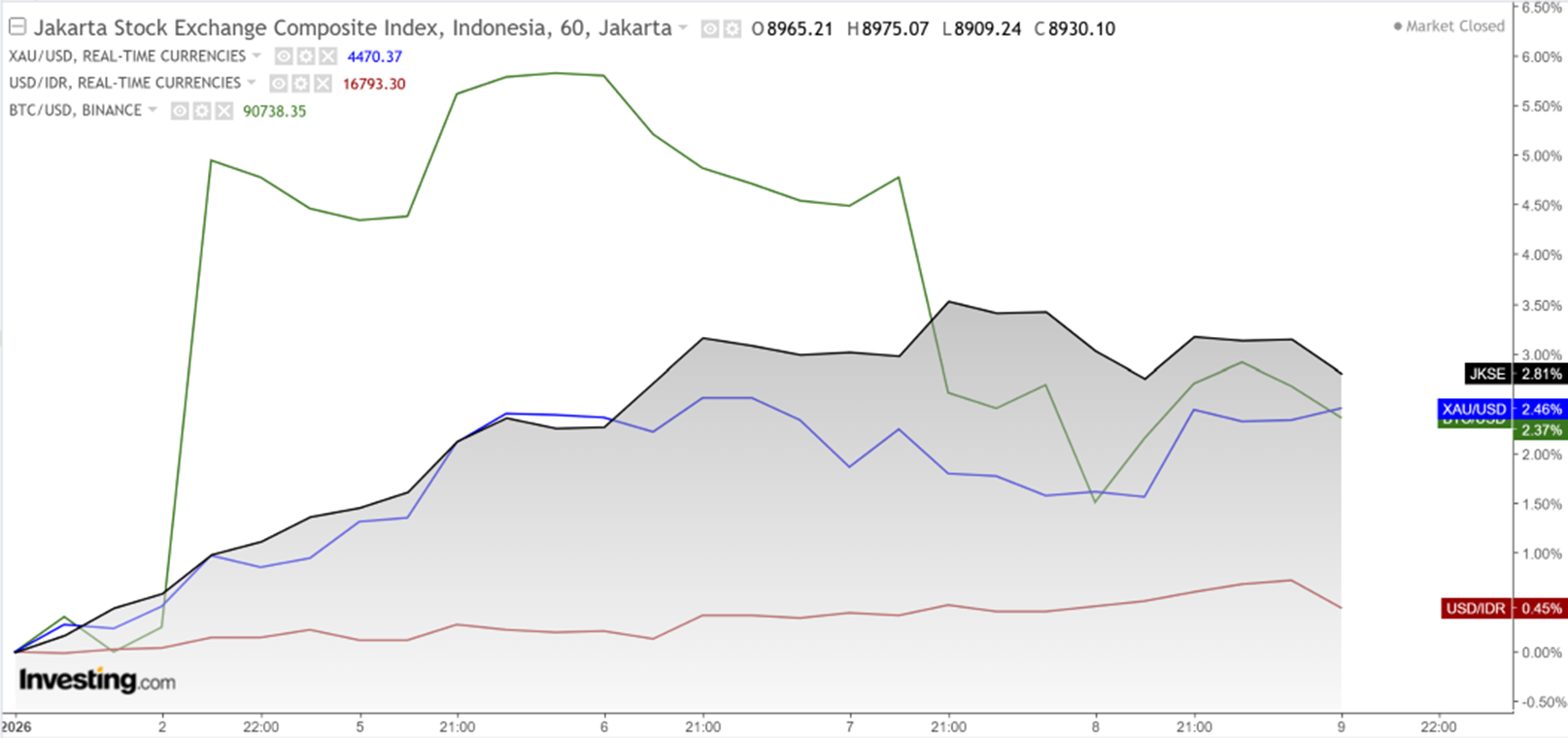

Performance IHSG, XAUUSD (Gold), BTCUSD (Bitcoin) & USDIDR since Jan 2025 (YtD)

Reksa Dana

| Inception | ||||||||||

| Reksa Dana PASAR UANG | NAV | 1Bln | 3Bln | 6Bln | YTD | 1Th | 3Th | % | Tanggal | AUM |

| HPAM Ultima Money Market | 1700.2135 | 0.49% | 1.35% | 2.78% | 0.10% | 5.52% | 16.03% | 70.02% | 10 Jun 2015 | 965.08 B |

| SAM Dana Kas | 1507.1723 | 0.43% | 1.21% | 2.90% | 0.10% | 5.58% | 14.36% | 50.72% | 10 Feb 2017 | 55.99 B |

| Setiabudi Dana Pasar Uang | 1588.9286 | 0.42% | 1.28% | 2.65% | 0.10% | 5.48% | 16.57% | 58.89% | 23 Dec 2016 | 544.42 B |

| Syailendra Dana Kas | 1775.4545 | 0.42% | 1.28% | 2.70% | 0.09% | 5.33% | 15.26% | 77.55% | 12 Jun 2015 | 2.99 T |

| BNI-AM Dana Likuid Kelas A | 1999.95 | 0.41% | 1.13% | 2.57% | 0.08% | 5.21% | 14.00% | 100.00% | 27 Dec 2012 | 502.39 B |

| Insight Money Syariah | 1731.7682 | 0.41% | 1.35% | 2.91% | 0.09% | 5.98% | 17.96% | 73.18% | 30 Sep 2015 | 187.11 B |

| Trimegah Kas Syariah | 1502.0959 | 0.41% | 1.21% | 2.52% | 0.08% | 5.23% | 15.70% | 50.21% | 30 Dec 2016 | 1.73 T |

| Insight Retail Cash Fund | 1676.9888 | 0.40% | 1.32% | 2.74% | 0.09% | 6.15% | 17.10% | 67.70% | 13 Apr 2018 | 225.80 B |

| Bahana Likuid Syariah Kelas G | 1268.7 | 0.39% | 1.23% | 2.50% | 0.09% | 5.19% | 15.37% | 26.87% | 12 Jul 2016 | 515.80 B |

| BRI Seruni Pasar Uang III | 1853.0881 | 0.39% | 1.21% | 2.56% | 0.09% | 5.30% | 15.62% | 85.31% | 16 Feb 2010 | 3.55 T |

| BRI Seruni Pasar Uang Syariah | 1402.9258 | 0.39% | 1.18% | 2.55% | 0.09% | 5.37% | 16.22% | 40.29% | 19 Jul 2018 | 1.83 T |

| Danakita Stabil Pasar Uang | 1694.3 | 0.38% | 1.19% | 2.58% | 0.08% | 5.13% | 15.28% | 69.43% | 10 Sep 2015 | 66.76 B |

| TRIM Kas 2 Kelas A | 1999.1229 | 0.38% | 1.19% | 2.48% | 0.08% | 5.29% | 15.58% | 99.91% | 8 Apr 2008 | 8.17 T |

| Cipta Dana Cash | 1810.05 | 0.35% | 1.23% | 2.86% | 0.08% | 5.85% | 16.95% | 81.01% | 8 Jun 2015 | 547.10 B |

Provided by Cermati Invest, last update 9 January 2026

| Inception | ||||||||||

| Reksa Dana PENDAPATAN TETAP | NAV | 1Bln | 3Bln | 6Bln | YTD | 1Th | 3Th | % | Tanggal | AUM |

| BRI Brawijaya Abadi Pendapatan Tetap | 1523.824 | 0.81% | 1.47% | 5.69% | -0.18% | 13.03% | 19.80% | 52.38% | 25 Feb 2019 | 120.60 B |

| BNI-AM Pendapatan Tetap Quality Long Duration Fund | 1685.29 | 0.80% | 1.40% | 4.63% | -0.04% | 9.23% | 17.12% | 74.56% | 16 Jun 2016 | 20.30 B |

| Cipta Bond | 1945.58 | 0.78% | 1.04% | 3.71% | -0.15% | 9.28% | 16.41% | 94.56% | 2 Jan 2019 | 111.39 B |

| Sequis Bond Optima | 1606.6684 | 0.77% | 0.72% | 4.27% | -0.03% | 9.47% | 15.03% | 60.67% | 8 Sep 2016 | 55.67 B |

| BRI Melati Pendapatan Utama | 2050.2547 | 0.75% | 1.29% | 5.35% | -0.02% | 10.20% | 17.78% | 105.03% | 27 Sep 2012 | 186.72 B |

| Principal Total Return Bond Fund | 2714.63 | 0.75% | 1.14% | 4.80% | 0.03% | 10.29% | 13.57% | 179.05% | 21 Aug 2008 | 13.91 B |

| Eastspring IDR Fixed Income Fund Kelas A | 1892.26 | 0.73% | 1.07% | 4.81% | 0.02% | 10.29% | 17.95% | 89.23% | 16 Mar 2015 | 192.59 B |

| Eastspring Investments IDR High Grade Kelas A | 1691.41 | 0.72% | 0.72% | 4.48% | -0.12% | 10.50% | 18.15% | 78.76% | 9 Jan 2013 | 10.09 T |

| Syailendra Fixed Income Fund Kelas A | 2806.88 | 0.71% | 0.31% | 4.45% | -0.14% | 9.84% | 18.47% | 180.69% | 8 Dec 2011 | 191.08 B |

| BNI-AM Short Duration Bonds Index Kelas R1 | 1111.17 | 0.68% | 0.11% | 4.34% | -0.12% | 10.01% | 19.02% | 15.53% | 1 Sep 2022 | 218.76 B |

| HPAM Government Bond | 1686.7296 | 0.63% | 0.61% | 4.67% | -0.24% | 11.05% | 21.23% | 76.17% | 18 May 2016 | 29.04 B |

| Eastspring Investments Yield Discovery Kelas A | 1672.37 | 0.56% | 0.40% | 4.41% | -0.09% | 9.00% | 14.16% | 72.71% | 29 May 2013 | 108.71 B |

| Insight Renewable Energy Fund | 2517.2329 | 0.46% | 1.60% | 5.40% | 0.10% | 9.67% | 24.79% | 151.72% | 22 Jun 2011 | 1.70 T |

| Insight Haji Syariah | 5560.5265 | 0.43% | 1.53% | 5.12% | 0.10% | 9.71% | 25.74% | 456.05% | 13 Jan 2005 | 2.55 T |

Provided by Cermati Invest, last update 9 January 2026

| Inception | ||||||||||

| Reksa Dana CAMPURAN | NAV | 1Bln | 3Bln | 6Bln | YTD | 1Th | 3Th | % | Tanggal | AUM |

| TRIM Kombinasi 2 | 3627.9 | 12.85% | 12.03% | 33.76% | 5.05% | 37.11% | 46.51% | 262.79% | 10 Nov 2006 | 50.85 B |

| TRIM Syariah Berimbang | 4379.81 | 12.76% | 14.27% | 35.09% | 5.41% | 36.03% | 48.30% | 337.98% | 27 Dec 2006 | 80.47 B |

| Trimegah Balanced Absolute Strategy Kelas A | 2377.12 | 9.52% | 9.08% | 31.40% | 4.65% | 36.24% | 49.73% | 137.71% | 28 Dec 2018 | 565.67 B |

| Bahana Primavera 99 Kelas G | 1420.47 | 8.55% | 15.20% | 20.90% | 2.60% | 19.60% | 13.68% | 42.05% | 5 Sep 2014 | 22.70 B |

| Syailendra Balanced Opportunity Fund | 4782.85 | 7.41% | 16.64% | 44.07% | 4.31% | 48.27% | 56.59% | 378.29% | 22 Apr 2008 | 263.78 B |

| Bahana Primavera Plus | 14902.74 | 4.19% | 11.14% | 29.17% | 2.22% | 33.29% | 9.85% | 1390.27% | 27 May 1997 | 84.90 B |

Provided by Cermati Invest, last update 9 January 2026

| Inception | ||||||||||

| Reksa Dana SAHAM | NAV | 1Bln | 3Bln | 6Bln | YTD | 1Th | 3Th | % | Tanggal | AUM |

| TRIM Syariah Saham | 2532.65 | 15.32% | 16.48% | 43.38% | 7.54% | 44.10% | 37.78% | 153.27% | 27 Dec 2006 | 130.63 B |

| BRI Syariah Saham | 932.2791 | 10.21% | 15.51% | 32.24% | 3.80% | 32.80% | 10.25% | -6.77% | 18 Sep 2014 | 15.35 B |

| BRI Mawar Konsumer 10 Kelas A | 1637.6854 | 8.81% | 13.89% | 21.32% | 3.76% | 11.50% | 5.92% | 63.77% | 16 Feb 2011 | 184.17 B |

| Bahana Primavera 99 Kelas G | 1420.47 | 8.55% | 15.20% | 20.90% | 2.60% | 19.60% | 13.68% | 42.05% | 5 Sep 2014 | 22.70 B |

| Principal Total Return Equity Fund Kelas O | 3816.27 | 7.57% | 10.44% | 22.89% | 3.46% | 23.33% | 14.60% | 281.63% | 1 Jul 2005 | 23.59 B |

| UOBAM Sustainable Equity Indonesia | 1060.5 | 7.18% | 7.64% | 24.14% | 2.51% | 14.99% | 10.21% | 6.05% | 4 Aug 2021 | 41.11 B |

| TRIM Kapital Plus | 5218.88 | 7.12% | 8.63% | 21.85% | 4.17% | 18.70% | 36.04% | 421.89% | 18 Apr 2008 | 504.57 B |

| Principal Islamic Equity Growth Syariah | 1442.56 | 6.36% | 7.15% | 24.31% | 3.87% | 28.56% | 18.80% | 44.26% | 10 Sep 2007 | 73.04 B |

| Bahana Primavera Plus | 14902.74 | 4.19% | 11.14% | 29.17% | 2.22% | 33.29% | 9.85% | 1390.27% | 27 May 1997 | 84.90 B |

| SAM Indonesian Equity Fund | 2979.3 | 2.70% | 19.55% | 55.59% | 5.31% | 50.74% | 79.18% | 254.90% | 18 Oct 2011 | 918.50 B |

Provided by Cermati Invest, last update 9 January 2026

| Inception | ||||||||||

| Reksa Dana USD | NAV | 1Bln | 3Bln | 6Bln | YTD | 1Th | 3Th | % | Tanggal | AUM |

| Eastspring Syariah Equity Islamic Asia Pacific USD Kelas A | 1.671817 | 6.63% | 12.78% | 46.24% | 1.48% | 77.48% | 67.71% | 67.18% | 28 Oct 2016 | 2.88 M |

| Eastspring Syariah Greater China Equity USD Kelas A | 0.761995 | 2.92% | -2.18% | 16.91% | 1.45% | 26.77% | 2.65% | -23.80% | 15 Jun 2020 | 7.81 M |

| Batavia Global ESG Sharia Equity USD | 1.2902 | 1.09% | 1.68% | 7.10% | 0.90% | 11.61% | 32.78% | 29.02% | 27 Jan 2021 | 10.63 M |

| BRI G20 Sharia Equity Fund Dollar | 1.2796 | 1.56% | 0.61% | 3.77% | 0.47% | 6.82% | 25.67% | 27.96% | 3 Dec 2019 | 1.16 M |

| STAR Fixed Income Dollar | 1.074325 | 0.32% | 0.97% | 2.45% | 0.07% | 4.35% | 16.95% | 7.43% | 10 Jul 2017 | 14.08 M |

| Eastspring Syariah Fixed Income USD Kelas A | 0.967854 | 0.25% | 0.35% | 1.11% | 0.02% | 4.45% | 8.48% | -0.24% | 8 Mar 2021 | 11.79 M |

| Batavia USD Bond Fund | 1.0687 | 0.24% | 0.33% | 1.39% | 0.01% | 4.72% | 4.23% | 6.87% | 18 Oct 2022 | 29.49 M |

| BRI Melati Premium Dollar | 1.460189 | -0.02% | 0.32% | 2.76% | -0.29% | 7.55% | 8.86% | 46.02% | 19 Feb 2007 | 1.95 M |

| Batavia Technology Sharia Equity USD | 1.3003 | -2.55% | -1.85% | 7.52% | -0.56% | 9.92% | 92.55% | 30.03% | 16 Feb 2022 | 107.61 M |

Provided by Cermati Invest, last update 9 January 2026

Surat Utang/Obligasi

| NAMA OBLIGASI | ISIN | MATA UANG | KUPON | JATUH TEMPO | HARGA BELI | HARGA JUAL | YIELD | RATING |

| FR0103 | IDG000024506 | IDR | 6.75% | 15-Jul-35 | 104 | 103 | 6.19% | BBB |

| FR0097 | IDG000020900 | IDR | 7.13% | 15-Jun-43 | 106 | 105 | 6.54% | BBB |

| PBS005 | IDP000001505 | IDR | 6.75% | 15-Apr-43 | 101.95 | 100.95 | 6.56% | BBB |

| BWPT01BCN2 | IDA0001522B2 | IDR | 11.00% | 26-Feb-28 | 101 | 100 | 10.56% | idA- |

| INKP05BCN1 | IDA0001485B2 | IDR | 10.75% | 4-Oct-29 | 101.25 | 100.25 | 10.38% | idA+ |

| Tuesday, 13 January 2026 | Previous | Consensus | Forecast | ||

| 6:50 AM | JP | Current Account NOV | ¥2834B | ¥3594B | ¥3300.0B |

| 7:01 AM | GB | BRC Retail Sales Monitor YoY DEC | 1.2% | 0.6% | 0.9% |

| 8:15 PM | US | ADP Employment Change Weekly | 11.5K | ||

| 8:30 PM | US | Core Inflation Rate MoM DEC | 0.3% | 0.2% | |

| 8:30 PM | US | Core Inflation Rate YoY DEC | 2.6% | 2.7% | 2.6% |

| 8:30 PM | US | Inflation Rate MoM DEC | 0.3% | 0.2% | |

| 8:30 PM | US | Inflation Rate YoY DEC | 2.7% | 2.7% | 2.6% |

| 8:30 PM | US | CPI DEC | 324.12 | 323.8 | |

| 8:30 PM | US | CPI s.a DEC | 325.031 | 325.7 | |

| Wednesday, 14 January 2026 | Previous | Consensus | Forecast | ||

| 2:00 AM | US | Monthly Budget Statement DEC | $-173B | $-250.0B | |

| 4:30 AM | US | API Crude Oil Stock Change JAN/09 | -2.8M | ||

| 10:00 AM | CN | Balance of Trade DEC | $111.68B | $113.5B | $ 105B |

| 10:00 AM | CN | Exports YoY DEC | 5.9% | 2.9% | |

| 10:00 AM | CN | Imports YoY DEC | 1.9% | 0.8% | |

| 7:00 PM | US | MBA 30-Year Mortgage Rate JAN/09 | 6.3% | ||

| 8:30 PM | US | PPI MoM OCT | 0.3% | 0.3% | |

| 8:30 PM | US | PPI MoM NOV | 0.3% | 0.2% | |

| 8:30 PM | US | Retail Sales MoM NOV | 0.0% | 0.4% | 0.3% |

| 8:30 PM | US | Core PPI MoM NOV | 0.2% | 0.2% | |

| 8:30 PM | US | Core PPI MoM OCT | 0.1% | 0.2% | |

| 8:30 PM | US | Current Account Q3 | $-251.3B | $-240B | $ -250.0B |

| 8:30 PM | US | Retail Sales Control Group MoM NOV | 0.8% | 0.1% | |

| 8:30 PM | US | Retail Sales Ex Autos MoM NOV | 0.4% | 0.4% | 0.1% |

| 10:00 PM | US | Existing Home Sales DEC | 4.13M | 4.2M | 4.06M |

| 10:00 PM | US | Business Inventories MoM OCT | 0.2% | 0.3% | 0.1% |

| 10:00 PM | US | Existing Home Sales MoM DEC | 0.5% | -1.6% | |

| 10:30 PM | US | EIA Crude Oil Stocks Change JAN/09 | -3.831M | ||

| 10:30 PM | US | EIA Gasoline Stocks Change JAN/09 | 7.702M | ||

| CN | New Yuan Loans DEC | CNY390B | CNY800B | CNY910.0B | |

| Thursday, 15 January 2026 | Previous | Consensus | Forecast | ||

| 7:01 AM | GB | RICS House Price Balance DEC | -16.0% | -15.0% | -16.0% |

| 2:00 PM | DE | Wholesale Prices MoM DEC | 0.3% | 0.2% | 0.2% |

| 2:00 PM | DE | Wholesale Prices YoY DEC | 1.5% | 1.6% | |

| 2:00 PM | GB | GDP MoM NOV | -0.1% | 0.0% | -0.1% |

| 2:00 PM | GB | GDP 3-Month Avg NOV | -0.1% | -0.2% | -0.1% |

| 2:00 PM | GB | Goods Trade Balance NOV | £-22.54B | £-20B | £-19.8B |

| 2:00 PM | GB | Goods Trade Balance Non-EU NOV | £-10.26B | £-9.1B | |

| 2:00 PM | GB | Industrial Production MoM NOV | 1.1% | 0.1% | 1.0% |

| 2:00 PM | GB | Manufacturing Production MoM NOV | 0.5% | 0.5% | 0.4% |

| 4:00 PM | DE | Full Year GDP Growth 2025 | -0.2% | 0.2% | |

| 8:30 PM | US | Export Prices MoM NOV | 0.1% | ||

| 8:30 PM | US | Import Prices MoM NOV | -0.2% | 0.1% | |

| 8:30 PM | US | Initial Jobless Claims JAN/10 | 208K | 208K | 212.0K |

| 8:30 PM | US | NY Empire State Manufacturing Index JAN | -3.9 | 1.0 | 1.0 |

| 8:30 PM | US | Philadelphia Fed Manufacturing Index JAN | -10.2 | -5.0 | -8.0 |

| Friday, 16 January 2026 | Previous | Consensus | Forecast | ||

| 4:00 AM | US | Net Long-term TIC Flows NOV | $17.5B | ||

| 9:15 PM | US | Industrial Production MoM DEC | 0.2% | 0.2% | 0.3% |

| 11:00 PM | RU | Inflation Rate MoM DEC | 0.4% | 0.5% | |

| 11:00 PM | RU | Inflation Rate YoY DEC | 6.6% | 5.8% | |

| US | NAHB Housing Market Index JAN | 39 | 40 | 39 | |

Disclaimer:

Dokumen ini dibuat hanya untuk memberikan informasi. Isi dokumen ini tidak boleh ditafsirkan sebagai suatu bentuk penawaran untuk membeli/menjual/dijadikan dasar dari atau yang dapat dijadikan pedoman sehubungan dengan suatu perjanjian atau komitmen apa pun atau suatu nasehat investasi.

Baca Juga Cermati Invest Weekly Update Sebelumnya: