Cermati Invest Weekly Update 23 Juni 2025

Ulasan Pasar

| INDONESIA | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| IHSG | -3.61% | 6,907.14 |

| ISSI | -2.95% | 224.94 |

| IDX30 | -4.51% | 397.09 |

| FTSE Indonesia | -4.55% | 2,933.94 |

| MSCI Indonesia | -4.34% | 6,125.00 |

| USD/IDR | 0.48% | 16,385.00 |

Provided by Cermati Invest, last update 20 Juni 2025

IHSG & Saham Pekan Ini

9 hari IHSG turun, dari 7239 ke posisi penutupan pekan lalu 6907. Hati-hati bila IHSG tembus ke bawah support kuat kuartal 2 ini yaitu 6723.719, karena artinya akan turun lebih dalam untuk menutup beberapa support gap di bawahnya yang sudah lama belum tertutup, antara lain yaitu 6678, 6611, 6538, 6368.

Walaupun kemungkinan bertahan di atas support kuartal 2 tersebut kecil, tetapi jika sampai akhir kuartal 2 nanti IHSG tutup di atasnya, maka besar kemungkinan IHSG masih mampu naik lebih tinggi di kuartal selanjutnya dengan target terdekat 7588.77.

75% emiten Indonesia harga sahamnya turun. Sepekan, investor asing melakukan net sell di pasar saham Indonesia sudah lebih dari 4.51T dan penyumbang net sell terbesar dari GOTO. Walau demikian, diperkirakan pekan ini IHSG berpotensi melawan koreksi lebih lanjut.

Bagi para dividen hunter, memasuki pertengahan tahun, sudah mulai jarang momen dividen, pekan ini yang cum date: DMND 7 (23 Jun), PBSA 55 (23 Jun), SSIA 15 (23 Jun), IMAS 4 (24 Jun), INKP 50 (24 Jun), SMAR 30 (24 Jun), TKIM 25 (24 Jun), DKFT 10 (25 Jun).

Walaupun indeks syariah masih di posisi terbaik, dikarenakan yang non syariah terutama indeks berbasis perbankan atau yang mayoritas emiten pemicunya adalah perbankan koreksi, tetapi menjelang akhir kuartal 2, semua cenderung turun performanya. Ada 2 yang terlihat sedikit melawan arah, yaitu indeks XIPI (Indeks PEFINDO i-Grade) dan FTSE Indonesia. Jika melihat arah kedua indeks ini, sepertinya sektor perbankan segera rebound.

Hampir semua sektor memiliki performa positif di kuartal 2 ini dengan sektor unggulan Basic-Industry (Industri Dasar), Transportasi, Energi, Kesehatan, dan Infrastruktur. Untuk energi, utamakan emas hitam atau bahan bakar minyak.

Pergerakan Rupiah

Sejak awal Juni 2025, walau terlihat sedikit melemah, tetapi sesungguhnya rupiah masih stabil dalam koridor yang sama, yaitu Rp16.169 - Rp16.510.

| COMMODITY | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| XAU/USD | -2.21% | 3,368.23 |

| Crude Oil WTI | 3.04% | 74.93 |

| Palm Oil c3 F | 0.00% | 4,480.00 |

| Natural Gas | 4.82% | 3.85 |

| Newcastle Coal | 1.28% | 106.60 |

| Nickel | -1.23% | 14,965.63 |

| Tin | 0.65% | 32,815.99 |

| Copper | 0.19% | 9,655.50 |

| Aluminium | 2.01% | 2,556.50 |

| US Soybeans | -0.16% | 1,068.00 |

| Silver | -0.98% | 36.02 |

Provided by Cermati Invest, last update 20 Juni 2025

Emas

Walaupun sejak 15 Mei 2025 emas dunia naik dari US$3120 ke US$3452, tetapi sudah beberapa hari ini harga emas dunia terlihat konsolidasi, bergerak sideways dan cenderung turun dalam kisaran US$3327 - US$3426. Walau demikian emas dunia diperkirakan mampu breakout US$3500 di kuartal 3 nanti.

Bagaimana dengan harga emas dalam negeri?

Sama seperti harga emas dunia yang bergerak naik sejak 15 Mei 2025, harga emas dalam negeri juga cenderung bergerak naik. Tetapi beberapa hari ini terlihat konsolidasi, stabil dalam kisaran Rp1.749.000 - Rp1.850.000 per gram. Sepertinya perang Iran - Israel belum banyak pengaruhnya terhadap pergerakan harga emas dunia maupun dalam negeri, tetapi sepertinya memengaruhi pergerakan harga emas hitam atau minyak dunia. Tetapi jika tiba-tiba rupiah kembali melemah signifikan, tentu harga emas dalam negeri ikut terpengaruh dan segera bergerak lebih tinggi. Investasi emas sekarang ini cenderung untuk LONG TERM INVESTMENT (investasi jangka panjang).

Sebagai salah satu aset investasi, memiliki emas digital maupun emas fisik sangatlah menarik. Setiap kali harga koreksi (turun), tidak perlu lama harga emas segera kembali naik. Harga emas fisik biasanya lebih tinggi Rp60.000 - Rp100.000 per gramnya dari harga emas digital.

| REGIONAL | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| Dow Jones | 0.02% | 42,206.82 |

| S&P 500 | -0.15% | 5,967.84 |

| FTSE 100 | -0.86% | 8,774.65 |

| DAX | -0.70% | 23,350.55 |

| Nikkei 225 | 0.89% | 38,403.23 |

| Hang Seng | -1.52% | 23,530.48 |

| CSI 300 | -0.45% | 3,846.64 |

| KOSPI | 4.40% | 3,021.84 |

Provided by Cermati Invest, last update 20 Juni 2025

Reksa Dana & Surat Berharga

1 bulan ini, Juni 2025, performa reksa dana campuran dan reksa dana saham sedikit turun, hal ini dikarenakan performa saham 2 pekan ini turun. Walau demikian, performa kuartal 2 masih positif. Jika IHSG mampu rebound pekan ini sampai penutupan akhir kuartal 2, kemungkinan NAB reksa dana saham dan reksa dana campuran masih mampu bertahan dan naik lebih tinggi. Pilih yang terbaik hanya di Cermati Invest.

Selain itu, bila ingin reksa dana yang stabil performanya, dapat pilih yang terbaik dari jenis reksa dana pasar uang dan reksa dana pendapatan tetap. Reksa dana terbaik pekan ini dapat dilihat pada tabel. Anda dapat memulai investasi reksa dana dengan memilih yang terbaik performanya 1 bulan terakhir atau sejak awal tahun (year to date). Jangan lupa beberapa reksa dana pendapatan tetap yang rutin membagikan dividen di akhir kuartal, dapat mulai Anda cermati akhir pekan ini untuk dipilih nanti di awal kuartal 3 dengan harga terbaik.

Surat berharga, beberapa obligasi yang kami pilihkan untuk Anda dapat dilihat pada tabel di bawah.

Perang di Timur Tengah Kembali Memanas, Pasar Keuangan Kembali Tertekan

Pasar keuangan Tanah Air berakhir di zona merah pada sepanjang pekan lalu, Rapat Dewan Gubernur (RDG) Bank Indonesia pada 17-18 Juni 2025 memutuskan untuk mempertahankan BI-Rate sebesar 5.50% dan diikuti bank sentral Amerika Serikat (AS) The Federal Reserve (The Fed) kembali menahan suku bunganya di level 4.25 - 4.50% bulan ini. Pelaku pasar pada pekan ini tampaknya masih akan dalam mode hati-hati, karena sejumlah kekhawatiran yang mencuat, terutama tensi geopolitik di Timur Tengah dan sejumlah rilis data ekonomi yang memengaruhi fundamental ekonomi. Presiden AS, Donald Trump mengumumkan pasukan Amerika Serikat telah melancarkan serangan pada tiga lokasi nuklir di Iran, yakni di Fordow, Natanz, dan Isfahan, pada Sabtu malam (21/6/2025) waktu setempat. Kemudian, Parlemen Iran menyetujui langkah untuk menutup Selat Hormuz, jalur transit global yang sangat penting, sebagai respons atas serangan udara Amerika Serikat semalam terhadap situs nuklir Iran, demikian dilaporkan media pemerintah Iran pada Minggu (22/6/2025), selat tersebut menghubungkan Teluk Persia dengan laut lepas dan menjadi salah satu titik tersumbat jalur pengiriman minyak paling kritis di dunia.

Kenaikan harga minyak bisa berdampak luas terhadap inflasi global. Inflasi yang semakin memanas ini cukup dikhawatirkan karena bisa menunda prospek penurunan suku bunga dan membawa efek suku bunga tinggi bertahan lebih lama. Selain mencermati konflik geopolitik di Timur Tengah, dari Amerika Serikat (AS) juga punya banyak agenda penting pekan depan, mulai dari rilis data ekonomi, jadwal Federal Reserve (The Fed), hingga laporan keuangan dari sejumlah emiten besar.

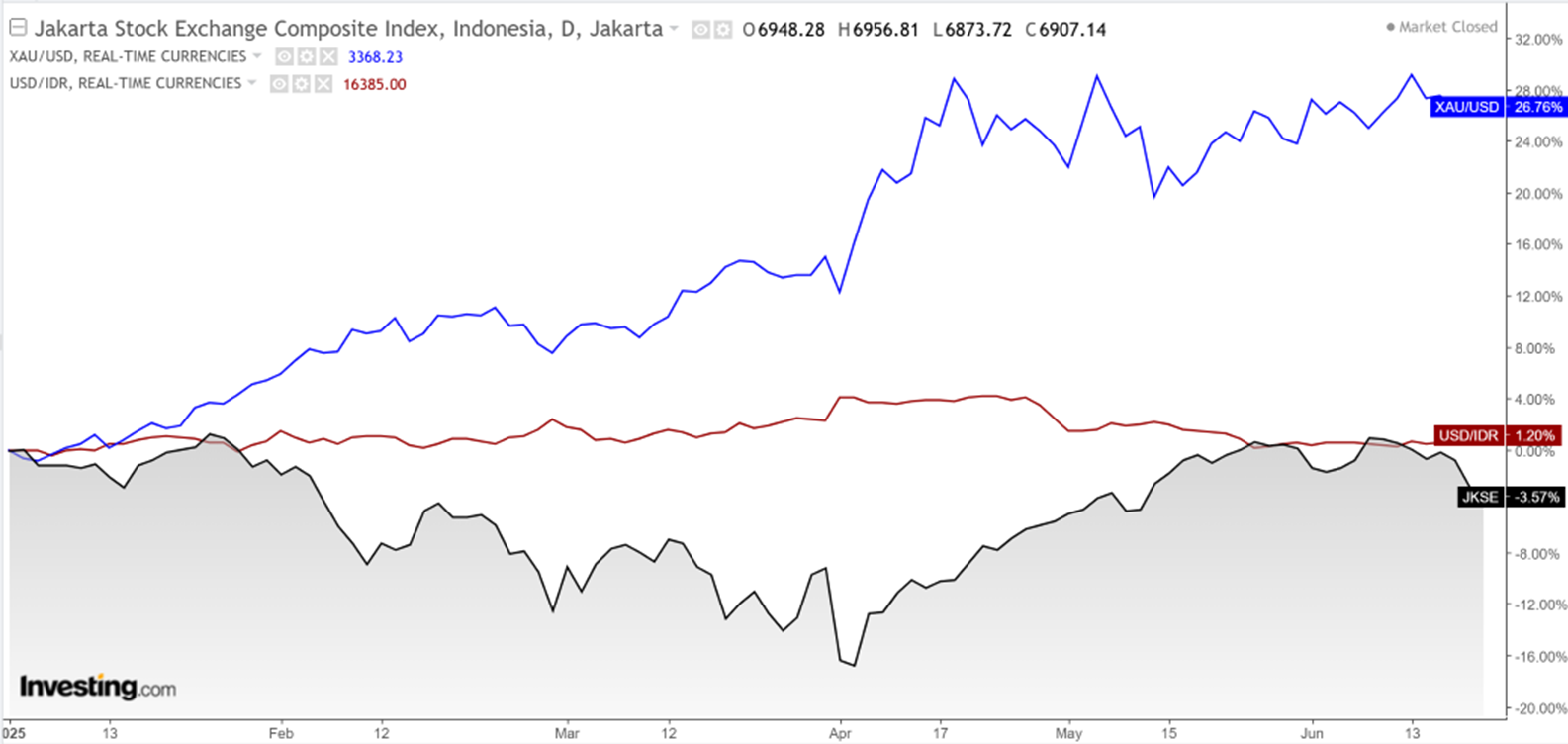

COMPOSITE INDEX compare to USDIDR & GOLD since 2025 (YtD)

Reksa Dana

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana PASAR UANG | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| Insight Money Syariah | 1677.363 | 0.55% | 1.55% | 2.97% | 2.75% | 6.09% | 16.71% | 67.74% | 30 Sep 2015 | 194.71 B |

| Insight Retail Cash Fund | 1621.755 | 0.53% | 1.56% | 2.95% | 2.75% | 6.39% | 15.34% | 62.18% | 13 Apr 2018 | 16.97 B |

| Cipta Dana Cash | 1754.850 | 0.50% | 1.43% | 2.98% | 2.77% | 5.70% | 15.87% | 75.49% | 8 Jun 2015 | 263.97 B |

| BNI-AM Dana Likuid Kelas A | 1944.560 | 0.48% | 1.37% | 2.57% | 2.41% | 4.90% | 12.33% | 94.46% | 27 Dec 2012 | 261.82 B |

| Syailendra Dana Kas | 1723.629 | 0.48% | 1.33% | 2.53% | 2.36% | 5.13% | 14.34% | 72.36% | 12 Jun 2015 | 1.81 T |

| BRI Seruni Pasar Uang Syariah | 1364.291 | 0.47% | 1.32% | 2.77% | 2.60% | 5.35% | 14.37% | 36.43% | 19 Jul 2018 | 682.06 B |

| Setiabudi Dana Pasar Uang | 1543.592 | 0.46% | 1.37% | 2.77% | 2.58% | 5.59% | 15.38% | 54.36% | 23 Dec 2016 | 633.20 B |

| TRIM Kas 2 Kelas A | 1945.571 | 0.46% | 1.38% | 2.78% | 2.58% | 5.52% | 14.73% | 94.56% | 8 Apr 2008 | 4.28 T |

| HPAM Ultima Money Market | 1649.344 | 0.45% | 1.37% | 2.59% | 2.42% | 5.37% | 14.74% | 64.93% | 10 Jun 2015 | 782.73 B |

| Trimegah Kas Syariah | 1460.992 | 0.45% | 1.33% | 2.63% | 2.45% | 5.35% | 14.79% | 46.10% | 30 Dec 2016 | 1.24 T |

| Bahana Likuid Syariah Kelas G | 1234.520 | 0.44% | 1.31% | 2.64% | 2.46% | 5.31% | 14.09% | 23.45% | 12 Jul 2016 | 603.07 B |

| Principal Cash Fund Syariah 2 | 1153.230 | 0.44% | 1.36% | 2.65% | 2.45% | 4.83% | 11.69% | 15.32% | 1 Dec 2020 | 12.59 B |

| BRI Seruni Pasar Uang III | 1801.960 | 0.42% | 1.34% | 2.70% | 2.51% | 5.59% | 14.05% | 80.20% | 16 Feb 2010 | 2.04 T |

| Principal Cash Fund | 1896.580 | 0.42% | 1.20% | 2.46% | 2.28% | 4.63% | 11.96% | 89.66% | 23 Dec 2011 | 111.04 B |

| SAM Dana Kas | 1460.762 | 0.42% | 1.23% | 2.56% | 2.44% | 4.32% | 12.20% | 46.08% | 10 Feb 2017 | 28.92 B |

| Danakita Stabil Pasar Uang | 1647.620 | 0.41% | 1.24% | 2.53% | 2.35% | 5.03% | 14.21% | 64.76% | 10 Sep 2015 | 76.33 B |

| Bahana Dana Likuid Kelas G | 1907.350 | 0.40% | 1.19% | 2.25% | 2.11% | 4.79% | 12.46% | 90.74% | 27 May 1997 | 3.45 T |

| Sequis Liquid Prima | 1465.936 | 0.40% | 1.18% | 2.41% | 2.25% | 4.85% | 12.85% | 46.59% | 8 Sep 2016 | 343.55 B |

Provided by Cermati Invest, last update 20 Juni 2025

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana PENDAPATAN TETAP | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| Principal Income Fund Syariah | 1170.180 | 1.16% | 1.78% | 2.48% | 2.11% | 4.63% | 13.08% | 17.02% | 21 Oct 2020 | 5.05 B |

| Insight Haji Syariah | 5266.345 | 0.99% | 2.29% | 4.27% | 4.03% | 8.62% | 24.04% | 426.63% | 13 Jan 2005 | 2.89 T |

| BRI Brawijaya Abadi Pendapatan Tetap | 1426.797 | 0.82% | 2.92% | 5.75% | 5.15% | 7.49% | 20.47% | 42.68% | 25 Feb 2019 | 3.10 B |

| Trimegah Fixed Income Plan | 1182.936 | 0.82% | 1.05% | 1.85% | 2.75% | 3.45% | 5.97% | 18.29% | 23 May 2019 | 2.82 T |

| TRIM Dana Tetap 2 Kelas A | 3340.370 | 0.79% | 2.07% | 3.99% | 3.86% | 7.80% | 18.59% | 234.04% | 13 May 2008 | 1.05 T |

| BRI Melati Pendapatan Utama | 1933.619 | 0.72% | 2.48% | 3.94% | 3.44% | 6.14% | 14.87% | 93.36% | 27 Sep 2012 | 43.11 B |

| HPAM Government Bond | 1641.438 | 0.72% | 2.92% | 3.18% | 2.53% | 6.68% | 18.95% | 64.14% | 18 May 2016 | 18.65 B |

| Insight Renewable Energy Fund | 2375.251 | 0.71% | 2.08% | 3.83% | 3.60% | 8.10% | 20.66% | 137.53% | 22 Jun 2011 | 1.85 T |

| Eastspring IDR Fixed Income Fund Kelas A | 1788.470 | 0.70% | 2.49% | 4.11% | 3.65% | 6.15% | 17.18% | 78.85% | 16 Mar 2015 | 169.26 B |

| HPAM Pendapatan Tetap Prima | 1080.030 | 0.67% | 0.57% | 0.97% | 1.97% | 2.28% | 6.44% | 8.00% | 29 Oct 2018 | 438.56 B |

| Principal Total Return Bond Fund | 2639.540 | 0.63% | 2.45% | 4.09% | 3.53% | 4.16% | 0.40% | 163.95% | 21 Aug 2008 | 14.17 B |

| Syailendra Pendapatan Tetap Premium | 1866.496 | 0.63% | 2.61% | 3.47% | 3.28% | 5.89% | 17.20% | 86.65% | 27 Mar 2017 | 2.89 T |

| Bahana Obligasi Ganesha Kelas D | 1013.190 | 0.60% | 1.29% | 1.70% | 1.57% | 3.96% | 2.35% | 1.32% | 26 Oct 2020 | 373.67 B |

| Danakita Obligasi Negara | 1151.540 | 0.59% | 2.12% | 4.06% | 3.68% | 6.30% | 16.07% | 15.15% | 26 Mar 2021 | 52.60 B |

| Sequis Bond Optima | 1526.298 | 0.59% | 2.28% | 3.91% | 3.46% | 5.59% | 11.11% | 52.63% | 8 Sep 2016 | 40.72 B |

| Eastspring Syariah Fixed Income Amanah Kelas A | 1515.140 | 0.56% | 1.57% | 2.46% | 2.14% | 4.58% | 12.86% | 51.51% | 17 Apr 2017 | 183.53 B |

| UOBAM Inovasi Obligasi Nasional | 1057.225 | 0.56% | 0.02% | 2.95% | 3.81% | 3.46% | 17.91% | 5.72% | 12 Jan 2021 | 109.11 B |

| Cipta Bond | 1863.480 | 0.49% | 2.74% | 4.24% | 3.80% | 6.63% | 16.92% | 86.35% | 2 Jan 2019 | 10.36 B |

| Eastspring Investments Yield Discovery Kelas A | 1620.930 | 0.49% | 1.15% | 2.42% | 2.18% | 2.38% | 1.31% | 62.09% | 29 May 2013 | 97.92 B |

| Eastspring Investments IDR High Grade Kelas A | 1655.170 | 0.47% | 1.61% | 2.12% | 1.53% | 1.51% | 12.54% | 65.52% | 9 Jan 2013 | 721.24 B |

| Syailendra Fixed Income Fund Kelas A | 2660.420 | 0.46% | 2.46% | 4.27% | 3.81% | 6.35% | 18.51% | 166.04% | 8 Dec 2011 | 124.86 B |

| SAM Sukuk Syariah Sejahtera | 2440.528 | 0.36% | 0.33% | 0.52% | 1.61% | 0.64% | -0.13% | 144.05% | 29 Oct 1997 | 46.52 B |

| Batavia Dana Obligasi Ultima | 2932.220 | 0.33% | 1.05% | 1.92% | 1.59% | 2.36% | 2.94% | 193.22% | 20 Dec 2006 | 1.04 T |

| BNI-AM Short Duration Bonds Index Kelas R1 | 1077.190 | -0.09% | 0.43% | 2.71% | 2.46% | 3.88% | - | 7.72% | 1 Sep 2022 | 13.30 B |

| BNI-AM Pendapatan Tetap Quality Long Duration Fund | 1637.430 | -0.47% | 1.01% | 2.30% | 1.86% | 1.93% | 13.84% | 63.74% | 16 Jun 2016 | 71.98 B |

| BNI-AM Dana Pendapatan Tetap Syariah Ardhani | 1567.190 | -1.25% | -0.43% | 0.41% | 0.06% | -1.41% | 7.71% | 56.72% | 16 Aug 2016 | 308.13 B |

Provided by Cermati Invest, last update 20 Juni 2025

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana CAMPURAN | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| Trimegah Balanced Absolute Strategy Kelas A | 1813.800 | 4.72% | 21.54% | 3.39% | 1.16% | 12.77% | 10.70% | 81.38% | 28 Dec 2018 | 272.99 B |

| TRIM Kombinasi 2 | 2709.760 | 4.71% | 20.98% | 1.97% | -0.30% | 8.81% | 7.05% | 170.98% | 10 Nov 2006 | 20.89 B |

| TRIM Syariah Berimbang | 3244.280 | 3.01% | 19.58% | 0.02% | -2.24% | 11.20% | 8.43% | 224.43% | 27 Dec 2006 | 21.88 B |

| HPAM Flexi Indonesia Sehat Kelas A | 2063.823 | 1.77% | 12.96% | 8.79% | 6.94% | 20.77% | 16.60% | 106.38% | 2 Mar 2011 | 75.46 B |

| Syailendra Balanced Opportunity Fund | 3275.830 | -0.38% | 12.58% | 3.34% | -0.08% | 4.85% | -2.51% | 227.58% | 22 Apr 2008 | 69.12 B |

| Setiabudi Dana Campuran | 1463.192 | -0.71% | 9.56% | 3.45% | 1.54% | 7.27% | 16.58% | 46.32% | 25 Sep 2017 | 85.25 B |

Provided by Cermati Invest, last update 20 Juni 2025

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana SAHAM | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| HPAM Ekuitas Syariah Berkah | 2001.409 | 8.13% | 21.60% | 5.02% | 4.91% | 8.99% | 41.16% | 100.14% | 20 Jan 2020 | 1.53 T |

| HPAM Ultima Ekuitas 1 | 2831.944 | 7.15% | 21.07% | 6.38% | 3.74% | 4.60% | 5.53% | 183.19% | 2 Nov 2009 | 1.08 T |

| TRIM Syariah Saham | 1735.450 | 3.82% | 22.72% | -2.20% | -5.34% | 6.53% | -7.38% | 73.55% | 27 Dec 2006 | 93.94 B |

| BRI Syariah Saham | 685.295 | 2.02% | 14.90% | -3.53% | -5.15% | -4.32% | -22.96% | -31.47% | 18 Sep 2014 | 12.21 B |

| Principal Islamic Equity Growth Syariah | 1126.680 | 1.10% | 14.42% | 0.42% | -2.13% | 2.61% | -5.89% | 12.67% | 10 Sep 2007 | 71.14 B |

| Principal Total Return Equity Fund Kelas O | 3067.140 | 1.02% | 17.58% | 0.50% | -2.58% | 1.40% | -12.24% | 206.71% | 1 Jul 2005 | 23.67 B |

| Cipta Saham Unggulan Syariah | 2287.560 | 0.16% | 11.66% | 3.46% | 1.94% | 15.37% | 0.33% | 128.76% | 5 Sep 2018 | 14.76 B |

| Bahana Primavera Plus | 11533.980 | -0.07% | 17.38% | 1.95% | -1.36% | -5.99% | -21.80% | 1053.40% | 27 May 1997 | 47.62 B |

| Cipta Saham Unggulan | 2892.810 | -1.35% | 8.30% | 2.27% | 0.15% | 9.96% | 9.37% | 189.28% | 4 Dec 2018 | 39.81 B |

| SAM Indonesian Equity Fund | 2233.050 | -1.43% | 13.31% | -1.78% | -6.09% | 3.44% | 7.34% | 123.31% | 18 Oct 2011 | 996.51 B |

| Syailendra Equity Opportunity Fund | 3894.270 | -2.95% | 13.42% | -1.85% | -5.09% | 3.00% | -0.26% | 289.43% | 7 Jun 2007 | 138.62 B |

| TRIM Kapital Plus | 4249.040 | -3.00% | 12.58% | -1.30% | -3.97% | 5.70% | 6.53% | 324.90% | 18 Apr 2008 | 398.80 B |

| TRIM Kapital | 10237.380 | -3.60% | 9.49% | -3.28% | -5.86% | -5.47% | -8.35% | 923.74% | 19 Mar 1997 | 232.99 B |

| Cipta Rencana Cerdas | 15968.110 | -3.71% | 7.79% | -2.34% | -4.80% | 0.49% | -4.94% | 1496.81% | 9 Jul 1999 | 61.88 B |

| Batavia Dana Saham Optimal | 2855.090 | -4.46% | 7.36% | -5.06% | -8.05% | -3.04% | -8.14% | 185.51% | 19 Oct 2006 | 235.06 B |

| Batavia Dana Saham | 55044.100 | -4.95% | 6.74% | -6.86% | -9.47% | -6.80% | -10.64% | 5404.41% | 16 Dec 1996 | 1.55 T |

Provided by Cermati Invest, last update 20 Juni 2025

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana USD | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| Eastspring Syariah Equity Islamic Asia Pacific USD Kelas A | 1.05706 | 8.74% | 14.20% | 11.61% | 13.02% | 2.49% | -0.03% | 5.71% | 28 Oct 2016 | 1.77 M |

| Batavia Technology Sharia Equity USD | 1.15500 | 2.19% | 10.59% | -1.31% | -1.27% | -0.16% | 59.40% | 15.50% | 16 Feb 2022 | 147.76 M |

| BRI Melati Premium Dollar | 1.41381 | 1.48% | 1.24% | 3.23% | 3.49% | 2.47% | 6.17% | 41.38% | 19 Feb 2007 | 1.94 M |

| Eastspring Syariah Greater China Equity USD Kelas A | 0.62688 | 1.41% | -5.58% | 1.73% | 4.30% | -2.41% | -21.63% | -37.31% | 15 Jun 2020 | 5.24 M |

| Batavia USD Bond Fund | 1.05200 | 0.80% | 1.19% | 2.82% | 2.84% | 1.78% | - | 5.20% | 18 Oct 2022 | 15.85 M |

| Batavia Global ESG Sharia Equity USD | 1.17920 | 0.67% | 4.53% | 1.96% | 3.07% | 3.13% | 28.33% | 17.92% | 27 Jan 2021 | 9.51 M |

| BRI G20 Sharia Equity Fund Dollar | 1.20600 | 0.40% | 4.11% | 0.66% | 1.88% | -5.21% | 32.29% | 20.60% | 3 Dec 2019 | 1.38 M |

| STAR Fixed Income Dollar | 1.04663 | 0.31% | 0.85% | 1.87% | 1.74% | 4.62% | 16.89% | 4.66% | 10 Jul 2017 | 14.56 M |

| Eastspring Syariah Fixed Income USD Kelas A | 0.97559 | -0.43% | 0.16% | 1.90% | 1.90% | 2.33% | 5.79% | -2.44% | 8 Mar 2021 | 1.27 M |

Provided by Cermati Invest, last update 20 Juni 2025

Surat Utang/Obligasi

| NAMA OBLIGASI | ISIN | MATA UANG | KUPON | TANGGAL JATUH TEMPO | INDIKASI HARGA BELI | INDIKASI HARGA JUAL | INDIKASI YIELD | RATING |

|---|---|---|---|---|---|---|---|---|

| FR0087 | IDG000015207 | IDR | 6.50% | 15-Feb-31 | 101.1 | 100.1 | 6.26% | BBB |

| FR0097 | IDG000020900 | IDR | 7.13% | 15-Jun-43 | 102 | 101 | 6.94% | BBB |

| PBS005 | IDP000001505 | IDR | 6.75% | 15-Apr-43 | 97.8 | 96.8 | 6.97% | BBB |

| BWPT01BCN2 | IDA0001522B2 | IDR | 11.00% | 26-Feb-28 | 101 | 100 | 10.57% | idA- |

| LPPI02ACN1 | IDA0001331A0 | IDR | 10.50% | 4-Jul-26 | 101.25 | 100.25 | 9.36% | idA |

Provided by Cermati Invest, last update 20 Juni 2025

Event Calendar

| Monday, 23 June 2025 | Previous | Consensus | Forecast | ||

| 7:30 AM | JP | Jibun Bank Manufacturing PMI Flash JUN | 49.40 | 49.50 | 49.70 |

| 7:30 AM | JP | Jibun Bank Services PMI Flash JUN | 51.00 | 51.50 | |

| 12:00 PM | IN | HSBC Manufacturing PMI Flash JUN | 57.60 | 57.70 | |

| 12:00 PM | IN | HSBC Services PMI Flash JUN | 58.80 | 59.00 | |

| 2:30 PM | DE | HCOB Manufacturing PMI Flash JUN | 48.30 | 48.70 | 49.10 |

| 2:30 PM | DE | HCOB Services PMI Flash JUN | 47.10 | 47.70 | 48.00 |

| 3:30 PM | GB | S&P Global Manufacturing PMI Flash JUN | 46.40 | 46.90 | 46.60 |

| 3:30 PM | GB | S&P Global Services PMI Flash JUN | 50.90 | 51.50 | 51.00 |

| 8:45 PM | US | S&P Global Manufacturing PMI Flash JUN | 52.00 | 51.20 | 52.00 |

| 8:45 PM | US | S&P Global Services PMI Flash JUN | 53.70 | 52.90 | 53.00 |

| 9:00 PM | US | Existing Home Sales MAY | 4M | 3.95M | 3.9M |

| Tuesday, 24 June 2025 | Previous | Consensus | Forecast | ||

| 4:00 AM | KR | Consumer Confidence JUN | 101.80 | 94.00 | |

| 3:00 PM | DE | Ifo Business Climate JUN | 87.50 | 88.00 | 88.40 |

| 5:00 PM | GB | CBI Industrial Trends Orders JUN | -30.00 | -29.00 | -32.00 |

| 7:30 PM | US | Current Account Q1 | $-380B | $-440B | $-450B |

| 8:00 PM | US | S&P/Case-Shiller Home Price YoY APR | 4.10% | 4.20% | 4.00% |

| 9:00 PM | US | Fed Chair Powell Testimony | |||

| 9:00 PM | US | CB Consumer Confidence JUN | 98.00 | 99.10 | 99.00 |

| Wednesday, 25 June 2025 | Previous | Consensus | Forecast | ||

| 3:30 AM | US | API Crude Oil Stock Change JUN/20 | -10.133M | ||

| 6:00 PM | US | MBA 30-Year Mortgage Rate JUN/20 | 6.84% | ||

| 9:00 PM | US | Fed Chair Powell Testimony | |||

| 9:00 PM | US | New Home Sales MAY | 0.743M | 0.71M | 0.7M |

| 9:00 PM | US | New Home Sales MoM MAY | 10.90% | -5.80% | |

| 9:30 PM | US | EIA Crude Oil Stocks Change JUN/20 | -11.473M | ||

| 9:30 PM | US | EIA Gasoline Stocks Change JUN/20 | 0.209M | ||

| Thursday, 26 June 2025 | Previous | Consensus | Forecast | ||

| 4:00 AM | KR | Business Confidence JUN | 73.00 | 75.00 | |

| 1:00 PM | DE | GfK Consumer Confidence JUL | -19.90 | -18.00 | -19.00 |

| 5:00 PM | GB | CBI Distributive Trades JUN | -27.00 | -32.00 | -30.00 |

| 7:30 PM | US | Durable Goods Orders MoM MAY | -6.30% | 0.068 | 0.052 |

| 7:30 PM | US | GDP Growth Rate QoQ Final Q1 | 2.40% | -0.002 | -0.002 |

| 7:30 PM | US | Chicago Fed National Activity Index MAY | -0.25 | -0.10 | |

| 7:30 PM | US | Corporate Profits QoQ Final Q1 | 5.90% | -3.60% | -3.60% |

| 7:30 PM | US | Durable Goods Orders Ex Transp MoM MAY | 0.20% | 0.10% | 0.10% |

| 7:30 PM | US | GDP Price Index QoQ Final Q1 | 2.30% | 3.70% | 3.70% |

| 7:30 PM | US | Goods Trade Balance Adv MAY | $-87.62B | $-91.9B | $-92B |

| 7:30 PM | US | Initial Jobless Claims JUN/21 | 245K | 247.0K | 247.0K |

| 7:30 PM | US | Retail Inventories Ex Autos MoM Adv MAY | 0.30% | 0.10% | |

| 7:30 PM | US | Wholesale Inventories MoM Adv MAY | 0.20% | 0.10% | 0.10% |

| 9:00 PM | US | Pending Home Sales MoM MAY | -6.30% | 0.10% | 0.30% |

| 9:00 PM | US | Pending Home Sales YoY MAY | -2.50% | -2.10% | |

| Friday, 27 June 2025 | Previous | Consensus | Forecast | ||

| 6:30 AM | JP | Unemployment Rate MAY | 2.50% | 2.50% | 2.50% |

| 6:50 AM | JP | Retail Sales YoY MAY | 3.30% | 2.60% | 3.00% |

| 1:00 PM | GB | Current Account Q1 | £-21B | £ -23.5B | |

| 7:30 PM | US | Core PCE Price Index MoM MAY | 0.10% | 0.10% | 0.10% |

| 7:30 PM | US | Personal Income MoM MAY | 0.80% | 0.30% | 0.40% |

| 7:30 PM | US | Personal Spending MoM MAY | 0.20% | 0.20% | 0.10% |

| 7:30 PM | US | PCE Price Index MoM MAY | 0.10% | 0.10% | |

| 7:30 PM | US | PCE Price Index YoY MAY | 2.10% | 2.20% | |

| 9:00 PM | US | Michigan Consumer Sentiment Final JUN | 52.20 | 60.50 | 60.50 |

Source: BI, CNBC Indonesia, Bloomberg, Investing, Trading Economics, KSEI, Cermati, Artha Investa Teknologi (AIT)

Disclaimer:

Dokumen ini dibuat hanya untuk memberikan informasi. Isi dokumen ini tidak boleh ditafsirkan sebagai suatu bentuk penawaran untuk membeli/menjual/dijadikan dasar dari atau yang dapat dijadikan pedoman sehubungan dengan suatu perjanjian atau komitmen apa pun atau suatu nasehat investasi.

Baca Juga Cermati Invest Weekly Update Sebelumnya:

- Cermati Invest Weekly Update 16 Juni 2025

- Cermati Invest Weekly Update 10 Juni 2025

- Cermati Invest Weekly Update 2 Juni 2025

- Cermati Invest Weekly Update 26 Mei 2025