Cermati Invest Weekly Update 26 Mei 2025

Ulasan Pasar

| INDONESIA | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| IHSG | 1.51% | 7,214.16 |

| ISSI | 1.15% | 225.77 |

| IDX30 | 1.44% | 426.69 |

| FTSE Indonesia | 1.44% | 3,167.75 |

| MSCI Indonesia | 1.85% | 6,644.96 |

| USD/IDR | -1.28% | 16,217.50 |

Provided by Cermati Invest, last update 23 Mei 2025

IHSG & Saham Pekan Ini

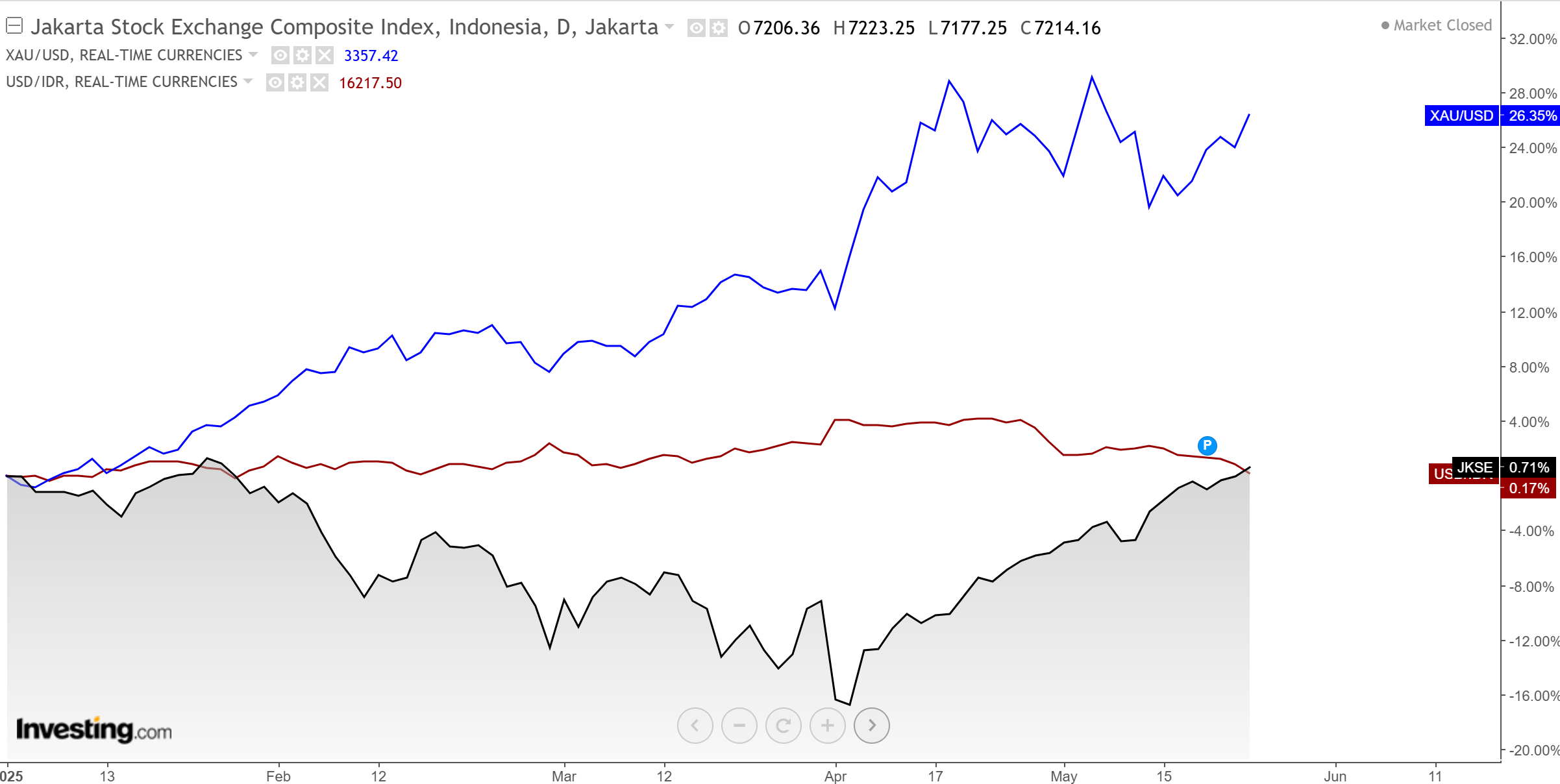

IHSG yang rebound sejak awal April 2025, seperti tidak mau turun, pekan lalu tutup di 7214.16, naik (+)1.51% (weekly), (+)5.76% (monthly) dan (+)9.92% (quarterly). Dalam 2 pekan ke depan IHSG diperkirakan terkoreksi wajar dan menembus ke bawah 7128 sampai 7000. Sepanjang kuartal 2 ini, IHSG aman selama di atas 6724.

Sampai akhir kuartal 2 ini, diperkirakan IHSG akan terus naik lebih tinggi dan menembus 7454. Semester 2 nanti diharapkan lebih dari 7564. Support ada di 6882.318, 6613.47, 6538.32, 6368.51, 6092.41, dan 5967.98.

Momen dividen sudah hampir usai, bagi dividen hunter, berikut adalah beberapa emiten yang cum date mulai pekan ini: BAYU 100 (26 Mei), BRIS 22.78 (26 Mei), INCO US$0.00329 (26 Mei), MARK 30 (26 Mei), MLBI 352 (26 Mei), PLIN 96 (26 Mei), PTPS 3.8 (26 Mei), CITA 328 (26 Mei), POWR 45.58 (27 Mei), BBLD 12 (27 Mei), PSSI 8 (28 Mei), ZATA 0.05 (28 Mei), UNIC 448 (28 Mei), HUMI 1 (28 Mei).

Indeks Konstituen dengan performa terbaik 2025 ini masih Indeks Syariah (ISSI dan JII) lalu Indeks PEFINDO I-Grade.

Sektor unggulan penggerak IHSG sejak awal tahun adalah Teknologi. Tetapi menjelang akhir kuartal 2 ini, sektor Basic-Industry (Industri Dasar) paling perform naiknya dari paling bawah (performa negatif), kini performanya positif, jauh melampaui sektor lainnya untuk menguasai IHSG. Selanjutnya yang sudah berada di zona positif adalah sektor Transportasi, Kesehatan, Energi, dan Keuangan (Perbankan).

Pergerakan Rupiah

Rupiah semakin kuat terhadap dolar Amerika. Setelah menyentuh Rp16.169, rupiah akan lebih kuat menuju area Rp15.564 per 1 dolar Amerika. Kalaupun melemah, sementara cukup ke Rp16.500 saja.

| COMMODITY | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| XAU/USD | 3.79% | 3,357.42 |

| Crude Oil WTI | -0.89% | 61.53 |

| Palm Oil c3 F | 0.00% | 4,480.00 |

| Natural Gas | 14.30% | 3.73 |

| Newcastle Coal | 1.41% | 100.40 |

| Nickel | 0.19% | 15,590.63 |

| Tin | -0.05% | 32,709.00 |

| Copper | 1.76% | 9,622.10 |

| Aluminium | -0.30% | 2,472.40 |

| US Soybeans | 0.98% | 1,060.25 |

| Silver | 2.99% | 33.61 |

Provided by Cermati Invest, last update 23 Mei 2025

Emas

Setelah turun menyentuh US$3120.765 per troy ounce, emas dunia kembali naik. Saat ini berada di US$3357.42 artinya naik lebih dari US$200 dolar dalam 2 pekan. Pergerakan harga emas dunia pekan ini berkisar US$3250 - US$3435. Support bawah US$3188.120.

Bagaimana dengan harga emas dalam negeri?

Harga emas naik tetapi rupiah menguat, sehingga harga emas murni cenderung stabil berkisar Rp1.659.000 - Rp1.779.000 per gram. Kali ini investasi emas akan sedikit berbeda, cenderung untuk LONG TERM INVESTMENT (investasi jangka panjang), karena rupiah cenderung menguat terhadap dolar Amerika.

Sebagai salah satu aset investasi, memiliki emas digital maupun emas fisik sangatlah menarik. Setiap kali harga koreksi (turun), tidak perlu lama harga emas segera kembali naik. Harga emas fisik biasanya lebih tinggi Rp60.000 - Rp100.000 per gramnya dari harga emas digital.

| REGIONAL | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| Dow Jones | -2.47% | 41,603.07 |

| S&P 500 | -2.61% | 5,802.82 |

| FTSE 100 | 0.38% | 8,717.97 |

| DAX | -0.58% | 23,629.58 |

| Nikkei 225 | -1.19% | 37,160.47 |

| Hang Seng | 1.10% | 23,601.26 |

| CSI 300 | -0.18% | 3,882.27 |

| KOSPI | -1.32% | 2,592.09 |

Provided by Cermati Invest, last update 23 Mei 2025

Reksa Dana & Surat Berharga

Performa year to date reksa dana campuran dan reksa dana saham semakin positif, terlihat dari performa 1 bulan banyak yang di atas 7%. Kedua jenis reksa dana ini dapat diperhatikan dan dimiliki untuk investasi long term (minimal 1 tahun ke depan). Sebagai contoh kali ini, reksa dana saham seperti BNI AM IDX Pefindo Prime Bank Kelas R1, BRI MSCI Indonesia ESG Screened Kelas A, Syailendra MSCI Indonesia Value Index Fund Kelas A, Cipta Saham Unggulan Syariah, dan UOBAM Indeks Bisnis-27 memiliki performa lebih dari 10% dalam 3 bulan terakhir. Sedangkan dari jenis campuran dapat perhatikan HPAM Flexi Indonesia Sehat Kelas A, Setiabudi Dana Campuran, TRIM Kombinasi 2, TRIM Syariah Berimbang, dan Trimegah Balanced Absolute Strategy Kelas A.

Pilihan reksa dana mana yang terbaik, dapat dilihat dalam tabel.

Surat berharga, dapatkan passive income rutin setiap bulan dengan memiliki Sukuk Ritel SR022 di pasar perdana mulai tanggal 16 Mei - 18 Juni 2025. Imbal hasil tetap sampai jatuh tempo dan pengembalian pokok investasi yang dijamin negara melalui Undang-Undang. Selain itu, ada juga beberapa obligasi yang kami pilihkan untuk Anda dalam tabel di bawah.

BI Rate Dipangkas dan Pemerintah Suntik Kebijakan, Pasar Investasi Diharapkan Semakin Pulih

Pasar keuangan Indonesia kompak menguat pada pekan lalu sejalan dengan meredanya perang dagang China dan Amerika Serikat, hingga pemangkasan suku bunga Bank Indonesia. Pasar keuangan Indonesia diharapkan bisa melanjutkan tren positif pada pekan ini. Dari dalam negeri, pelaku pasar menyambut positif potensi penurunan suku bunga acuan dan membaiknya defisit transaksi berjalan. Bank Indonesia (BI) kembali memangkas BI Rate atau suku bunga acuan menjadi 25 basis poin (bps). BI Rate kini berada di angka 5.50%. Penurunan tersebut berdampak langsung ke bunga kredit. Cicilan makin ringan dan daya beli bisa terdongkrak.

Jika BI Rate turun, bunga pinjaman ikut melandai di semua perbankan. Masyarakat bisa pinjam dengan bunga lebih rendah. Serta pelaku usaha juga makin mudah melakukan ekspansi bisnis. Nilai rupiah berhasil mencatat penguatan selama enam hari beruntun terhadap dolar AS hingga akhir pekan lalu. Dalam upaya mendorong ekonomi dalam negeri, pemerintah akan mengeluarkan paket kebijakan insentif ekonomi pada 5 Juni mendatang. Paket itu terdiri dari enam insentif untuk mendorong aktivitas ekonomi dan daya beli masyarakat pada pertengahan tahun ini. Enam insentif itu ialah subsidi pembelian motor listrik senilai Rp7.000.000, bantuan pangan untuk periode Juni - Juli 2025, Bantuan Subsidi Upah atau BSU seperti saat masa pandemi Covid-19 maupun diskon iuran Jaminan Kecelakaan Kerja (JKK), diskon tarif listrik seperti awal tahun ini, diskon tarif tiket pesawat lewat pajak pertambahan nilai ditanggung pemerintah (PPN DTP), hingga diskon tarif tol.

COMPOSITE INDEX compare to USDIDR & GOLD since 2025 (YtD)

Reksa Dana

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana PASAR UANG | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| Cipta Dana Cash | 1746.930 | 0.53% | 1.37% | 2.91% | 2.30% | 5.67% | 15.67% | 74.69% | 8 Jun 2015 | 235.95 B |

| Insight Retail Cash Fund | 1613.948 | 0.51% | 1.54% | 2.92% | 2.26% | 6.33% | 15.24% | 61.39% | 13 Apr 2018 | 27.04 B |

| Insight Money Syariah | 1668.938 | 0.48% | 1.48% | 2.93% | 2.24% | 6.06% | 16.58% | 66.89% | 30 Sep 2015 | 200.62 B |

| SAM Dana Kas | 1455.266 | 0.48% | 1.15% | 2.29% | 2.06% | 4.18% | 12.38% | 45.53% | 10 Feb 2017 | 28.61 B |

| BNI-AM Dana Likuid Kelas A | 1936.120 | 0.47% | 1.28% | 2.45% | 1.97% | 4.79% | 11.99% | 93.61% | 27 Dec 2012 | 335.69 B |

| BRI Seruni Pasar Uang III | 1795.080 | 0.47% | 1.35% | 2.71% | 2.12% | 5.61% | 13.82% | 79.51% | 16 Feb 2010 | 1.91 T |

| BRI Seruni Pasar Uang Syariah | 1358.515 | 0.46% | 1.30% | 2.56% | 2.16% | 5.32% | 14.30% | 35.85% | 19 Jul 2018 | 643.46 B |

| HPAM Ultima Money Market | 1642.855 | 0.45% | 1.35% | 2.60% | 2.01% | 5.34% | 14.69% | 64.29% | 10 Jun 2015 | 758.60 B |

| Setiabudi Dana Pasar Uang | 1537.228 | 0.45% | 1.39% | 2.78% | 2.15% | 5.59% | 15.19% | 53.72% | 23 Dec 2016 | 649.88 B |

| TRIM Kas 2 Kelas A | 1937.587 | 0.45% | 1.38% | 2.77% | 2.16% | 5.52% | 14.60% | 93.76% | 8 Apr 2008 | 4.59 T |

| Syailendra Dana Kas | 1716.159 | 0.44% | 1.21% | 2.48% | 1.91% | 5.05% | 14.19% | 71.62% | 12 Jun 2015 | 1.80 T |

| Trimegah Kas Syariah | 1455.083 | 0.44% | 1.31% | 2.62% | 2.03% | 5.35% | 14.61% | 45.51% | 30 Dec 2016 | 1.35 T |

| Bahana Likuid Syariah Kelas G | 1229.620 | 0.42% | 1.32% | 2.63% | 2.05% | 5.30% | 13.88% | 22.96% | 12 Jul 2016 | 617.33 B |

| Danakita Stabil Pasar Uang | 1641.500 | 0.41% | 1.24% | 2.50% | 1.97% | 5.00% | 14.04% | 64.15% | 10 Sep 2015 | 75.28 B |

| Sequis Liquid Prima | 1460.683 | 0.39% | 1.18% | 2.42% | 1.88% | 4.86% | 12.65% | 46.07% | 8 Sep 2016 | 348.42 B |

Provided by Cermati Invest, last update 23 Mei 2025

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana PENDAPATAN TETAP | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| Syailendra Pendapatan Tetap Premium | 1858.707 | 1.48% | 1.88% | 2.49% | 2.85% | 5.96% | 18.51% | 85.87% | 27 Mar 2017 | 2.81 T |

| BNI-AM Short Duration Bonds Index Kelas R1 | 1080.280 | 1.36% | 0.33% | 1.50% | 2.76% | 3.00% | - | 8.03% | 1 Sep 2022 | 8.77 B |

| BRI Brawijaya Abadi Pendapatan Tetap | 1418.427 | 1.34% | 1.19% | 4.57% | 4.53% | 6.48% | 20.14% | 41.84% | 25 Feb 2019 | 2.83 B |

| Principal Total Return Bond Fund | 2625.840 | 1.28% | 0.84% | 3.05% | 2.99% | 2.82% | 0.21% | 162.58% | 21 Aug 2008 | 13.80 B |

| HPAM Government Bond | 1632.040 | 1.25% | -0.47% | 2.16% | 1.94% | 5.01% | 17.55% | 63.20% | 18 May 2016 | 18.10 B |

| Eastspring IDR Fixed Income Fund Kelas A | 1778.170 | 1.22% | 1.00% | 3.00% | 3.05% | 4.80% | 16.72% | 77.82% | 16 Mar 2015 | 166.00 B |

| Cipta Bond | 1855.940 | 1.16% | 1.18% | 3.31% | 3.38% | 5.23% | 16.55% | 85.59% | 2 Jan 2019 | 13.76 B |

| Sequis Bond Optima | 1518.898 | 1.15% | 0.96% | 2.93% | 2.96% | 4.48% | 10.62% | 51.89% | 8 Sep 2016 | 40.49 B |

| Syailendra Fixed Income Fund Kelas A | 2650.970 | 1.09% | 1.23% | 3.46% | 3.44% | 5.24% | 18.17% | 165.10% | 8 Dec 2011 | 132.23 B |

| BNI-AM Pendapatan Tetap Quality Long Duration Fund | 1646.710 | 1.05% | 0.85% | 0.60% | 2.44% | 1.47% | 14.33% | 64.67% | 16 Jun 2016 | 53.51 B |

| BRI Melati Pendapatan Utama | 1923.419 | 1.05% | 1.14% | 2.97% | 2.89% | 4.92% | 14.57% | 92.34% | 27 Sep 2012 | 45.43 B |

| Danakita Obligasi Negara | 1145.400 | 0.91% | 1.16% | 3.10% | 3.13% | 5.57% | 15.16% | 14.54% | 26 Mar 2021 | 52.30 B |

| Eastspring Investments IDR High Grade Kelas A | 1650.160 | 0.91% | -0.13% | 0.88% | 1.22% | 0.27% | 10.74% | 65.02% | 9 Jan 2013 | 776.00 B |

| TRIM Dana Tetap 2 Kelas A | 3317.480 | 0.85% | 1.70% | 3.41% | 3.14% | 7.60% | 18.82% | 231.75% | 13 May 2008 | 823.35 B |

| Trimegah Fixed Income Plan | 1174.588 | 0.85% | 0.65% | 1.22% | 2.02% | 3.22% | 6.60% | 17.46% | 23 May 2019 | 2.72 T |

| Insight Haji Syariah | 5223.012 | 0.74% | 2.01% | 4.02% | 3.18% | 8.31% | 23.65% | 422.30% | 13 Jan 2005 | 2.80 T |

| Bahana Obligasi Ganesha Kelas D | 1009.490 | 0.73% | 0.97% | 1.41% | 1.20% | 3.27% | 2.95% | 0.95% | 26 Oct 2020 | 321.47 B |

| SAM Sukuk Syariah Sejahtera | 2434.748 | 0.71% | -0.23% | 0.08% | 1.37% | 0.24% | -0.19% | 143.47% | 29 Oct 1997 | 46.39 B |

| Insight Renewable Energy Fund | 2360.026 | 0.69% | 2.00% | 3.95% | 2.94% | 7.98% | 20.70% | 136.00% | 22 Jun 2011 | 1.67 T |

| Batavia Dana Obligasi Ultima | 2925.620 | 0.66% | 0.31% | 1.08% | 1.36% | 1.34% | 2.81% | 192.56% | 20 Dec 2006 | 962.11 B |

| Eastspring Investments Yield Discovery Kelas A | 1614.740 | 0.58% | 0.37% | 1.36% | 1.79% | 1.70% | 1.15% | 61.47% | 29 May 2013 | 95.25 B |

| HPAM Pendapatan Tetap Prima | 1073.629 | 0.58% | 0.48% | 0.92% | 1.37% | 2.19% | 5.81% | 7.36% | 29 Oct 2018 | 366.54 B |

Provided by Cermati Invest, last update 23 Mei 2025

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana CAMPURAN | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| Trimegah Balanced Absolute Strategy Kelas A | 1792.980 | 12.85% | 4.20% | 0.59% | 0.00% | 2.77% | 4.13% | 79.30% | 28 Dec 2018 | 250.66 B |

| TRIM Syariah Berimbang | 3268.750 | 12.65% | 3.10% | 0.67% | -1.50% | 5.11% | 6.52% | 226.88% | 27 Dec 2006 | 20.37 B |

| TRIM Kombinasi 2 | 2678.250 | 12.50% | 3.01% | -0.91% | -1.46% | -0.21% | 2.22% | 167.83% | 10 Nov 2006 | 18.86 B |

| Syailendra Balanced Opportunity Fund | 3331.080 | 9.56% | 4.80% | 2.49% | 1.61% | 5.13% | 2.66% | 233.11% | 22 Apr 2008 | 67.19 B |

| SAM Mutiara Nusantara Nusa Campuran | 1671.361 | 8.05% | 3.87% | -6.64% | -3.14% | -12.36% | -6.01% | 67.14% | 21 Dec 2017 | 16.51 B |

| Setiabudi Dana Campuran | 1493.331 | 6.04% | 6.93% | 2.50% | 3.64% | 7.61% | 19.65% | 49.33% | 25 Sep 2017 | 81.98 B |

| Sequis Balance Ultima | 1242.290 | 5.17% | 3.66% | -0.34% | 0.71% | 1.24% | 7.90% | 24.23% | 8 Sep 2016 | 98.79 B |

| Batavia Dana Dinamis | 8924.220 | 4.86% | 2.64% | -2.87% | -1.67% | -1.72% | 0.71% | 792.42% | 3 Jun 2002 | 42.49 B |

| HPAM Flexi Indonesia Sehat Kelas A | 2039.061 | 3.57% | 6.82% | 4.48% | 5.65% | 13.04% | 12.22% | 103.91% | 2 Mar 2011 | 74.58 B |

| Danakita Investasi Fleksibel | 1470.510 | 3.31% | 4.34% | 1.22% | 2.43% | 2.81% | 8.14% | 47.05% | 8 Jun 2017 | 9.93 B |

Provided by Cermati Invest, last update 23 Mei 2025

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana SAHAM | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| TRIM Syariah Saham | 1750.200 | 15.24% | 2.62% | -3.95% | -4.53% | -1.54% | -9.55% | 75.02% | 27 Dec 2006 | 85.09 B |

| HPAM Ultima Ekuitas 1 | 2737.592 | 14.32% | 5.97% | 1.78% | 0.29% | -5.21% | 0.16% | 173.76% | 2 Nov 2009 | 967.66 B |

| HPAM Ekuitas Syariah Berkah | 1899.421 | 14.06% | 5.70% | -2.73% | -0.44% | 1.90% | 32.53% | 89.94% | 20 Jan 2020 | 1.32 T |

| SAM Indonesian Equity Fund | 2322.430 | 12.20% | -0.12% | 2.00% | -2.33% | 1.41% | 10.26% | 132.24% | 18 Oct 2011 | 911.22 B |

| Syailendra Equity Opportunity Fund | 4094.710 | 11.90% | 5.78% | 2.48% | -0.20% | 3.26% | 4.74% | 309.47% | 7 Jun 2007 | 142.29 B |

| BNI AM IDX Pefindo Prime Bank Kelas R1 | 897.700 | 11.60% | 13.62% | 1.14% | 3.65% | 0.91% | - | -10.23% | 2 Apr 2024 | 48.17 B |

| UOBAM Sustainable Equity Indonesia | 890.350 | 11.59% | 4.04% | -5.57% | -4.81% | -8.51% | -13.96% | -10.97% | 4 Aug 2021 | 101.24 B |

| UOBAM Indeks Bisnis-27 | 1321.480 | 11.41% | 10.40% | -0.17% | 2.24% | -1.69% | 1.64% | 32.15% | 15 Aug 2012 | 160.37 B |

| TRIM Kapital Plus | 4468.040 | 11.28% | 5.98% | 2.60% | 0.98% | 4.17% | 9.69% | 346.80% | 18 Apr 2008 | 464.74 B |

| BRI MSCI Indonesia ESG Screened Kelas A | 979.470 | 11.15% | 10.58% | -0.18% | 2.45% | -3.49% | - | -2.05% | 7 Sep 2022 | 67.60 B |

| Principal Total Return Equity Fund Kelas O | 3076.390 | 11.05% | 4.38% | -3.02% | -2.28% | -2.42% | -12.07% | 207.64% | 1 Jul 2005 | 22.45 B |

| Principal Indo Domestic Equity Fund | 705.220 | 11.00% | 4.03% | -5.14% | -3.75% | -8.42% | -17.91% | -29.48% | 11 Apr 2013 | 15.40 B |

| BNI-AM Indeks IDX Growth30 Kelas R1 | 1104.970 | 10.72% | 8.69% | -2.72% | 0.34% | -0.72% | 3.66% | 10.50% | 27 Jan 2022 | 3.48 B |

| Principal Index IDX30 Kelas O | 1257.250 | 10.69% | 9.69% | -0.52% | 2.51% | -1.04% | -11.53% | 25.73% | 7 Dec 2012 | 65.88 B |

| BNI-AM Indeks IDX30 | 774.590 | 10.64% | 9.57% | -0.26% | 2.42% | -3.29% | -16.43% | -22.54% | 28 Dec 2017 | 1.12 T |

| Cipta Sakura Equity | 1108.720 | 10.57% | 6.81% | -3.03% | -0.99% | 0.02% | -12.54% | 10.87% | 11 Dec 2014 | 20.98 B |

| BRI Syariah Saham | 691.259 | 10.23% | 2.41% | -7.29% | -4.33% | -6.94% | -23.56% | -30.87% | 18 Sep 2014 | 11.49 B |

| Trimegah FTSE Indonesia Low Volatility Factor Index | 1156.125 | 10.17% | 9.54% | -1.43% | 0.64% | -5.04% | 4.72% | 15.61% | 3 Nov 2020 | 49.93 B |

| Bahana Primavera Plus | 11730.560 | 10.12% | 8.47% | -5.63% | 0.32% | -10.96% | -19.36% | 1073.06% | 27 May 1997 | 44.20 B |

| Cipta Saham Unggulan Syariah | 2339.920 | 10.11% | 8.95% | 3.27% | 4.28% | 12.93% | 4.47% | 133.99% | 5 Sep 2018 | 14.42 B |

| Syailendra MSCI Indonesia Value Index Fund Kelas A | 1049.900 | 10.11% | 10.03% | 0.30% | 2.70% | -1.14% | -1.02% | 4.99% | 8 Jun 2018 | 850.13 B |

| TRIM Kapital | 10825.030 | 9.89% | 5.96% | -0.33% | -0.45% | -6.31% | -4.84% | 982.50% | 19 Mar 1997 | 254.22 B |

| Insight Sri Kehati Likuid - I Sri Likuid | 1098.007 | 9.74% | 9.66% | -0.61% | 2.22% | -0.59% | 3.84% | 9.80% | 29 Mar 2018 | 13.37 B |

| Batavia Dana Saham Optimal | 3028.600 | 8.39% | 3.81% | -4.06% | -2.47% | -1.66% | -2.51% | 202.86% | 19 Oct 2006 | 235.22 B |

| Batavia Dana Saham | 58679.250 | 7.79% | 3.81% | -5.57% | -3.49% | -5.00% | -5.69% | 5767.93% | 16 Dec 1996 | 1.49 T |

| Cipta Rencana Cerdas | 16826.470 | 7.27% | 5.91% | -2.12% | 0.31% | 1.53% | -1.29% | 1582.65% | 9 Jul 1999 | 59.79 B |

| Cipta Saham Unggulan | 2981.200 | 7.06% | 8.44% | 3.03% | 3.21% | 8.51% | 15.43% | 198.12% | 4 Dec 2018 | 39.37 B |

Provided by Cermati Invest, last update 23 Mei 2025

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana USD | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| Batavia Technology Sharia Equity USD | 1.12840 | 17.59% | -5.53% | -0.73% | -3.54% | 1.80% | 39.45% | 12.84% | 16 Feb 2022 | 135.58 M |

| Eastspring Syariah Equity Islamic Asia Pacific USD Kelas A | 0.96697 | 14.79% | 1.39% | 2.21% | 3.39% | -1.60% | -3.59% | -3.30% | 28 Oct 2016 | 2.11 M |

| BRI G20 Sharia Equity Fund Dollar | 1.19710 | 10.72% | 0.34% | -2.50% | 1.12% | -3.00% | 24.27% | 19.71% | 3 Dec 2019 | 1.48 M |

| Batavia Global ESG Sharia Equity USD | 1.16910 | 9.73% | 0.24% | 0.06% | 2.19% | 0.87% | 17.66% | 16.91% | 27 Jan 2021 | 9.80 M |

| Eastspring Syariah Greater China Equity USD Kelas A | 0.62379 | 9.34% | -3.88% | 1.46% | 3.79% | -1.83% | -11.67% | -37.62% | 15 Jun 2020 | 5.25 M |

| BRI Melati Premium Dollar | 1.39423 | 1.80% | 1.22% | 0.44% | 2.05% | 1.45% | 4.03% | 39.42% | 19 Feb 2007 | 1.97 M |

| Eastspring Syariah Fixed Income USD Kelas A | 0.98023 | 1.13% | 1.50% | 1.94% | 2.38% | 2.99% | 5.19% | -1.98% | 8 Mar 2021 | 1.19 M |

| Batavia USD Bond Fund | 1.04400 | 0.98% | 1.35% | 1.12% | 2.06% | 1.14% | - | 4.40% | 18 Oct 2022 | 10.84 M |

| STAR Fixed Income Dollar | 1.04300 | 0.29% | 0.94% | 1.90% | 1.38% | 5.55% | 16.59% | 4.30% | 10 Jul 2017 | 10.50 M |

Provided by Cermati Invest, last update 23 Mei 2025

Surat Utang/Obligasi

| NAMA OBLIGASI | ISIN | MATA UANG | KUPON | TANGGAL JATUH TEMPO | INDIKASI HARGA BELI | INDIKASI HARGA JUAL | INDIKASI YIELD | RATING |

|---|---|---|---|---|---|---|---|---|

| FR0087 | IDG000015207 | IDR | 6.50% | 15-Feb-31 | 100.5 | 99.5 | 6.39% | BBB |

| FR0097 | IDG000020900 | IDR | 7.13% | 15-Jun-43 | 101.8 | 100.8 | 6.95% | BBB |

| PBS005 | IDP000001505 | IDR | 6.75% | 15-Apr-43 | 97.8 | 96.8 | 6.97% | BBB |

| INKP02CCN1 | IDA0001183C1 | IDR | 11.00% | 30-Sep-26 | 101.25 | 100.25 | 9.17% | idA+ |

| LPPI02ACN1 | IDA0001331A0 | IDR | 10.50% | 4-Jul-26 | 101.25 | 100.25 | 9.61% | idA |

Provided by Cermati Invest, last update 23 Mei 2025

Event Calendar

| Monday, 26 May 2025 | Actual | Consensus | Previous | ||

| 1:40 AM | US | Fed Chair Powell Speech | |||

| Tuesday, 27 May 2025 | Actual | Consensus | Previous | ||

| 4:00 AM | KR | Consumer Confidence MAY | 93.8 | 94.0 | |

| 11:00 AM | EU | New Car Registrations YoY APR | -0.20% | -1.00% | |

| 1:00 PM | DE | GfK Consumer Confidence JUN | -20.6 | -19.7 | -19.0 |

| 5:00 PM | GB | CBI Distributive Trades MAY | -8.0 | -14.0 | 6.0 |

| 7:30 PM | US | Durable Goods Orders MoM APR | 7.50% | -8.00% | -6.80% |

| 7:30 PM | US | Durable Goods Orders Ex Transp MoM APR | -0.40% | 0.00% | -0.20% |

| 8:00 PM | US | S&P/Case-Shiller Home Price YoY MAR | 4.50% | 4.50% | 4.20% |

| 9:00 PM | US | CB Consumer Confidence MAY | 86.0 | 88.0 | 84.0 |

| 9:30 PM | US | Dallas Fed Manufacturing Index MAY | -35.8 | -25.0 | |

| Wednesday, 28 May 2025 | Actual | Consensus | Previous | ||

| 4:00 AM | KR | Business Confidence MAY | 68.0 | 70.0 | |

| 7:00 AM | US | Fed Williams Speech | |||

| 2:55 PM | DE | Unemployed Persons MAY | 2.922M | 2.932M | |

| 2:55 PM | DE | Unemployment Change MAY | 4K | 10K | 10.0K |

| 2:55 PM | DE | Unemployment Rate MAY | 6.30% | 6.30% | 6.40% |

| 3:00 PM | US | Fed Kashkari Speech | |||

| 5:30 PM | IN | Industrial Production YoY APR | 3.00% | 3.00% | 3.20% |

| 5:30 PM | IN | Manufacturing Production YoY APR | 3.00% | 3.00% | 3.10% |

| 6:00 PM | US | MBA 30-Year Mortgage Rate MAY/23 | 6.92% | ||

| Thursday, 29 May 2025 | Previous | Consensus | Forecast | ||

| 1:00 AM | US | FOMC Minutes | |||

| 3:30 AM | US | API Crude Oil Stock Change MAY/23 | 2.499M | ||

| 8:00 AM | KR | Interest Rate Decision | 2.75% | 2.50% | |

| 12:00 PM | JP | Consumer Confidence MAY | 31.2 | 31.8 | 32.8 |

| 7:30 PM | US | GDP Growth Rate QoQ 2nd Est Q1 | 2.40% | -0.30% | -0.30% |

| 7:30 PM | US | Corporate Profits QoQ Prel Q1 | 5.90% | 5.90% | 4.00% |

| 7:30 PM | US | GDP Price Index QoQ 2nd Est Q1 | 2.30% | 3.70% | 3.70% |

| 7:30 PM | US | Initial Jobless Claims MAY/24 | 227K | 230K | 230K |

| 9:00 PM | US | Pending Home Sales MoM APR | 6.10% | -1.00% | -1.50% |

| 9:00 PM | US | Pending Home Sales YoY APR | -0.60% | 1.90% | |

| 9:40 PM | US | Fed Goolsbee Speech | |||

| 11:00 PM | US | EIA Crude Oil Stocks Change MAY/23 | 1.328M | ||

| 11:00 PM | US | EIA Gasoline Stocks Change MAY/23 | 0.816M | ||

| Friday, 30 May 2025 | Previous | Consensus | Forecast | ||

| 6:30 AM | JP | Unemployment Rate APR | 2.50% | 2.50% | 2.50% |

| 6:50 AM | JP | Industrial Production MoM Prel APR | 0.20% | -1.40% | -0.70% |

| 6:50 AM | JP | Retail Sales YoY APR | 3.10% | 3.10% | 0.70% |

| 7:00 AM | US | Fed Logan Speech | |||

| 12:00 PM | JP | Housing Starts YoY APR | 39.10% | -18.30% | 3.50% |

| 1:00 PM | DE | Retail Sales MoM APR | -0.20% | 0.30% | 0.60% |

| 1:00 PM | DE | Retail Sales YoY APR | 2.20% | 2.40% | |

| 5:30 PM | IN | GDP Growth Rate YoY Q1 | 6.20% | 6.70% | 6.00% |

| 7:00 PM | DE | Inflation Rate YoY Prel MAY | 2.10% | 2.00% | |

| 7:00 PM | DE | Inflation Rate MoM Prel MAY | 0.40% | 0.10% | 0.00% |

| 7:30 PM | US | Core PCE Price Index MoM APR | 0.00% | 0.10% | 0.20% |

| 7:30 PM | US | Personal Income MoM APR | 0.50% | 0.30% | 0.40% |

| 7:30 PM | US | Personal Spending MoM APR | 0.70% | 0.20% | -0.10% |

| 7:30 PM | US | Goods Trade Balance Adv APR | $-161.99B | $-141.8B | $-159.0B |

| 7:30 PM | US | PCE Price Index YoY APR | 2.30% | 2.20% | |

| 7:30 PM | US | Retail Inventories Ex Autos MoM Adv APR | 0.40% | 0.10% | |

| 8:45 PM | US | Chicago PMI MAY | 44.6 | 45.1 | 47 |

| 9:00 PM | US | Michigan Consumer Sentiment Final MAY | 52.2 | 50.8 | 50.8 |

| 11:20 PM | US | Fed Bostic Speech | |||

| GB | Nationwide Housing Prices MoM MAY | -0.60% | 0.50% | ||

| GB | Nationwide Housing Prices YoY MAY | 3.40% | 3.50% | ||

| Saturday, 31 May 2025 | Previous | Consensus | Forecast | ||

| 6:30 AM | US | Fed Goolsbee Speech | |||

| 8:30 AM | CN | NBS Manufacturing PMI MAY | 49.0 | 49.5 | 48.6 |

| 8:30 AM | CN | NBS Non Manufacturing PMI MAY | 50.4 | 50.6 | 50.4 |

| Sunday, 01 June 2025 | Previous | Consensus | Forecast | ||

| 7:00 AM | KR | Exports YoY MAY | 3.70% | 0.90% | |

Source: BI, CNBC Indonesia, Bloomberg, Investing, Trading Economics, KSEI, Cermati, Artha Investa Teknologi (AIT)

Disclaimer:

Dokumen ini dibuat hanya untuk memberikan informasi. Isi dokumen ini tidak boleh ditafsirkan sebagai suatu bentuk penawaran untuk membeli/menjual/dijadikan dasar dari atau yang dapat dijadikan pedoman sehubungan dengan suatu perjanjian atau komitmen apa pun atau suatu nasehat investasi.

Baca Juga Cermati Invest Weekly Update Sebelumnya:

- Cermati Invest Weekly Update 19 Mei 2025

- Cermati Invest Weekly Update 14 Mei 2025

- Cermati Invest Weekly Update 5 Mei 2025

- Cermati Invest Weekly Update 28 April 2025