Cermati Invest Weekly Update 25 Agustus 2025

Ulasan Pasar

| INDONESIA | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| IHSG | -0.50% | 7,858.85 |

| ISSI | 1.09% | 193.51 |

| IDX30 | 0.28% | 425.47 |

| FTSE Indonesia | 0.27% | 3,151.77 |

| MSCI Indonesia | -0.39% | 6,426.25 |

| USD/IDR | 1.19% | 16,340.00 |

Provided by Cermati Invest, last update 22 Agustus 2025

IHSG & Saham Pekan Ini

Indeks, sudah 2 minggu bergerak sideways di kisaran 7732 - 8017 setelah mencetak angka tertinggi (all time high) di 8017.

Jenuh, walau beberapa indikator IHSG dan indeks konstituen terlihat jenuh beli, tetapi masih mampu bertahan naik kembali dengan dukungan Indeks Syariah (ISSI & JII70) dan Indeks SMInfra18.

Pekan ini indeks PEFINDO I-Grade turut mendominasi pasar, berisi 30 emiten di Bursa Efek Indonesia (BEI) yang telah mendapatkan peringkat Investment Grade (rating) idAAA sampai dengan idBBB dari PEFINDO.

Bila nantinya ada koreksi wajar, selama masih di atas support 7216 - 7288, terbilang aman. Ke depannya, IHSG berpotensi mencapai resistance 8456 - 8481.

Saham, walaupun masih jadi indeks konstituen terbaik, begitupun sektor Teknologi, Infrastruktur, dan Industri, tetapi jika emiten atau saham utamanya terkoreksi, akan mendorong IHSG untuk turun.

Pekan ini perhatikan: HRTA, AKRA, BRIS, HEAL, INKP, JSMR, MBMA, ISAT, BRPT, MDKA, TLKM, BMTR, ANTM, TOBA, PSAB.

Pergerakan Rupiah

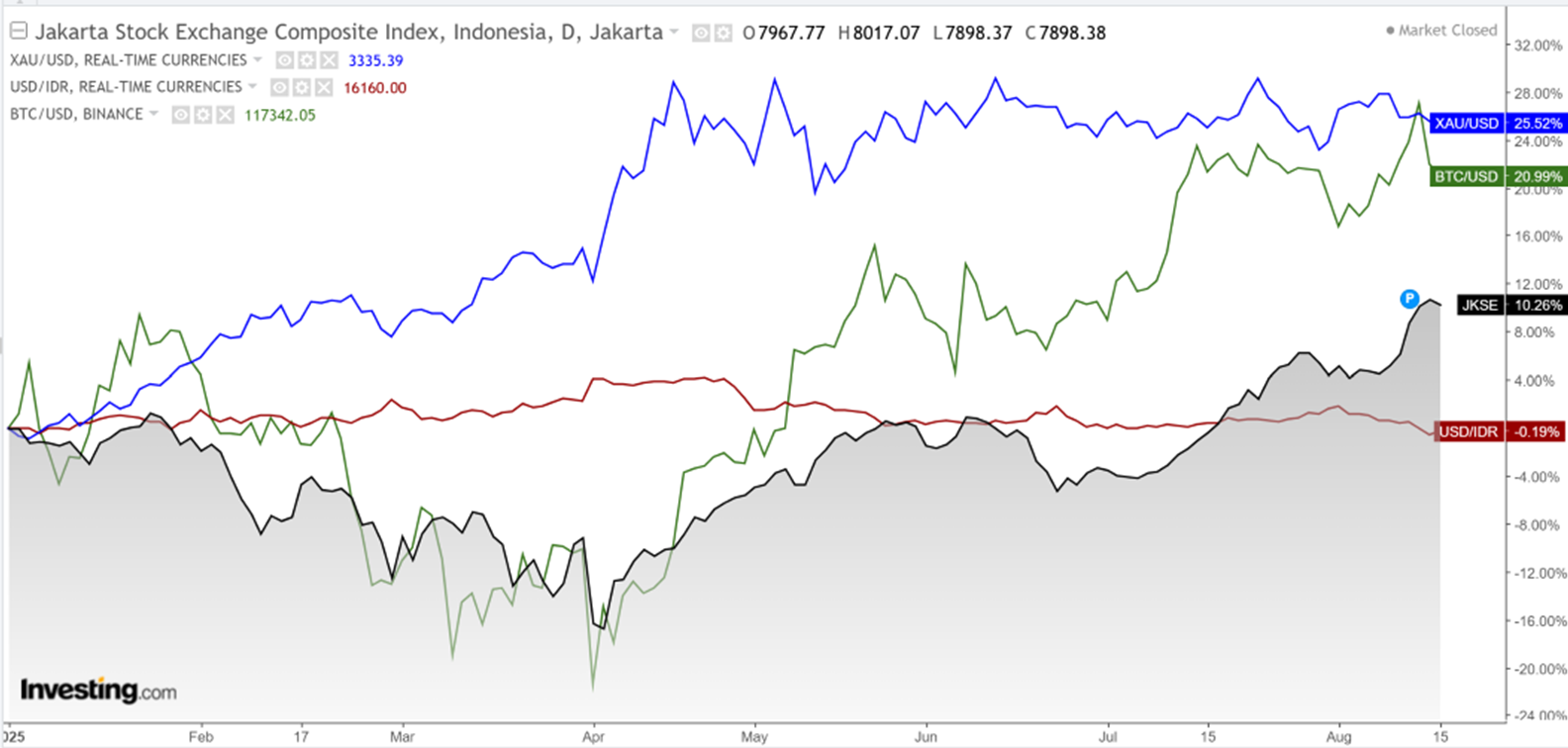

Nilai tukar rupiah stabil sejak awal tahun 2025 dan bergerak dalam area Rp16.050 - Rp16.500.

| COMMODITY | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| XAU/USD | 1.35% | 3,372.11 |

| Crude Oil WTI | 1.37% | 63.66 |

| Palm Oil c3 F | 0.00% | 4,480.00 |

| Natural Gas | -3.98% | 2.80 |

| Newcastle Coal | 0.41% | 111.30 |

| Nickel | -0.98% | 14,997.63 |

| Tin | 0.23% | 33,821.00 |

| Copper | 0.01% | 9,780.30 |

| Aluminium | 0.73% | 2,622.55 |

| US Soybeans | 1.53% | 1,058.50 |

| Silver | 2.84% | 39.05 |

Provided by Cermati Invest, last update 22 Agustus 2025

Emas & Bitcoin (BTC)

Emas, masih sideways dalam area US$3244 (support) - US$3448 (resistance). Emas dunia dikatakan rebound dan lanjut rallies bila berhasil break ke atas resistance. Sebaliknya, bearish bila break support. Emas dunia sejak awal tahun sudah naik 28.27%.

Dalam rupiah, harga emas juga sideways, hal ini karena nilai tukar rupiah terhadap dolar Amerika juga stabil. Harga emas murni di Indonesia masih di kisaran Rp1.692.000 - Rp1.842.000 per gram, naik 29.56% sejak awal tahun. Investasi emas sekarang ini cenderung untuk LONG TERM INVESTMENT (investasi jangka panjang), karena sejak April 2025, harga emas agak lebih sulit naiknya, cenderung sideways, tidak ada tren.

Memiliki emas digital lebih mudah daripada emas fisik, sehingga cocok dijadikan sebagai cadangan dana darurat yang sewaktu-waktu dapat dicairkan langsung ke rekening dengan harga terkini. Jadi beli emas digital sebelum harga naik lebih tinggi lagi, jangan lupa gunakan kode promonya.

Kripto, akhir pekan lalu naik signifikan.

Ethereum (ETH), kembali mencetak all time high baru US$4958 setelah akhir pekan lalu breakout menembus ke atas all time high sebelumnya (November 2021) US$4869. Pekan ini ETH bergerak dalam area US$4400 (support) - US$5000 (resistance). Sejak awal tahun, ETH sudah naik 41.59%.

Bitcoin (BTC), sebaliknya. Pekan lalu break low, sesuai prediksi turun ke kisaran support US$110305. Pekan ini, walau BTC berusaha naik, tetapi arahnya tetap turun menuju support berikutnya US$108522. Resistance sekitar US$117350 - US$122054. Sejak awal tahun, bitcoin sudah naik 20.66%.

Investasi terbaik di Indonesia saat ini adalah saham, bitcoin, emas, dan dolar Amerika.

| REGIONAL | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| Dow Jones | 1.53% | 45,631.74 |

| S&P 500 | 0.27% | 6,466.91 |

| FTSE 100 | 2.00% | 9,321.40 |

| DAX | 0.02% | 24,363.09 |

| Nikkei 225 | -1.72% | 42,633.29 |

| Hang Seng | 0.27% | 25,339.14 |

| CSI 300 | 4.18% | 4,378.00 |

| KOSPI | -1.76% | 3,168.73 |

Provided by Cermati Invest, last update 22 Agustus 2025

Reksa Dana

Pekan depan sudah masuk bulan terakhir kuartal 3, persiapkan profit akhir tahun Anda, belum terlambat. Return atau performa reksa dana 1 tahun terakhir untuk jenis pasar uang, ada yang mencapai di atas 6%. Untuk reksa dana jenis pendapatan tetap bahkan ada yang lebih dari 9% dalam 1 tahun terakhir. Untuk reksa dana jenis campuran, 1 tahun terakhir ada yang lebih dari 10% dan jenis saham juga ada yang di atas 25%. Untuk reksa dana dalam mata uang dolar Amerika, 1 tahun terakhir bahkan ada yang di atas 20%.

Cermati dalam tabel yang sudah kami pilihkan di bawah atau langsung dalam aplikasi Cermati Invest, gunakan fasilitas filter yang sesuai dengan kriteria Anda. Jika Anda memerlukan Client Advisor kami, jangan sungkan untuk pilih menu Cermati Invest Prioritas.

Bingung cari investasi reksa dana yang aman dan menguntungkan? Cermati Invest solusinya!

Surat Berharga

Beberapa obligasi yang kami pilihkan untuk Anda di saat arah inflasi dan suku bunga cenderung turun dapat dilihat pada tabel di bawah atau di aplikasi Cermati.

Suku Bunga Kembali Dipangkas, Pasar Investasi Semakin Positif

Pasar keuangan Indonesia menutup perdagangan pekan lalu dengan nada negatif. Koreksi pasar domestik ini terjadi di tengah sorotan global terhadap Jackson Hole Economic Symposium, di mana pidato Ketua bank sentral Amerika The Fed, Jerome Powell, menjadi kunci arah kebijakan moneter Amerika Serikat (AS) dan juga seiringan pemangkasan suku bunga acuan Bank Indonesia (BI). Bank Indonesia yang kembali memangkas suku bunga acuan atau BI Rate sebesar 25 bps menjadi 5.00%. Suku bunga Deposit Facility juga turun menjadi sebesar 4.25% dan suku bunga Lending Facility turun menjadi 5.75%.

Gubernur BI, Perry Warjiyo, menuturkan kebijakan ini konsisten dengan tetap rendahnya perkiraan inflasi pada tahun 2025 dan 2026, serta terjaganya nilai tukar dan upaya mendorong pertumbuhan ekonomi sesuai dengan kapasitas BI. Selain itu, kebijakan makroprudensial longgar terus diperkuat untuk mendorong kredit/pembiayaan, menurunkan suku bunga, dan meningkatkan likuiditas perbankan bagi pencapaian pertumbuhan ekonomi yang lebih tinggi. Chairman bank sentral Amerika Serikat (AS) The Federal Reserve (The Fed), Jerome Powell, memberi isyarat jika The Fed akan segera memangkas suku bunga. Namun, ia tidak memberi petunjuk kapan kebijakan itu akan diambil. Bagi Indonesia, isyarat pemangkasan ini menjadi kabar positif. Jika The Fed memangkas suku bunga maka ada potensi aliran dana dari AS sehingga pasar investasi dan nilai rupiah berpotensi menguat. Pemangkasan The Fed juga menurunkan ketidakpastian global sehingga ekonomi dunia bisa tumbuh lebih cepat.

COMPOSITE INDEX compare to USDIDR & GOLD since 2025 (YtD)

Reksa Dana

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana PASAR UANG | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| Cipta Dana Cash | 1773.74 | 0.57% | 1.55% | 2.93% | 3.87% | 5.88% | 16.37% | 77.37% | 8 Jun 2015 | 263.98 B |

| Insight Money Syariah | 1695.26 | 0.52% | 1.59% | 3.08% | 3.85% | 6.08% | 17.14% | 69.53% | 30 Sep 2015 | 177.14 B |

| BRI Seruni Pasar Uang Syariah | 1377.87 | 0.50% | 1.44% | 2.75% | 3.62% | 5.45% | 15.32% | 37.79% | 19 Jul 2018 | 912.66 B |

| BRI Seruni Pasar Uang III | 1818.48 | 0.45% | 1.32% | 2.67% | 3.45% | 5.52% | 14.61% | 81.85% | 16 Feb 2010 | 2.54 T |

| Setiabudi Dana Pasar Uang | 1557.98 | 0.45% | 1.36% | 2.75% | 3.53% | 5.61% | 15.82% | 55.80% | 23 Dec 2016 | 556.59 B |

| Trimegah Kas Syariah | 1474.37 | 0.44% | 1.34% | 2.65% | 3.38% | 5.37% | 15.18% | 47.44% | 30 Dec 2016 | 1.31 T |

| HPAM Ultima Money Market | 1663.88 | 0.43% | 1.30% | 2.65% | 3.32% | 5.32% | 15.14% | 66.39% | 10 Jun 2015 | 662.34 B |

| Insight Retail Cash Fund | 1642.41 | 0.43% | 1.78% | 3.33% | 4.06% | 6.27% | 15.95% | 64.24% | 13 Apr 2018 | 7.15 B |

| TRIM Kas 2 Kelas A | 1962.88 | 0.43% | 1.32% | 2.71% | 3.49% | 5.51% | 15.09% | 96.29% | 8 Apr 2008 | 5.41 T |

| Bahana Likuid Syariah Kelas G | 1245.07 | 0.41% | 1.27% | 2.59% | 3.34% | 5.32% | 14.57% | 24.51% | 12 Jul 2016 | 566.20 B |

Provided by Cermati Invest, last update 22 Agustus 2025

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana PENDAPATAN TETAP | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| Insight Renewable Energy Fund | 2432.73 | 1.46% | 3.11% | 5.14% | 6.11% | 9.43% | 22.09% | 143.27% | 22 Jun 2011 | 1.23 T |

| Insight Haji Syariah | 5378.92 | 1.16% | 3.07% | 5.05% | 6.26% | 9.64% | 24.61% | 437.89% | 13 Jan 2005 | 2.17 T |

| BRI Melati Pendapatan Utama | 1981.40 | 1.14% | 3.16% | 4.19% | 5.99% | 6% | 15.91% | 98.14% | 27 Sep 2012 | 41.12 B |

| BRI Brawijaya Abadi Pendapatan Tetap | 1471.06 | 1.03% | 3.90% | 4.95% | 8.41% | 7.65% | 20.95% | 47.11% | 25 Feb 2019 | 76.66 B |

| Syailendra Fixed Income Fund Kelas A | 2739.83 | 0.98% | 3.50% | 4.62% | 6.90% | 6.20% | 18.74% | 173.98% | 8 Dec 2011 | 112.75 B |

| BNI-AM Short Duration Bonds Index Kelas R1 | 1106.73 | 0.97% | 2.63% | 2.79% | 5.27% | 4.35% | - | 10.67% | 1 Sep 2022 | 90.52 B |

| HPAM Pendapatan Tetap Prima | 1084.56 | 0.92% | 1.04% | 1.50% | 2.40% | 2.80% | 6.55% | 8.46% | 29 Oct 2018 | 536.19 B |

| Danakita Obligasi Negara | 1175.32 | 0.91% | 2.65% | 3.80% | 5.82% | 6.26% | 16.45% | 17.53% | 26 Mar 2021 | 51.96 B |

| Trimegah Fixed Income Plan | 1189.34 | 0.87% | 1.32% | 1.92% | 3.30% | 3.65% | 6.25% | 18.93% | 23 May 2019 | 3.40 T |

| TRIM Dana Tetap 2 Kelas A | 3391.76 | 0.86% | 2.30% | 3.98% | 5.45% | 7.97% | 18.30% | 239.18% | 13 May 2008 | 2.38 T |

| Bahana Obligasi Ganesha Kelas D | 1025.84 | 0.83% | 1.74% | 2.61% | 2.84% | 4.72% | 3.74% | 2.58% | 26 Oct 2020 | 475.65 B |

| Eastspring Investments IDR High Grade Kelas A | 1682.90 | 0.45% | 2.13% | 1.85% | 3.23% | 0.96% | 11.88% | 68.29% | 9 Jan 2013 | 1.93 T |

| HPAM Government Bond | 1643.71 | -1.88% | 0.87% | 0.24% | 2.67% | 3.18% | 16.06% | 64.37% | 18 May 2016 | 22.52 B |

Provided by Cermati Invest, last update 22 Agustus 2025

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana CAMPURAN | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| Setiabudi Dana Campuran | 1585.16 | 5.60% | 6.12% | 13.51% | 10.01% | 7.59% | 23.41% | 58.52% | 25 Sep 2017 | 81.54 B |

| Syailendra Balanced Opportunity Fund | 3521.20 | 2.41% | 5.84% | 10.78% | 7.41% | 5.29% | 7.77% | 252.12% | 22 Apr 2008 | 64.24 B |

| Trimegah Balanced Absolute Strategy Kelas A | 1961.14 | 1.33% | 11.57% | 13.97% | 9.38% | 13.18% | 17.70% | 96.11% | 28 Dec 2018 | 267.29 B |

| TRIM Syariah Berimbang | 3528.93 | 1.26% | 10.13% | 11.31% | 6.34% | 14.31% | 14.75% | 252.89% | 27 Dec 2006 | 29.37 B |

| HPAM Flexi Indonesia Sehat Kelas A | 2233.58 | 0.82% | 9.72% | 17.01% | 15.73% | 10.84% | 32.27% | 123.36% | 2 Mar 2011 | 68.28 B |

| TRIM Kombinasi 2 | 2938.32 | 0.73% | 11.78% | 13.01% | 8.11% | 10.09% | 15.09% | 193.83% | 10 Nov 2006 | 23.63 B |

Provided by Cermati Invest, last update 22 Agustus 2025

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana SAHAM | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| SAM Indonesian Equity Fund | 2631.30 | 11.36% | 14.75% | 13.16% | 10.66% | 12.40% | 23.19% | 163.13% | 18 Oct 2011 | 1.03 T |

| Cipta Saham Unggulan | 3155.58 | 8.85% | 6.38% | 14.79% | 9.25% | 8.81% | 14.44% | 215.56% | 4 Dec 2018 | 37.31 B |

| Cipta Saham Unggulan Syariah | 2580.76 | 8.00% | 10.68% | 20.17% | 15.01% | 14.18% | 7.09% | 158.08% | 5 Sep 2018 | 14.99 B |

| Syailendra MSCI Indonesia Value Index Fund Kelas A | 1070.95 | 7.68% | 2.30% | 12.24% | 4.76% | -3.74% | -0.72% | 7.10% | 8 Jun 2018 | 694.68 B |

| Eastspring IDX ESG Leaders Plus Kelas A | 949.53 | 7.26% | -0.43% | 8.99% | 4.06% | -6.55% | -4.53% | -5.05% | 12 Jan 2022 | 131.20 B |

| UOBAM Indeks Bisnis-27 | 1353.45 | 6.16% | 2.66% | 13.08% | 4.71% | -5.91% | -0.05% | 35.34% | 15 Aug 2012 | 113.72 B |

| Principal Indo Domestic Equity Fund | 755.26 | 5.73% | 7.49% | 11.42% | 3.08% | -4.38% | -11.12% | -24.47% | 11 Apr 2013 | 17.12 B |

| Cipta Rencana Cerdas | 17000.56 | 5.21% | 1.00% | 7.01% | 1.35% | -3.96% | 0.31% | 1600.06% | 9 Jul 1999 | 57.84 B |

| BNI-AM Indeks IDX30 | 782.24 | 4.89% | 1.18% | 10.65% | 3.44% | -7.19% | -16.57% | -21.78% | 28 Dec 2017 | 1.07 T |

| Principal Index IDX30 Kelas O | 1267.83 | 4.86% | 1.04% | 10.61% | 3.37% | -4.93% | -11.10% | 26.78% | 7 Dec 2012 | 55.75 B |

| BNI-AM Inspiring Equity Fund | 919.62 | 4.65% | 3.43% | 9.20% | 1.32% | -6.66% | -13.38% | -8.04% | 7 Apr 2014 | 1.13 T |

| Batavia Dana Saham Optimal | 3049.64 | 4.33% | 0.91% | 4.53% | -1.79% | -5.42% | -3.93% | 204.96% | 19 Oct 2006 | 208.20 B |

| Principal Islamic Equity Growth Syariah | 1260.06 | 4.07% | 11.44% | 13.86% | 9.46% | 9.08% | 4.52% | 26.01% | 10 Sep 2007 | 77.67 B |

| TRIM Kapital | 11051.20 | 3.50% | 2.69% | 8.17% | 1.63% | -2.18% | -2.31% | 1005.12% | 19 Mar 1997 | 268.61 B |

| BRI Syariah Saham | 750.12 | 3.08% | 9.57% | 11.13% | 3.82% | 0.84% | -17.39% | -24.99% | 18 Sep 2014 | 13.06 B |

| TRIM Kapital Plus | 4589.52 | 3.05% | 3.54% | 8.86% | 3.73% | 7.02% | 14.03% | 358.95% | 18 Apr 2008 | 333.72 B |

| Principal Total Return Equity Fund Kelas O | 3347.23 | 2.99% | 9.31% | 13.56% | 6.32% | 3.09% | -5.75% | 234.72% | 1 Jul 2005 | 23.81 B |

| UOBAM Sustainable Equity Indonesia | 923.21 | 2.72% | 4.41% | 7.88% | -1.30% | -5.66% | -11.63% | -7.68% | 4 Aug 2021 | 102.95 B |

| Bahana Primavera 99 Kelas G | 1241.64 | 2.64% | 0.36% | 8.19% | 1.77% | -6.20% | -3.74% | 24.16% | 5 Sep 2014 | 17.92 B |

| Syailendra Equity Opportunity Fund | 4133.70 | 2.23% | 2.07% | 6.79% | 0.75% | 0.57% | 2.57% | 313.37% | 7 Jun 2007 | 135.23 B |

| Batavia Dana Saham Syariah | 1615.54 | 2.20% | 3.09% | 6.32% | 0.44% | 0.85% | -12.93% | 61.55% | 19 Jul 2007 | 19.60 B |

| TRIM Syariah Saham | 1941.26 | 1.11% | 13.85% | 13.82% | 5.89% | 11.88% | 0.22% | 94.13% | 27 Dec 2006 | 97.31 B |

| HPAM Ultima Ekuitas 1 | 3329.78 | 0.36% | 22.57% | 28.90% | 21.98% | 12.81% | 27.70% | 232.98% | 2 Nov 2009 | 912.81 B |

| Bahana Primavera Plus | 12169.93 | -0.96% | 4.19% | 12.53% | 4.08% | -7.04% | -19.17% | 1116.99% | 27 May 1997 | 49.60 B |

| HPAM Ekuitas Syariah Berkah | 2361.61 | -5.32% | 25.24% | 31.42% | 23.79% | 20.82% | 72.06% | 136.16% | 20 Jan 2020 | 1.53 T |

Provided by Cermati Invest, last update 22 Agustus 2025

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana USD | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| Eastspring Syariah Equity Islamic Asia Pacific USD Kelas A | 1.2715 | 5.26% | 29.11% | 30.60% | 35.95% | 29.83% | 20.47% | 27.15% | 28 Oct 2016 | 1.73 M |

| Eastspring Syariah Greater China Equity USD Kelas A | 0.6877 | 1.67% | 9.10% | 2.11% | 14.42% | 16.93% | -9.34% | -31.23% | 15 Jun 2020 | 6.35 M |

| BRI Melati Premium Dollar | 1.4386 | 1.04% | 4.09% | 3.89% | 5.30% | 0.81% | 6.71% | 43.86% | 19 Feb 2007 | 1.97 M |

| STAR Fixed Income Dollar | 1.0561 | 0.57% | 1.20% | 2.14% | 2.66% | 4.28% | 15.20% | 5.61% | 10 Jul 2017 | 15.14 M |

| Batavia USD Bond Fund | 1.0591 | 0.36% | 1.67% | 2.60% | 3.54% | 0.69% | - | 5.91% | 18 Oct 2022 | 69.98 M |

| Eastspring Syariah Fixed Income USD Kelas A | 0.9796 | 0.19% | 0.19% | 1.10% | 2.32% | 0.19% | 5.42% | -2.04% | 8 Mar 2021 | 3.44 M |

| Batavia Global ESG Sharia Equity USD | 1.2024 | -0.05% | 3.38% | 3.61% | 5.10% | 1.35% | 21.71% | 20.24% | 27 Jan 2021 | 7.83 M |

| BRI G20 Sharia Equity Fund Dollar | 1.2172 | -0.99% | 2.60% | 2.04% | 2.82% | -3.17% | 20.53% | 21.72% | 3 Dec 2019 | 1.38 M |

| Batavia Technology Sharia Equity USD | 1.2031 | -1.63% | 8.50% | 4.81% | 2.85% | 5.17% | 40.34% | 20.31% | 16 Feb 2022 | 68.23 M |

Provided by Cermati Invest, last update 22 Agustus 2025

Surat Utang/Obligasi

| NAMA OBLIGASI | ISIN | MATA UANG | KUPON | TANGGAL JATUH TEMPO | INDIKASI HARGA BELI | INDIKASI HARGA JUAL | INDIKASI YIELD | RATING |

|---|---|---|---|---|---|---|---|---|

| FR0087 | IDG000015207 | IDR | 6.50% | 15-Feb-31 | 101 | 100 | 6.28% | BBB |

| FR0097 | IDG000020900 | IDR | 7.13% | 15-Jun-43 | 102.3 | 101.3 | 6.90% | BBB |

| PBS005 | IDP000001505 | IDR | 6.75% | 15-Apr-43 | 98 | 97 | 6.95% | BBB |

| BWPT01BCN2 | IDA0001522B2 | IDR | 11.00% | 26-Feb-28 | 101 | 100 | 10.56% | idA- |

| INKP05BCN1 | IDA0001485B2 | IDR | 10.75% | 4-Oct-29 | 101.25 | 100.25 | 10.38% | idA+ |

Provided by Cermati Invest, last update 22 Agustus 2025

Event Calendar

| Monday, 25 August 2025 | Previous | Consensus | Forecast | ||

| 3:00 PM | DE | Ifo Business Climate AUG | 88.6 | 88.6 | 87.0 |

| 7:30 PM | US | Chicago Fed National Activity Index JUL | -0.1 | -0.2 | |

| 9:00 PM | US | New Home Sales JUL | 0.627M | 0.63M | 0.62M |

| 9:00 PM | US | New Home Sales MoM JUL | 0.60% | -1.10% | |

| 9:30 PM | US | Dallas Fed Manufacturing Index AUG | 0.9 | 0.2 | |

| Tuesday, 26 August 2025 | Previous | Consensus | Forecast | ||

| 7:30 PM | US | Durable Goods Orders MoM JUL | -9.30% | -4.00% | -2.50% |

| 7:30 PM | US | Durable Goods Orders Ex Transp MoM JUL | 0.20% | 0.10% | -0.40% |

| 7:30 PM | US | Fed Barkin Speech | |||

| 8:00 PM | US | S&P/Case-Shiller Home Price YoY JUN | 2.80% | 2.90% | 2.70% |

| 9:00 PM | US | CB Consumer Confidence AUG | 97.2 | 98.0 | 96.0 |

| Wednesday, 27 August 2025 | Previous | Consensus | Forecast | ||

| 3:30 AM | US | API Crude Oil Stock Change AUG/22 | -2.4M | ||

| 1:00 PM | DE | GfK Consumer Confidence SEP | -21.5 | -21.2 | -21.3 |

| 5:00 PM | GB | CBI Distributive Trades AUG | -34.0 | -33.0 | -30.0 |

| 6:00 PM | US | MBA 30-Year Mortgage Rate AUG/22 | 6.68% | ||

| 9:30 PM | US | EIA Crude Oil Stocks Change AUG/22 | -6.014M | ||

| 9:30 PM | US | EIA Gasoline Stocks Change AUG/22 | -2.72M | ||

| 11:00 PM | RU | Unemployment Rate JUL | 2.20% | 2.20% | 2.20% |

| 11:45 PM | US | Fed Barkin Speech | |||

| Thursday, 28 August 2025 | Previous | Consensus | Forecast | ||

| 8:30 AM | JP | BoJ Nakagawa Speech | |||

| 5:30 PM | IN | Industrial Production YoY JUL | 1.50% | 2.00% | |

| 5:30 PM | IN | Manufacturing Production YoY JUL | 3.90% | 2.90% | |

| 7:30 PM | US | GDP Growth Rate QoQ 2nd Est Q2 | -0.50% | 3.00% | 3.00% |

| 7:30 PM | US | Initial Jobless Claims AUG/23 | 235K | 236K | 237.0K |

| 9:00 PM | US | Pending Home Sales MoM JUL | -0.80% | 0.30% | -0.20% |

| 9:00 PM | US | Pending Home Sales YoY JUL | -2.80% | 0.40% | |

| Friday, 29 August 2025 | Previous | Consensus | Forecast | ||

| 5:00 AM | US | Fed Waller Speech | |||

| 6:30 AM | JP | Unemployment Rate JUL | 2.50% | 2.50% | 2.50% |

| 6:50 AM | JP | Industrial Production MoM Prel JUL | 2.10% | -1.00% | -0.50% |

| 6:50 AM | JP | Retail Sales YoY JUL | 2.00% | 1.80% | 2.20% |

| 12:00 PM | JP | Consumer Confidence AUG | 33.7 | 33.5 | 34.2 |

| 12:00 PM | JP | Housing Starts YoY JUL | -15.60% | -9.60% | -9.00% |

| 1:00 PM | DE | Retail Sales MoM JUL | 1.00% | 0.20% | 0.30% |

| 1:00 PM | DE | Retail Sales YoY JUL | 4.90% | 2.00% | |

| 1:00 PM | GB | Nationwide Housing Prices MoM AUG | 0.60% | 0.50% | |

| 1:00 PM | GB | Nationwide Housing Prices YoY AUG | 2.40% | 4.20% | |

| 2:55 PM | DE | Unemployed Persons AUG | 2.97M | 3.0M | |

| 2:55 PM | DE | Unemployment Rate AUG | 6.30% | 6.30% | 6.30% |

| 7:00 PM | DE | Inflation Rate YoY Prel AUG | 2.00% | 2.10% | 2.10% |

| 7:00 PM | DE | Inflation Rate MoM Prel AUG | 0.30% | 0.00% | 0.10% |

| 7:00 PM | IN | GDP Growth Rate YoY Q2 | 7.40% | 7.80% | |

| 7:30 PM | US | Core PCE Price Index MoM JUL | 0.30% | 0.30% | 0.20% |

| 7:30 PM | US | Personal Income MoM JUL | 0.30% | 0.40% | 0.30% |

| 7:30 PM | US | Personal Spending MoM JUL | 0.30% | 0.50% | 0.30% |

| 7:30 PM | US | PCE Price Index MoM JUL | 0.30% | 0.30% | 0.20% |

| 8:45 PM | US | Chicago PMI AUG | 47.1 | 45.3 | 46 |

| 9:00 PM | US | Michigan Consumer Sentiment Final AUG | 61.7 | 58.6 | 58.6 |

| Sunday, 31 August 2025 | Previous | Consensus | Forecast | ||

| 8:30 AM | CN | NBS Manufacturing PMI AUG | 49.3 | 49.7 | |

| 8:30 AM | CN | NBS Non Manufacturing PMI AUG | 50.1 | 50.4 | |

Source: BI, CNBC Indonesia, Bloomberg, Investing, Trading Economics, KSEI, Kaf Sekuritas, Cermati, Artha Investa Teknologi (AIT).

Disclaimer:

Dokumen ini dibuat hanya untuk memberikan informasi. Isi dokumen ini tidak boleh ditafsirkan sebagai suatu bentuk penawaran untuk membeli/menjual/dijadikan dasar dari atau yang dapat dijadikan pedoman sehubungan dengan suatu perjanjian atau komitmen apa pun atau suatu nasehat investasi.

Baca Juga Cermati Invest Weekly Update Sebelumnya:

- Cermati Invest Weekly Update 19 Agustus 2025

- Cermati Invest Weekly Update 11 Agustus 2025

- Cermati Invest Weekly Update 4 Agustus 2025

- Cermati Invest Weekly Update 28 Juli 2025