Cermati Invest Weekly Update 19 Mei 2025

Ulasan Pasar

| INDONESIA | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| IHSG | 4.01% | 7,106.53 |

| ISSI | 2.33% | 223.20 |

| IDX30 | 5.99% | 420.64 |

| FTSE Indonesia | 5.40% | 3,122.64 |

| MSCI Indonesia | 5.75% | 6,524.24 |

| USD/IDR | -0.52% | 16,428.40 |

Provided by Cermati Invest, last update 16 Mei 2025

IHSG & Saham Pekan Ini

IHSG terus naik semakin tinggi sejak April 2025 atau awal kuartal 2 tahun 2025 ini. Saat ini IHSG berada di posisi 7106.526 sudah naik (+)9.58% (quarterly) dan (+)5.44% (monthly). Sepanjang kuartal 2 ini, IHSG aman selama di atas 6724.

Diperkirakan pasar saham masih akan terus naik menuju 7417.75 sampai Juni 2025 dan tembus ke atas 7563.06 di semester 2 tahun ini. Support di 6882.318, 6613.47, 6538.32, 6368.51, 6092.41, dan 5967.98.

Jangan sampai ketinggalan momen awal berinvestasi di pasar saham maupun reksa dana jenis saham maupun campuran.

Bagi dividen hunter, berikut adalah beberapa emiten yang cum date mulai pekan ini: JATI 0.467 (19 Mei), PPRI 1.05 (19 Mei), JSMR 156.23 (19 Mei), LTLS 45 (19 Mei), PSGO 8 (20 Mei), ASII 308 (21 Mei), BFIN 32 (20 Mei), SGRO 330 (21 Mei), RALS 60 (21 Mei), ALII 4.5 (21 Mei).

Indeks Konstituen dengan performa terbaik 2025 ini masih Indeks Syariah. Selanjutnya Indeks PEFINDO I-Grade, Srikehati, dan IDX30.

Fokus pada sektor unggulan penggerak IHSG yaitu Teknologi. Kemudian Energi, Basic-Industry, Keuangan (Perbankan), dan Kesehatan. Sektor Basic-Industry (Industri Dasar) yang sejak awal 2025 terpuruk paling dalam, tetapi saat ini sudah kembali naik dan bersama dengan sektor teknologi menguasai IHSG.

Pergerakan Rupiah

Rupiah stabil, cenderung menguat dan bergerak dalam area Rp16.169 - Rp16.518 per 1 dolar Amerika.

| COMMODITY | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| XAU/USD | -2.63% | 3,235.06 |

| Crude Oil WTI | 1.70% | 62.08 |

| Palm Oil c3 F | 0.00% | 4,480.00 |

| Natural Gas | -14.15% | 3.26 |

| Newcastle Coal | 0.10% | 99.00 |

| Nickel | -1.51% | 15,561.13 |

| Tin | 2.84% | 32,726.00 |

| Copper | 0.08% | 9,455.75 |

| Aluminium | 2.43% | 2,479.90 |

| US Soybeans | -0.52% | 1,046.25 |

| Silver | -0.89% | 32.62 |

Provided by Cermati Invest, last update 16 Mei 2025

Emas

Sesuai prediksi, akhirnya emas dunia terkoreksi, turun dan menembus US$3176 bahkan menyentuh US$3120.765 per troy ounce. Pekan ini pergerakan harga emas dunia berkisar US$3120.765 - US$3325.97. Walaupun terlihat naik, tetapi harga emas dunia diperkirakan akan turun kembali menembus ke bawah US$3188.120.

Bagaimana dengan harga emas dalam negeri?

Harga emas dunia yang cenderung turun, menyebabkan harga emas di Indonesia juga turun. Pekan ini harga emas berkisar Rp1.624.000 - Rp1.778.000 per gram. Harga emas selalu menyesuaikan antara perubahan harga emas dunia dan nilai tukar dolar terhadap rupiah. Kali ini investasi emas akan sedikit berbeda, cenderung untuk LONG TERM INVESTMENT (investasi jangka panjang), karena walau harga emas dunia saat ini ada kecenderungan rebound, tetapi rupiah cenderung menguat.

Sebagai salah satu aset investasi, memiliki emas digital maupun emas fisik sangatlah menarik. Setiap kali harga koreksi (turun), tidak perlu lama harga emas segera kembali naik. Harga emas fisik biasanya lebih tinggi Rp60.000 - Rp100.000 per gramnya dari harga emas digital.

| REGIONAL | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| Dow Jones | 0.58% | 42,654.74 |

| S&P 500 | 5.27% | 5,958.38 |

| FTSE 100 | 0.92% | 8,684.56 |

| DAX | 1.14% | 23,767.43 |

| Nikkei 225 | 0.67% | 37,580.00 |

| Hang Seng | -0.87% | 23,345.05 |

| CSI 300 | 1.12% | 3,889.09 |

| KOSPI | 1.92% | 2,613.25 |

Provided by Cermati Invest, last update 16 Mei 2025

Reksa Dana & Surat Berharga

Semakin banyak reksa dana campuran dan reksa dana saham yang performa year to date nya semakin positif, terlihat dari performa 1 bulan yang bahkan ada yang di atas 10%. Artinya sejak awal kuartal 2 tahun ini, kedua jenis reksa dana ini membaik atau rebound. Sebagai contoh, reksa dana BNI AM IDX Pefindo Prime Bank Kelas R1, Syailendra MSCI Indonesia Value Index Fund Kelas A dan Cipta Saham Unggulan Syariah memiliki performa lebih dari 10% dalam 3 bulan terakhir. Kedua jenis reksa dana ini dapat mulai dibeli untuk investasi long term (minimal 1 tahun ke depan)

Bagaimana dengan jenis reksa dana pasar uang dan reksa dana pendapatan tetap? Kedua jenis reksa dana ini, memiliki performa stabil. Reksa dana pasar uang performanya naik terus walau tidak lebih dari reksa dana pendapatan tetap. Saat ini, reksa dana pasar uang dan reksa dana pendapatan tetap performa year to date nya banyak yang di atas 2%, misalkan reksa dana BRI Brawijaya Abadi Pendapatan Tetap yang performanya 4.23%. Untuk reksa dana pendapatan tetap dan reksa dana pasar uang performanya stabil dalam range 5% - 8% per tahun.

Pilihan reksa dana mana yang terbaik, dapat dilihat dalam tabel.

Surat berharga, beberapa obligasi kami pilihkan dalam tabel.

Pasar Investasi Kembali Positif, Suku Bunga Indonesia akan Diumumkan Pekan Ini

Pasar keuangan Indonesia berakhir di zona hijau pada perdagangan pekan lalu di mana Indeks Harga Saham Gabungan (IHSG) dan nilai rupiah terhadap dolar Amerika sama-sama menguat. Pasar keuangan Indonesia diperkirakan akan bergerak volatil pekan ini karena banyaknya data ekonomi yang akan keluar. Naiknya pasar investasi secara mayoritas didukung oleh negosiasi yang dilakukan akan pemberlakuan tarif dagang dari Amerika Serikat kepada China dan juga negara-negara lain. Presiden AS Donald Trump mengatakan pada hari Jumat bahwa pemerintahannya akan mengirim surat kepada banyak negara yang merinci tarif baru, kemungkinan dalam dua hingga tiga minggu ke depan. Surat-surat tersebut akan menggantikan negosiasi perdagangan dengan negara-negara yang tidak sempat ditemui oleh AS.

Pada pekan ini, Bank Indonesia (BI) juga akan menggelar Rapat Dewan Gubernur (RDG) bulan Mei 2025 yang berlangsung pada Selasa dan Rabu pekan ini (20 - 21 Mei 2025). Pelaku pasar menunggu apakah BI akan memangkas suku bunga di tengah melambatnya perekonomian Indonesia. Sebagai catatan, ekonomi Indonesia hanya tumbuh 4.87% secara tahunan pada kuartal 1 2025, terendah sejak kuartal 3 2021 saat era pandemi Covid-19. Selain itu, pemerintah akan menyerahkan dokumen KEM PPKF atau Kerangka Ekonomi Makro dan Pokok-Pokok Kebijakan Fiskal untuk 2026 pada Selasa (20/5/2025). Kebijakan fiskal ini sangat penting untuk menjadi gambaran belanja prioritas pada tahun depan serta target-target pemerintah, mulai dari pertumbuhan hingga inflasi.

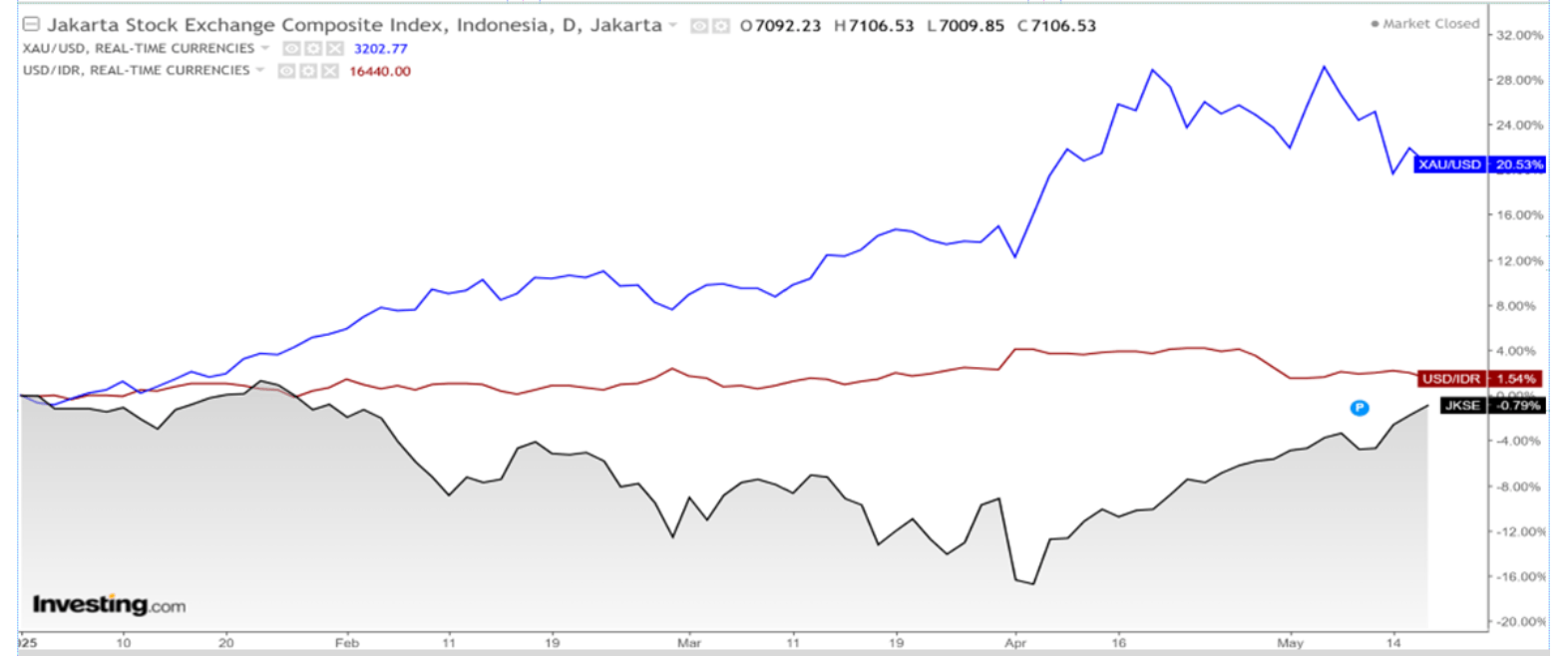

COMPOSITE INDEX compare to USDIDR & GOLD since 2025 (YtD)

Reksa Dana

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana PASAR UANG | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| Principal Cash Fund Syariah 2 | 1147.65 | 0.62% | 1.16% | 2.39% | 1.96% | 4.75% | 11.37% | 14.77% | 1 Dec 2020 | 12.46 B |

| Cipta Dana Cash | 1745.13 | 0.53% | 1.38% | 2.92% | 2.20% | 5.64% | 15.75% | 74.51% | 8 Jun 2015 | 252.40 B |

| Insight Retail Cash Fund | 1612.09 | 0.51% | 1.52% | 2.96% | 2.14% | 6.30% | 15.25% | 61.21% | 13 Apr 2018 | 13.62 B |

| BNI-AM Dana Likuid Kelas A | 1934.27 | 0.48% | 1.28% | 2.45% | 1.87% | 4.79% | 12.01% | 93.43% | 27 Dec 2012 | 230.75 B |

| BRI Seruni Pasar Uang III | 1793.32 | 0.48% | 1.36% | 2.71% | 2.02% | 5.61% | 13.86% | 79.33% | 16 Feb 2010 | 1.74 T |

| Insight Money Syariah | 1667.06 | 0.48% | 1.47% | 2.92% | 2.12% | 6.04% | 16.62% | 66.71% | 30 Sep 2015 | 183.49 B |

| BRI Seruni Pasar Uang Syariah | 1357.18 | 0.46% | 1.32% | 2.55% | 2.06% | 5.30% | 14.31% | 35.72% | 19 Jul 2018 | 596.55 B |

| Setiabudi Dana Pasar Uang | 1535.62 | 0.45% | 1.39% | 2.79% | 2.05% | 5.57% | 15.17% | 53.56% | 23 Dec 2016 | 667.35 B |

| TRIM Kas 2 Kelas A | 1935.57 | 0.45% | 1.39% | 2.77% | 2.05% | 5.49% | 14.64% | 93.56% | 8 Apr 2008 | 4.29 T |

| HPAM Ultima Money Market | 1640.99 | 0.44% | 1.34% | 2.57% | 1.90% | 5.29% | 14.74% | 64.10% | 10 Jun 2015 | 565.98 B |

| Trimegah Kas Syariah | 1453.62 | 0.44% | 1.31% | 2.62% | 1.93% | 5.33% | 14.64% | 45.36% | 30 Dec 2016 | 1.69 T |

| Syailendra Dana Kas | 1714.30 | 0.43% | 1.20% | 2.47% | 1.80% | 5.02% | 14.17% | 71.43% | 12 Jun 2015 | 2.35 T |

| Bahana Likuid Syariah Kelas G | 1228.45 | 0.42% | 1.33% | 2.64% | 1.96% | 5.28% | 13.92% | 22.85% | 12 Jul 2016 | 588.12 B |

| Danakita Stabil Pasar Uang | 1640.00 | 0.42% | 1.25% | 2.51% | 1.87% | 4.99% | 14.06% | 64.00% | 10 Sep 2015 | 75.03 B |

| Sequis Liquid Prima | 1459.38 | 0.39% | 1.19% | 2.42% | 1.79% | 4.84% | 12.63% | 45.94% | 8 Sep 2016 | 230.17 B |

Provided by Cermati Invest, last update 16 Mei 2025

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana PENDAPATAN TETAP | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| Eastspring IDR Fixed Income Fund Kelas A | 1773.55 | 1.44% | 0.96% | 2.71% | 2.78% | 4.54% | 17.59% | 77.36% | 16 Mar 2015 | 135.64 B |

| Principal Total Return Bond Fund | 2619.21 | 1.42% | 0.76% | 2.76% | 2.73% | 2.56% | 1.45% | 161.92% | 21 Aug 2008 | 16.46 B |

| BNI-AM Short Duration Bonds Index Kelas R1 | 1075.49 | 1.41% | 0.20% | 1.01% | 2.30% | 2.58% | - | 7.55% | 1 Sep 2022 | 8.16 B |

| BRI Brawijaya Abadi Pendapatan Tetap | 1414.27 | 1.39% | 1.06% | 4.25% | 4.23% | 6.17% | 20.95% | 41.43% | 25 Feb 2019 | 2.63 B |

| Sequis Bond Optima | 1514.34 | 1.27% | 0.92% | 2.54% | 2.65% | 4.12% | 11.57% | 51.43% | 8 Sep 2016 | 39.95 B |

| Syailendra Pendapatan Tetap Premium | 1852.27 | 1.26% | 1.60% | 2.16% | 2.49% | 5.71% | 18.32% | 85.23% | 27 Mar 2017 | 2.89 T |

| BNI-AM Pendapatan Tetap Quality Long Duration Fund | 1642.64 | 1.21% | 0.85% | 0.23% | 2.18% | 1.08% | 15.10% | 64.26% | 16 Jun 2016 | 29.48 B |

| Cipta Bond | 1850.05 | 1.19% | 1.19% | 3.04% | 3.06% | 4.81% | 17.11% | 85.01% | 2 Jan 2019 | 14.61 B |

| HPAM Government Bond | 1625.29 | 1.17% | -0.75% | 1.86% | 1.52% | 4.52% | 18.92% | 62.53% | 18 May 2016 | 17.88 B |

| Syailendra Fixed Income Fund Kelas A | 2642.89 | 1.15% | 1.16% | 3.12% | 3.12% | 4.98% | 19.60% | 164.29% | 8 Dec 2011 | 92.58 B |

| Danakita Obligasi Negara | 1143.61 | 1.13% | 1.27% | 2.96% | 2.97% | 5.48% | 16.68% | 14.36% | 26 Mar 2021 | 51.71 B |

| BRI Melati Pendapatan Utama | 1918.07 | 1.03% | 1.06% | 2.70% | 2.60% | 4.49% | 15.82% | 91.81% | 27 Sep 2012 | 52.82 B |

| Eastspring Investments IDR High Grade Kelas A | 1643.56 | 0.91% | -0.71% | 0.06% | 0.82% | -0.19% | 12.36% | 64.36% | 9 Jan 2013 | 752.69 B |

| TRIM Dana Tetap 2 Kelas A | 3310.75 | 0.84% | 1.71% | 3.29% | 2.94% | 7.60% | 19.37% | 231.08% | 13 May 2008 | 595.78 B |

| Trimegah Fixed Income Plan | 1172.09 | 0.83% | 0.65% | 1.09% | 1.80% | 3.20% | 6.77% | 17.21% | 23 May 2019 | 2.76 T |

| SAM Sukuk Syariah Sejahtera | 2427.33 | 0.79% | -0.31% | -0.17% | 1.06% | -0.06% | 0.61% | 142.73% | 29 Oct 1997 | 46.39 B |

| Batavia Dana Obligasi Ultima | 2919.46 | 0.73% | 0.37% | 0.87% | 1.14% | 1.14% | 4.08% | 191.95% | 20 Dec 2006 | 912.61 B |

| Insight Renewable Energy Fund | 2356.18 | 0.68% | 1.98% | 3.98% | 2.77% | 7.92% | 20.42% | 135.62% | 22 Jun 2011 | 1.57 T |

| Insight Haji Syariah | 5208.69 | 0.61% | 1.93% | 3.89% | 2.89% | 8.13% | 23.53% | 420.87% | 13 Jan 2005 | 2.49 T |

| HPAM Pendapatan Tetap Prima | 1072.06 | 0.57% | 0.46% | 0.90% | 1.22% | 2.15% | 5.66% | 7.21% | 29 Oct 2018 | 349.24 B |

| Bahana Obligasi Ganesha Kelas D | 1005.53 | 0.50% | 0.50% | 0.73% | 0.81% | 2.94% | 3.53% | 0.55% | 26 Oct 2020 | 323.45 B |

| UOBAM Inovasi Obligasi Nasional | 1056.60 | 0.13% | 1.77% | 4.33% | 3.75% | 4.87% | 18.29% | 5.66% | 12 Jan 2021 | 74.29 B |

Provided by Cermati Invest, last update 16 Mei 2025

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana CAMPURAN | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| Syailendra Balanced Opportunity Fund | 3298.26 | 13.01% | 5.41% | 1.83% | 0.61% | 4.36% | 2.85% | 229.83% | 22 Apr 2008 | 63.54 B |

| TRIM Syariah Berimbang | 3122.49 | 12.80% | -1.58% | -4.18% | -5.91% | 1.80% | 1.65% | 212.25% | 27 Dec 2006 | 18.87 B |

| Trimegah Balanced Absolute Strategy Kelas A | 1715.53 | 12.31% | -0.48% | -4.48% | -4.32% | -0.28% | -0.33% | 71.55% | 28 Dec 2018 | 241.62 B |

| TRIM Kombinasi 2 | 2566.73 | 11.69% | -1.51% | -5.68% | -5.56% | -3.30% | -1.41% | 156.67% | 10 Nov 2006 | 17.98 B |

| SAM Mutiara Nusantara Nusa Campuran | 1652.03 | 10.22% | 3.70% | -6.99% | -4.26% | -11.52% | -6.63% | 65.20% | 21 Dec 2017 | 17.77 B |

| Setiabudi Dana Campuran | 1477.37 | 7.66% | 6.26% | 1.05% | 2.53% | 6.38% | 20.05% | 47.74% | 25 Sep 2017 | 78.44 B |

| Batavia Dana Dinamis | 8877.05 | 6.49% | 2.13% | -2.94% | -2.19% | -2.92% | 2.75% | 787.71% | 3 Jun 2002 | 40.24 B |

| Sequis Balance Ultima | 1228.73 | 5.82% | 2.39% | -1.06% | -0.39% | -0.44% | 8.18% | 22.87% | 8 Sep 2016 | 95.58 B |

| Danakita Investasi Fleksibel | 1463.78 | 4.00% | 3.95% | 0.48% | 1.97% | 1.60% | 7.98% | 46.38% | 8 Jun 2017 | 9.97 B |

| HPAM Flexi Indonesia Sehat Kelas A | 2026.96 | 3.29% | 7.02% | 3.40% | 5.03% | 9.98% | 11.96% | 102.70% | 2 Mar 2011 | 71.42 B |

Provided by Cermati Invest, last update 16 Mei 2025

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana SAHAM | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| HPAM Ekuitas Syariah Berkah | 1831.78 | 15.16% | 4.36% | -6.13% | -3.98% | -3.88% | 33.32% | 83.18% | 20 Jan 2020 | 1.19 T |

| Bahana Primavera Plus | 11538.82 | 15.11% | 7.59% | -6.95% | -1.32% | -12.15% | -18.46% | 1053.88% | 27 May 1997 | 41.27 B |

| Syailendra Equity Opportunity Fund | 4015.66 | 14.88% | 6.02% | -0.45% | -2.13% | 0.02% | 4.42% | 301.57% | 7 Jun 2007 | 135.13 B |

| SAM Indonesian Equity Fund | 2270.89 | 14.62% | 0.30% | 0.28% | -4.50% | -2.15% | 9.06% | 127.09% | 18 Oct 2011 | 857.84 B |

| Principal Total Return Equity Fund Kelas O | 3015.46 | 14.46% | 3.13% | -5.61% | -4.22% | -5.51% | -12.58% | 201.55% | 1 Jul 2005 | 20.97 B |

| TRIM Kapital Plus | 4388.71 | 13.99% | 5.37% | 0.53% | -0.81% | 2.30% | 8.80% | 338.87% | 18 Apr 2008 | 521.76 B |

| BNI-AM Indeks IDX Growth30 Kelas R1 | 1098.56 | 13.89% | 8.04% | -2.67% | -0.25% | -3.70% | 2.77% | 9.86% | 27 Jan 2022 | 4.53 B |

| BNI AM IDX Pefindo Prime Bank Kelas R1 | 880.21 | 13.04% | 11.51% | -2.87% | 1.63% | -4.18% | - | -11.98% | 2 Apr 2024 | 48.26 B |

| UOBAM Indeks Bisnis-27 | 1293.36 | 12.91% | 8.41% | -2.23% | 0.06% | -5.82% | 0.14% | 29.34% | 15 Aug 2012 | 169.78 B |

| Syailendra MSCI Indonesia Value Index Fund Kelas A | 1041.09 | 12.81% | 10.51% | 0.01% | 1.84% | -4.26% | -3.49% | 4.11% | 8 Jun 2018 | 902.92 B |

| Principal Indo Domestic Equity Fund | 689.40 | 12.76% | 2.75% | -7.20% | -5.91% | -11.49% | -18.16% | -31.06% | 11 Apr 2013 | 14.53 B |

| Insight Sri Kehati Likuid - I Sri Likuid | 1090.40 | 12.61% | 9.27% | -1.18% | 1.51% | -3.16% | 3.62% | 9.04% | 29 Mar 2018 | 13.66 B |

| Principal Islamic Equity Growth Syariah | 1116.20 | 12.61% | 2.99% | -2.73% | -3.04% | -2.82% | -6.75% | 11.62% | 10 Sep 2007 | 61.78 B |

| BRI MSCI Indonesia ESG Screened Kelas A | 956.53 | 12.44% | 8.61% | -2.70% | 0.05% | -7.77% | - | -4.35% | 7 Sep 2022 | 64.69 B |

| HPAM Ultima Ekuitas 1 | 2611.44 | 12.37% | 2.08% | -4.11% | -4.33% | -11.21% | -4.04% | 161.14% | 2 Nov 2009 | 872.82 B |

| Principal Index IDX30 Kelas O | 1234.84 | 12.37% | 8.03% | -1.76% | 0.68% | -4.45% | -12.72% | 23.48% | 7 Dec 2012 | 65.30 B |

| BNI-AM Indeks IDX30 | 760.83 | 12.32% | 7.93% | -1.48% | 0.60% | -6.61% | -17.54% | -23.92% | 28 Dec 2017 | 1.11 T |

| Trimegah FTSE Indonesia Low Volatility Factor Index | 1138.26 | 12.14% | 7.94% | -3.77% | -0.92% | -8.48% | 3.09% | 13.83% | 3 Nov 2020 | 51.83 B |

| Bahana Primavera 99 Kelas G | 1218.17 | 11.96% | 6.77% | -2.72% | -0.15% | -6.12% | -1.70% | 21.82% | 5 Sep 2014 | 32.12 B |

| BRI Syariah Saham | 676.16 | 11.81% | 2.48% | -8.18% | -6.42% | -8.76% | -25.13% | -32.38% | 18 Sep 2014 | 10.59 B |

| Batavia Dana Saham Optimal | 3007.13 | 11.52% | 3.16% | -3.74% | -3.16% | -3.45% | -0.30% | 200.71% | 19 Oct 2006 | 230.38 B |

| Batavia Dana Saham Syariah | 1554.06 | 11.28% | 2.64% | -3.02% | -3.38% | -2.66% | -15.06% | 55.41% | 19 Jul 2007 | 21.48 B |

| Eastspring Investments Alpha Navigator Kelas A | 1461.79 | 11.22% | 3.61% | -6.42% | -3.98% | -4.81% | -0.88% | 46.18% | 29 Aug 2012 | 132.73 B |

| Batavia Disruptive Equity | 984.54 | 11.15% | 3.32% | -5.05% | -4.16% | -6.62% | -0.47% | -1.55% | 15 Dec 2021 | 12.52 B |

| TRIM Kapital | 10628.43 | 11.03% | 4.78% | -2.31% | -2.26% | -7.99% | -5.80% | 962.84% | 19 Mar 1997 | 220.23 B |

| Eastspring IDX ESG Leaders Plus Kelas A | 939.20 | 10.89% | 7.92% | 1.09% | 2.93% | -8.46% | -4.94% | -6.08% | 12 Jan 2022 | 129.75 B |

| Cipta Sakura Equity | 1085.85 | 10.88% | 6.15% | -4.83% | -3.03% | -4.90% | -12.88% | 8.59% | 11 Dec 2014 | 19.61 B |

| BNI-AM Inspiring Equity Fund | 872.90 | 10.82% | 4.85% | -6.88% | -3.82% | -9.57% | -17.00% | -12.71% | 7 Apr 2014 | 998.29 B |

| Danakita Saham Prioritas | 1149.62 | 10.74% | 7.71% | -0.05% | 2.39% | -0.47% | 9.55% | 14.96% | 17 Oct 2018 | 7.37 B |

| Sequis Equity Maxima | 885.17 | 10.64% | 5.32% | -4.15% | -3.13% | -6.91% | -7.05% | -11.48% | 25 Aug 2016 | 223.90 B |

| Cipta Saham Unggulan Syariah | 2308.81 | 10.52% | 10.80% | 2.31% | 2.89% | 10.27% | 4.30% | 130.88% | 5 Sep 2018 | 13.46 B |

| BRI Mawar Konsumer 10 Kelas A | 1414.00 | 10.36% | 2.76% | -7.78% | -5.42% | -9.31% | -11.66% | 41.40% | 16 Feb 2011 | 183.01 B |

| Batavia Dana Saham | 58229.97 | 10.31% | 2.45% | -5.30% | -4.23% | -6.75% | -3.58% | 5723.00% | 16 Dec 1996 | 1.47 T |

| Cipta Rencana Cerdas | 16730.54 | 9.67% | 6.44% | -2.34% | -0.26% | -1.01% | -0.33% | 1573.05% | 9 Jul 1999 | 57.59 B |

| Cipta Saham Unggulan | 2918.50 | 7.29% | 6.91% | 0.13% | 1.04% | 5.56% | 14.01% | 191.85% | 4 Dec 2018 | 38.21 B |

Provided by Cermati Invest, last update 16 Mei 2025

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana USD | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| Batavia Technology Sharia Equity USD | 1.12840 | 17.59% | -5.53% | -0.73% | -3.54% | 1.80% | 39.45% | 12.84% | 16 Feb 2022 | 135.58 M |

| Eastspring Syariah Equity Islamic Asia Pacific USD Kelas A | 0.96697 | 14.79% | 1.39% | 2.21% | 3.39% | -1.60% | -3.59% | -3.30% | 28 Oct 2016 | 2.11 M |

| BRI G20 Sharia Equity Fund Dollar | 1.19710 | 10.72% | 0.34% | -2.50% | 1.12% | -3.00% | 24.27% | 19.71% | 3 Dec 2019 | 1.48 M |

| Batavia Global ESG Sharia Equity USD | 1.16910 | 9.73% | 0.24% | 0.06% | 2.19% | 0.87% | 17.66% | 16.91% | 27 Jan 2021 | 9.80 M |

| Eastspring Syariah Greater China Equity USD Kelas A | 0.62379 | 9.34% | -3.88% | 1.46% | 3.79% | -1.83% | -11.67% | -37.62% | 15 Jun 2020 | 5.25 M |

| BRI Melati Premium Dollar | 1.39423 | 1.80% | 1.22% | 0.44% | 2.05% | 1.45% | 4.03% | 39.42% | 19 Feb 2007 | 1.97 M |

| Eastspring Syariah Fixed Income USD Kelas A | 0.98023 | 1.13% | 1.50% | 1.94% | 2.38% | 2.99% | 5.19% | -1.98% | 8 Mar 2021 | 1.19 M |

| Batavia USD Bond Fund | 1.04400 | 0.98% | 1.35% | 1.12% | 2.06% | 1.14% | - | 4.40% | 18 Oct 2022 | 10.84 M |

| STAR Fixed Income Dollar | 1.04300 | 0.29% | 0.94% | 1.90% | 1.38% | 5.55% | 16.59% | 4.30% | 10 Jul 2017 | 10.50 M |

Provided by Cermati Invest, last update 16 Mei 2025

Surat Utang/Obligasi

| NAMA OBLIGASI | ISIN | MATA UANG | KUPON | TANGGAL JATUH TEMPO | INDIKASI HARGA BELI | INDIKASI HARGA JUAL | INDIKASI YIELD | RATING |

|---|---|---|---|---|---|---|---|---|

| FR0087 | IDG000015207 | IDR | 6.50% | 15-Feb-31 | 100.2 | 99.2 | 6.46% | BBB |

| FR0097 | IDG000020900 | IDR | 7.13% | 15-Jun-43 | 101.8 | 100.8 | 6.95% | BBB |

| PBS005 | IDP000001505 | IDR | 6.75% | 15-Apr-43 | 97.4 | 96.4 | 7.00% | BBB |

| INKP02CCN1 | IDA0001183C1 | IDR | 11.00% | 30-Sep-26 | 101.25 | 100.25 | 9.17% | idA+ |

| LPPI02ACN1 | IDA0001331A0 | IDR | 10.50% | 4-Jul-26 | 101.25 | 100.25 | 9.61% | idA |

Provided by Cermati Invest, last update 16 Mei 2025

Event Calendar

| Monday, 19 May 2025 | Actual | Consensus | Previous | ||

| 4:20 AM | US | Fed Williams Speech | |||

| 8:30 AM | CN | House Price Index YoY APR | -4.50% | -4.30% | |

| 9:00 AM | CN | Industrial Production YoY APR | 7.70% | 5.50% | 6.20% |

| 9:00 AM | CN | Retail Sales YoY APR | 5.90% | 5.50% | 5.60% |

| 9:00 AM | CN | Fixed Asset Investment (YTD) YoY APR | 4.20% | 4.20% | 4.60% |

| 7:30 PM | US | Fed Bostic Speech | |||

| 7:45 PM | US | Fed Williams Speech | |||

| Tuesday, 20 May 2025 | Actual | Consensus | Previous | ||

| 12:15 AM | US | Fed Logan Speech | |||

| 12:30 AM | US | Fed Kashkari Speech | |||

| 8:15 AM | CN | Loan Prime Rate 1Y | 3.10% | 3.00% | 3.00% |

| 8:15 AM | CN | Loan Prime Rate 5Y MAY | 3.60% | 3.50% | 3.50% |

| 1:00 PM | DE | PPI YoY APR | -0.20% | -0.70% | |

| 8:00 PM | US | Fed Barkin Speech | |||

| 8:30 PM | US | Fed Collins Speech | |||

| Wednesday, 21 May 2025 | Actual | Consensus | Previous | ||

| 12:00 AM | US | Fed Musalem Speech | |||

| 3:30 AM | US | API Crude Oil Stock Change MAY/16 | 4.287M | ||

| 4:00 AM | US | Fed Kugler Speech | |||

| 6:00 AM | US | Fed Daly Speech | |||

| 6:50 AM | JP | Balance of Trade APR | ¥544.1B | ¥227.1B | ¥200.0B |

| 6:50 AM | JP | Exports YoY APR | 3.90% | 2.00% | 1.80% |

| 1:00 PM | GB | Inflation Rate YoY APR | 2.60% | 3.30% | 3.30% |

| 1:00 PM | GB | Core Inflation Rate YoY APR | 3.40% | 3.60% | 3.50% |

| 1:00 PM | GB | Inflation Rate MoM APR | 0.30% | 1.00% | |

| 2:30 PM | ID | Interest Rate Decision | 5.75% | 5.75% | |

| 6:00 PM | US | MBA 30-Year Mortgage Rate MAY/16 | 6.86% | ||

| 9:30 PM | US | EIA Crude Oil Stocks Change MAY/16 | 3.454M | ||

| 9:30 PM | US | EIA Gasoline Stocks Change MAY/16 | -1.022M | ||

| 11:00 PM | US | Fed Barkin Speech | |||

| Thursday, 22 May 2025 | Previous | Consensus | Forecast | ||

| 6:50 AM | JP | Machinery Orders MoM MAR | 4.30% | -1.60% | -2.00% |

| 6:50 AM | JP | Machinery Orders YoY MAR | 1.50% | -2.20% | -0.30% |

| 7:30 AM | JP | Jibun Bank Manufacturing PMI Flash MAY | 48.5 | 48.5 | |

| 7:30 AM | JP | Jibun Bank Services PMI Flash MAY | 52.4 | 51.2 | |

| 8:30 AM | JP | BOJ Noguchi Speech | |||

| 12:00 PM | IN | HSBC Composite PMI Flash MAY | 59.7 | 59.5 | |

| 2:30 PM | DE | HCOB Manufacturing PMI Flash MAY | 48.4 | 49.0 | 49.1 |

| 2:30 PM | DE | HCOB Services PMI Flash MAY | 49.0 | 49.5 | 49.9 |

| 3:00 PM | DE | Ifo Business Climate MAY | 86.9 | 87.7 | 87.5 |

| 3:30 PM | GB | S&P Global Manufacturing PMI Flash MAY | 45.4 | 45.8 | 46.0 |

| 3:30 PM | GB | S&P Global Services PMI Flash MAY | 49.0 | 49.5 | 49.3 |

| 5:00 PM | GB | CBI Industrial Trends Orders MAY | -26.0 | -25.0 | -30.0 |

| 7:30 PM | US | Chicago Fed National Activity Index APR | -0.03 | -0.20 | |

| 7:30 PM | US | Initial Jobless Claims MAY/17 | 229K | 232K | 231.0K |

| 8:45 PM | US | S&P Global Manufacturing PMI Flash MAY | 50.2 | 49.9 | 50.1 |

| 9:00 PM | US | Existing Home Sales APR | 4.02M | 4.1M | 3.9M |

| 9:00 PM | US | Existing Home Sales MoM APR | -5.90% | -3.00% | |

| Friday, 23 May 2025 | Previous | Consensus | Forecast | ||

| 1:00 AM | US | Fed Williams Speech | |||

| 6:01 AM | GB | Gfk Consumer Confidence MAY | -23.0 | -22.0 | -23.0 |

| 6:30 AM | JP | Inflation Rate YoY APR | 3.60% | 3.70% | |

| 6:30 AM | JP | Core Inflation Rate YoY APR | 3.20% | 3.40% | 3.30% |

| 1:00 PM | GB | Retail Sales MoM APR | 0.40% | 0.40% | 0.30% |

| 1:00 PM | GB | Retail Sales YoY APR | 2.60% | 3.00% | |

| 9:00 PM | US | New Home Sales APR | 0.724M | 0.70M | 0.69M |

| 9:00 PM | US | New Home Sales MoM APR | 7.40% | -4.70% | |

| 11:00 PM | US | Fed Cook Speech | |||

| CN | FDI (YTD) YoY APR | -10.80% | -15.00% | ||

Source: BI, CNBC Indonesia, Bloomberg, Investing, Trading Economics, KSEI, Cermati, Artha Investa Teknologi (AIT)

Disclaimer:

Dokumen ini dibuat hanya untuk memberikan informasi. Isi dokumen ini tidak boleh ditafsirkan sebagai suatu bentuk penawaran untuk membeli/menjual/dijadikan dasar dari atau yang dapat dijadikan pedoman sehubungan dengan suatu perjanjian atau komitmen apa pun atau suatu nasehat investasi.

Baca Juga Cermati Invest Weekly Update Sebelumnya:

- Cermati Invest Weekly Update 14 Mei 2025

- Cermati Invest Weekly Update 5 Mei 2025

- Cermati Invest Weekly Update 28 April 2025

- Cermati Invest Weekly Update 21 April 2025