Cermati Invest Weekly Update 24 Maret 2025

Ulasan Pasar

| INDONESIA | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| IHSG | -3.95% | 6,258.18 |

| ISSI | -3.01% | 197.81 |

| IDX30 | -4.58% | 361.51 |

| FTSE Indonesia | -5.15% | 2,686.26 |

| MSCI Indonesia | -4.93% | 5,629.61 |

| USD/IDR | 0.94% | 16,498.40 |

Provided by Cermati Invest, last update 21 Maret 2025

IHSG & Saham Pekan Ini

IHSG (Indeks Harga Saham Gabungan), sempat trading halt nyaris 3 kali pada Selasa, 18 Maret 2025 dikarenakan IHSG ambruk (-)10% dalam sehari, dari 6465.224 ke 6011.842.

Trading halt (suspend, dihentikan perdagangannya) pernah terjadi saat krisis keuangan global 2008 (krisis keuangan Amerika, market bubble) dan Maret 2020 saat awal pademi Covid di Indonesia.

Ambruknya IHSG sekaligus menutup semua support gap yang ada dan meninggalkan resistance gap di 6258.17, 6471.94, 6647.41 dan 7324.78, sehingga IHSG berpotensi rebound untuk menutupnya walau tetap dalam pola channel tren turun.

Rata-rata performa indeks konstituen ambruk/minus, tetapi Indeks Saham Syariah Indonesia (ISSI) masih lebih baik dari IHSG dan lainnya. Dari sisi sektoral, indeks Teknologi masih positif, walau arahnya cenderung turun.

Pergerakan Rupiah

Pekan ini nilai tukar 1 dolar Amerika berkisar Rp16.460 - Rp16.680.

| COMMODITY | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| XAU/USD | 1.28% | 3,023.28 |

| Crude Oil WTI | 1.93% | 68.18 |

| Palm Oil c3 F | 0.00% | 4,480.00 |

| Natural Gas | -4.19% | 3.94 |

| Newcastle Coal | -3.72% | 97.00 |

| Nickel | -2.49% | 16,108.00 |

| Tin | 0.00% | 32,581.00 |

| Copper | 0.77% | 9,870.70 |

| Aluminium | -2.08% | 2,626.20 |

| US Soybeans | 1.05% | 1,009.75 |

| Silver | -2.59% | 33.55 |

Provided by Cermati Invest, last update 21 Maret 2025

Emas

Setelah beberapa pekan harga emas selalu naik dan mencetak all time high (US$3058), pekan lalu akhirnya ditutup turun ke US$2999 harganya. Pekan ini harga emas dunia cenderung turun ke kisaran US$2983 - US$3057. Arah pergerakan harga jangka panjang masih naik (uptrend).

Setelah all time high pada pekan lalu, pekan ini harga emas diperkirakan bergerak dalam kisaran Rp1.580.000 - RP1.640.000. Performa harga emas yang naik terus, sangatlah menarik sebagai salah satu aset investasi, jadi setiap kali ada koreksi (turun), tidak perlu lama harga emas segera kembali strong (kuat). Jadi, gunakan kesempatan tersebut untuk membeli emas. Harga emas fisik biasanya lebih tinggi Rp60.000 - Rp100.000 per gramnya dari harga emas digital.

| REGIONAL | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| Dow Jones | 1.20% | 41,985.35 |

| S&P 500 | 0.51% | 5,667.56 |

| FTSE 100 | 0.17% | 8,646.79 |

| DAX | -0.41% | 22,891.68 |

| Nikkei 225 | 1.68% | 37,677.06 |

| Hang Seng | -1.13% | 23,689.72 |

| CSI 300 | -2.29% | 3,914.70 |

| KOSPI | 2.99% | 2,643.13 |

Provided by Cermati Invest, last update 21 Maret 2025

Reksa Dana & Surat Berharga

Reksa dana, belum ada yang menarik, sementara dapat membeli reksa dana pasar uang dan beberapa reksa dana pendapatan tetap yang memiliki kecenderungan naik dan performa lebih dari 5% per tahun (lihat dalam tabel reksa dana pasar uang dan pendapatan tetap). Jangan lupa, akhir kuartal 1 ini reksa dana pendapatan tetap Trimegah Fixed Income Plan dan HPAM Pendapatan Tetap Prima membagikan dividen, sehingga terlihat turun, waktu terbaik untuk membeli kedua reksa dana ini adalah setiap awal kuartal. Untuk reksa dana saham, beberapa yang positif masih reksa dana dalam mata uang dolar Amerika (USD).

Surat berharga, dapat cermati beberapa obligasi yang kami pilihkan dalam tabel. Jelang momen Lebaran 2025, pemerintah menawarkan Sukuk Tabungan 2025 (ST014) dengan masa penawaran 7 Maret - 16 April 2025, tingkat imbalan/kupon mengambang (floating with floor) yang dibayarkan setiap tanggal 10 (hari kerja). Sukuk Tabungan ini ada 2 seri, yaitu: ST014-T2 dengan tenor 2 tahun kupon 6.50% per tahun dan Green Sukuk Seri ST014-T4 dengan tenor 4 tahun kupon 6.60% per tahun.

Indeks Saham Anjlok, Tren Suku Bunga Belum Turun, Simak Dampaknya ke Pasar Investasi

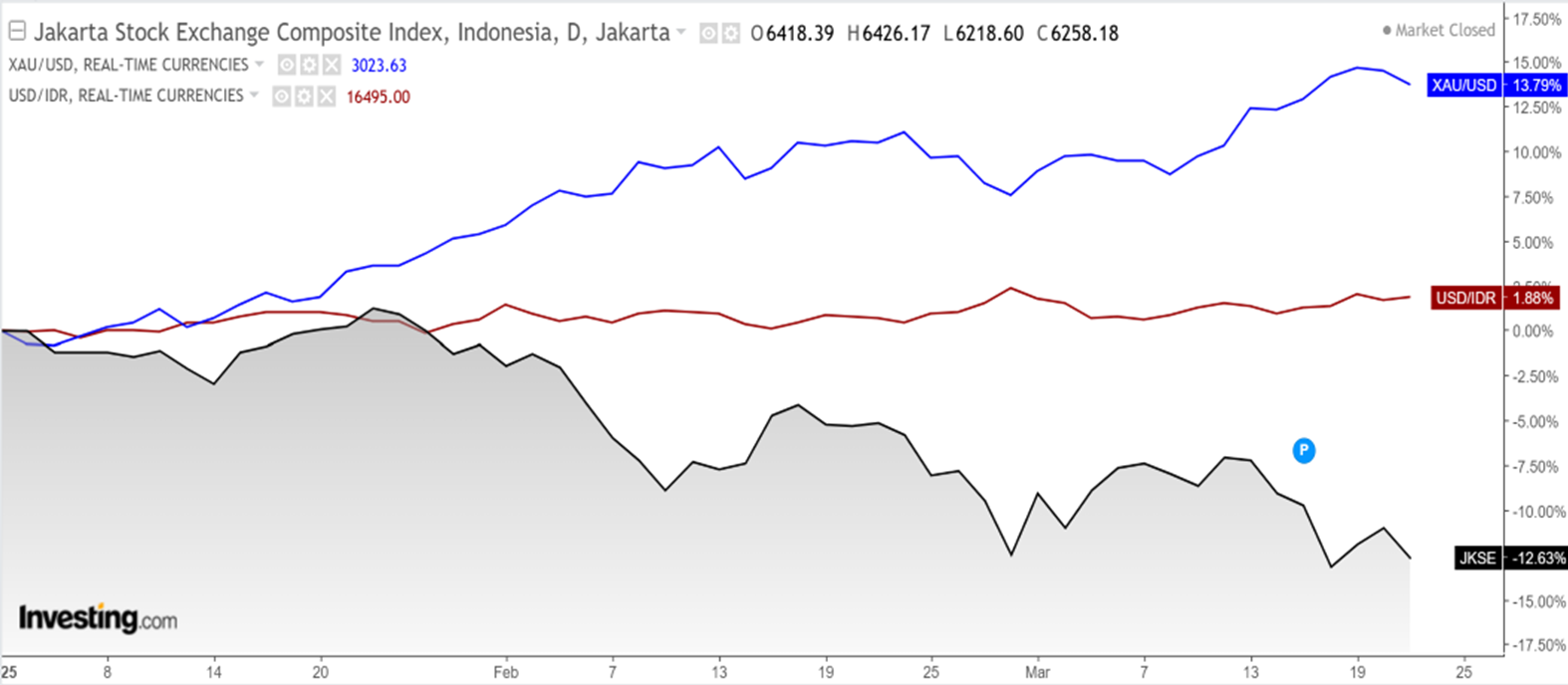

Indeks Harga Saham Gabungan (IHSG) pekan lalu anjlok 3.95% ke level 6.258,18 hingga penutupan Jumat (21/3/2025). Koreksi ini memperpanjang tren negatif sepanjang 2025, dengan IHSG telah melemah 11.61% sejak awal tahun. Bahkan, pada perdagangan Selasa (18/3/2025), IHSG sempat mengalami pemberhentian sementara setelah turun hingga 7.11% ke level 6.011,84. Investor asing terus menarik dananya dari pasar saham domestik. Aksi jual dari investor asing selama sebulan terakhir mencapai Rp19,85 triliun, sementara sepanjang tahun ini dana asing yang keluar telah mencapai Rp30,82 triliun. Nilai tukar rupiah juga melemah terhadap dolar Amerika Serikat (AS), ditutup di Rp16.495/US$, rupiah melemah usai Rapat Dewan Gubernur Bank Indonesia (RDG BI) mengumumkan bahwa BI menahan suku bunganya di bulan ini di level 5.75%.

Ini sejalan dengan perkiraan inflasi ke depan dan stabilitas nilai tukar rupiah. Keputusan ini konsisten dengan upaya menjaga perkiraan inflasi 2025-2026 dalam sasaran 2.5 plus minus 1%, stabilitas rupiah di tengah ketidakpastian global dan turut mendorong pertumbuhan ekonomi yang berkelanjutan. Sementara, bank sentral Amerika Serikat/The Fed mempertahankan suku bunga pada level 4.25% hingga 4.5%, sesuai dengan ekspektasi pasar. Meskipun demikian, The Fed tetap memproyeksikan dua kali pemangkasan suku bunga dalam sisa tahun ini. Bursa saham domestik memasuki pekan terakhir sebelum libur panjang Lebaran. Dengan hanya empat hari perdagangan tersisa, aktivitas di pasar diperkirakan akan melambat seiring dengan fokus investor yang mulai beralih ke libur panjang.

COMPOSITE INDEX compare to USDIDR & GOLD since 2025 (YtD)

Reksa Dana

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana PASAR UANG | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| Insight Retail Cash Fund | 1597.063 | 0.47% | 1.38% | 2.88% | 1.19% | 5.99% | 14.95% | 59.71% | 13 Apr 2018 | 17.73 B |

| Insight Money Syariah | 1651.958 | 0.45% | 1.41% | 2.90% | 1.20% | 5.94% | 16.42% | 65.20% | 30 Sep 2015 | 191.33 B |

| Setiabudi Dana Pasar Uang | 1522.910 | 0.44% | 1.39% | 2.79% | 1.20% | 5.52% | 14.74% | 52.29% | 23 Dec 2016 | 658.11 B |

| TRIM Kas 2 Kelas A | 1919.284 | 0.43% | 1.39% | 2.73% | 1.19% | 5.37% | 14.19% | 91.93% | 8 Apr 2008 | 4.18 T |

| Bahana Likuid Syariah Kelas G | 1218.740 | 0.42% | 1.33% | 2.65% | 1.15% | 5.27% | 13.38% | 21.87% | 12 Jul 2016 | 587.59 B |

| BRI Seruni Pasar Uang Syariah | 1346.476 | 0.41% | 1.43% | 2.53% | 1.26% | 5.38% | 13.61% | 34.65% | 19 Jul 2018 | 552.98 B |

| Cipta Dana Cash | 1730.310 | 0.41% | 1.54% | 2.86% | 1.33% | 5.55% | 15.37% | 73.03% | 8 Jun 2015 | 297.83 B |

| BRI Seruni Pasar Uang III | 1778.281 | 0.40% | 1.35% | 2.71% | 1.16% | 5.51% | 13.30% | 77.83% | 16 Feb 2010 | 1.91 T |

| Trimegah Kas Syariah | 1441.960 | 0.40% | 1.30% | 2.62% | 1.11% | 5.29% | 14.24% | 44.20% | 30 Dec 2016 | 1.63 T |

| Danakita Stabil Pasar Uang | 1627.670 | 0.39% | 1.28% | 2.50% | 1.11% | 4.92% | 13.71% | 62.77% | 10 Sep 2015 | 83.86 B |

| HPAM Ultima Money Market | 1627.286 | 0.39% | 1.22% | 2.57% | 1.05% | 5.17% | 14.42% | 62.73% | 10 Jun 2015 | 679.93 B |

| Bahana Dana Likuid Kelas G | 1885.170 | 0.38% | 1.07% | 2.32% | 0.93% | 4.77% | 11.77% | 88.52% | 27 May 1997 | 3.50 T |

| Sequis Liquid Prima | 1449.016 | 0.38% | 1.23% | 2.43% | 1.07% | 4.83% | 12.20% | 44.90% | 8 Sep 2016 | 168.54 B |

| Batavia Dana Kas Maxima | 1811.200 | 0.36% | 1.17% | 2.31% | 1% | 4.61% | 11.61% | 81.12% | 20 Feb 2007 | 12.16 T |

| BNI-AM Dana Likuid Kelas A | 1918.550 | 0.36% | 1.20% | 2.33% | 1.04% | 4.58% | 11.49% | 91.86% | 27 Dec 2012 | 283.57 B |

| Syailendra Dana Kas | 1701.166 | 0.32% | 1.19% | 2.47% | 1.02% | 4.98% | 13.87% | 70.12% | 12 Jun 2015 | 2.03 T |

Provided by Cermati Invest, last update 21 Maret 2025

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana PENDAPATAN TETAP | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| UOBAM Inovasi Obligasi Nasional | 1053.353 | 1.25% | 2.57% | 4.49% | 3.43% | 6.15% | 12.68% | 5.34% | 12 Jan 2021 | 78.18 B |

| Insight Renewable Energy Fund | 2327.366 | 0.59% | 1.73% | 4.14% | 1.51% | 7.59% | 19.84% | 132.74% | 22 Jun 2011 | 1.46 T |

| Insight Haji Syariah | 5149.375 | 0.57% | 1.96% | 3.99% | 1.72% | 7.88% | 22.99% | 414.94% | 13 Jan 2005 | 2.28 T |

| HPAM Pendapatan Tetap Prima | 1074.151 | 0.53% | 0.42% | 1.16% | 1.42% | 2.07% | 6.43% | 7.42% | 29 Oct 2018 | 294.64 B |

| TRIM Dana Tetap 2 Kelas A | 3272.960 | 0.33% | 1.89% | 3.18% | 1.76% | 6.83% | 16.20% | 227.30% | 13 May 2008 | 736.61 B |

| Trimegah Fixed Income Plan | 1170.841 | 0.33% | 0.81% | 1.04% | 1.69% | 2.31% | 5.85% | 17.08% | 23 May 2019 | 2.30 T |

| Bahana Obligasi Ganesha Kelas D | 1000.630 | 0.09% | 0.44% | 1.09% | 0.31% | 2.01% | 1.17% | 0.06% | 26 Oct 2020 | 316.06 B |

| SAM Sukuk Syariah Sejahtera | 2429.802 | -0.43% | 0.08% | -1.27% | 1.16% | -0.61% | -1.16% | 142.98% | 29 Oct 1997 | 46.47 B |

| Syailendra Pendapatan Tetap Premium | 1816.477 | -0.44% | 0.70% | 0.51% | 0.51% | 3.15% | 17.32% | 81.65% | 27 Mar 2017 | 2.97 T |

| Batavia Dana Obligasi Ultima | 2898.200 | -0.63% | 0.73% | -1.30% | 0.41% | -0.34% | -0.34% | 189.82% | 20 Dec 2006 | 919.63 B |

| Syailendra Fixed Income Fund Kelas A | 2588.550 | -1.16% | 1.45% | -1.03% | 1% | 2.21% | 12.24% | 158.86% | 8 Dec 2011 | 97.47 B |

| BRI Brawijaya Abadi Pendapatan Tetap | 1380.599 | -1.51% | 2.33% | -0.81% | 1.75% | 3.23% | 14.02% | 38.06% | 25 Feb 2019 | 2.60 B |

| Eastspring Investments IDR High Grade Kelas A | 1624.020 | -1.71% | 0.20% | -3.56% | -0.38% | -1.64% | 6.89% | 62.40% | 9 Jan 2013 | 621.28 B |

| HPAM Government Bond | 1589.569 | -3.06% | -0.08% | -1.75% | -0.71% | 1.94% | 12.52% | 58.96% | 18 May 2016 | 17.88 B |

Provided by Cermati Invest, last update 21 Maret 2025

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana CAMPURAN | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| HPAM Flexi Indonesia Sehat Kelas A | 1803.930 | -5.50% | -4.91% | -12.79% | -6.53% | -1.19% | -4.09% | 80.39% | 2 Mar 2011 | 74.29 B |

| Batavia Dana Dinamis | 8095.290 | -6.90% | -8.89% | -16.69% | -10.81% | -14.79% | -9.71% | 709.53% | 3 Jun 2002 | 42.72 B |

| Syailendra Balanced Opportunity Fund | 2869.600 | -9.72% | -9.47% | -14.50% | -12.47% | -11.32% | -11.43% | 186.96% | 22 Apr 2008 | 63.72 B |

| SAM Mutiara Nusantara Nusa Campuran | 1406.476 | -12.59% | -16.38% | -28.37% | -18.49% | -27.89% | -21.89% | 40.65% | 21 Dec 2017 | 18.47 B |

| Trimegah Balanced Absolute Strategy Kelas A | 1463.090 | -14.97% | -16.60% | -20.54% | -18.40% | -14.51% | -13.84% | 46.31% | 28 Dec 2018 | 257.06 B |

| TRIM Kombinasi 2 | 2196.380 | -15.52% | -17.35% | -21.72% | -19.19% | -16.87% | -16.87% | 119.64% | 10 Nov 2006 | 18.96 B |

| TRIM Syariah Berimbang | 2677.310 | -15.55% | -17.46% | -18.51% | -19.33% | -12% | -11.38% | 167.73% | 27 Dec 2006 | 21.35 B |

Provided by Cermati Invest, last update 21 Maret 2025

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana SAHAM | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| Cipta Saham Unggulan | 2643.180 | -3.85% | -6.56% | -12.47% | -8.49% | -9.86% | 8.23% | 164.32% | 4 Dec 2018 | 37.19 B |

| Cipta Saham Unggulan Syariah | 2008.620 | -6.47% | -9.16% | -16.91% | -10.49% | -10.71% | -6.05% | 100.86% | 5 Sep 2018 | 13.88 B |

| Cipta Rencana Cerdas | 14537.090 | -8.50% | -11.09% | -22.26% | -13.33% | -20.70% | -13.90% | 1353.71% | 9 Jul 1999 | 54.79 B |

| TRIM Kapital | 9176.190 | -10.18% | -13.31% | -21.21% | -15.62% | -24.04% | -18.73% | 817.62% | 19 Mar 1997 | 274.78 B |

| HPAM Ekuitas Syariah Berkah | 1612.935 | -10.24% | -15.36% | -25.10% | -15.45% | -6.27% | 22.69% | 61.29% | 20 Jan 2020 | 1.57 T |

| Batavia Dana Saham | 50448.700 | -10.75% | -14.64% | -24.20% | -17.03% | -23.37% | -19.47% | 4944.87% | 16 Dec 1996 | 1749.35 B |

| Batavia Dana Saham Optimal | 2596.040 | -11.02% | -13.68% | -22.78% | -16.40% | -21.35% | -17.03% | 159.60% | 19 Oct 2006 | 246.49 B |

| Bahana Primavera Plus | 9591.570 | -11.31% | -15.22% | -28.38% | -17.97% | -28.30% | -31.32% | 859.16% | 27 May 1997 | 40.36 B |

| HPAM Ultima Ekuitas 1 | 2285.441 | -11.53% | -14.15% | -27.17% | -16.28% | -21.42% | -19.46% | 128.54% | 2 Nov 2009 | 958.77 B |

| TRIM Kapital Plus | 3681.260 | -12.68% | -14.49% | -19.46% | -16.80% | -17.41% | -8.88% | 268.13% | 18 Apr 2008 | 492.66 B |

| Syailendra Equity Opportunity Fund | 3366.210 | -13.04% | -15.16% | -21.54% | -17.96% | -20.81% | -15.15% | 236.62% | 7 Jun 2007 | 136.00 B |

| Principal Total Return Equity Fund Kelas O | 2540.800 | -13.80% | -16.75% | -25.63% | -19.29% | -26.58% | -29.99% | 154.08% | 1 Jul 2005 | 21.21 B |

| SAM Indonesian Equity Fund | 1923.140 | -17.29% | -15.41% | -19.69% | -19.12% | -21.22% | -7.08% | 92.31% | 18 Oct 2011 | 900.29 B |

Provided by Cermati Invest, last update 21 Maret 2025

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana USD | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| Eastspring Syariah Greater China Equity USD Kelas A | 0.6564 | 0.91% | 7.60% | 12.51% | 9.21% | 6.98% | -19.45% | -34.36% | 15 Jun 2020 | 5.38 M |

| BRI Melati Premium Dollar | 1.3945 | 0.70% | 1.82% | -3.45% | 2.07% | 1.31% | 1.13% | 39.45% | 19 Feb 2007 | 2.02 M |

| Batavia USD Bond Fund | 1.0393 | 0.68% | 1.58% | -1.89% | 1.60% | 0.69% | - | 3.93% | 18 Oct 2022 | 15.80 M |

| Eastspring Syariah Fixed Income USD Kelas A | 0.9739 | 0.52% | 1.72% | -1.18% | 1.72% | 2.24% | 2.10% | -2.61% | 8 Mar 2021 | 1.32 M |

| STAR Fixed Income Dollar | 1.0379 | 0.38% | 1.02% | 2.02% | 0.89% | 6.55% | 11.99% | 3.79% | 10 Jul 2017 | 8.76 M |

| Eastspring Syariah Equity Islamic Asia Pacific USD Kelas A | 0.9244 | -3.93% | -1.24% | -5.62% | -1.16% | -4.41% | -17.21% | -7.56% | 28 Oct 2016 | 2.51 M |

| BRI G20 Sharia Equity Fund Dollar | 1.1554 | -4.47% | -3.49% | -7.34% | -2.40% | -6.19% | 7.74% | 15.54% | 3 Dec 2019 | 1.52 M |

| Batavia Global ESG Sharia Equity USD | 1.1239 | -4.51% | -2.86% | -5.73% | -1.77% | -2.70% | 6.20% | 12.39% | 27 Jan 2021 | 10.35 M |

| Batavia Technology Sharia Equity USD | 1.0400 | -12.14% | -12.25% | -7.83% | -11.10% | -5.33% | 3.14% | 4% | 16 Feb 2022 | 143.30 M |

Provided by Cermati Invest, last update 21 Maret 2025

Surat Utang/Obligasi

| NAMA OBLIGASI | ISIN | MATA UANG | KUPON | TANGGAL JATUH TEMPO | INDIKASI HARGA BELI | INDIKASI HARGA JUAL | INDIKASI YIELD | RATING |

| FR0087 | IDG000015207 | IDR | 6.50% | 15-Feb-31 | 99.2 | 98.2 | 6.66% | BBB |

| FR0097 | IDG000020900 | IDR | 7.13% | 15-Jun-43 | 101.15 | 100.15 | 7.01% | BBB |

| PBS005 | IDP000001505 | IDR | 6.75% | 15-Apr-43 | 97.35 | 96.35 | 7.01% | BBB |

| INKP02CCN1 | IDA0001183C1 | IDR | 11.00% | 30-Sep-26 | 101.25 | 100.25 | 9.17% | idA+ |

| LPPI02ACN1 | IDA0001331A0 | IDR | 10.50% | 4-Jul-26 | 101.25 | 100.25 | 9.61% | idA |

Provided by Cermati Invest, last update 21 Maret 2025

Event Calendar

| Monday, 24 March 2025 | Previous | Consensus | Forecast | ||

| 7:30 AM | JP | Jibun Bank Manufacturing PMI Flash MAR | 49.0 | 49.2 | 49.4 |

| 12:00 PM | IN | HSBC Services PMI Flash MAR | 59.0 | 59.4 | |

| 3:30 PM | DE | HCOB Manufacturing PMI Flash MAR | 46.5 | 47.7 | 48.0 |

| 4:30 PM | GB | S&P Global Manufacturing PMI Flash MAR | 46.9 | 47.3 | 47.0 |

| 4:30 PM | GB | S&P Global Services PMI Flash MAR | 51.0 | 51.2 | 51.1 |

| 7:30 PM | US | Chicago Fed National Activity Index FEB | -0.03 | 0.08 | |

| 8:45 PM | US | S&P Global Manufacturing PMI Flash MAR | 52.7 | 51.9 | 52.1 |

| Tuesday, 25 March 2025 | Previous | Consensus | Forecast | ||

| 12:45 AM | US | Fed Bostic Speech | |||

| 1:00 AM | GB | BoE Gov Bailey Speech | |||

| 2:10 AM | US | Fed Barr Speech | |||

| 4:00 AM | KR | Consumer Confidence MAR | 95.2 | 98.0 | |

| 6:50 AM | JP | BoJ Monetary Policy Meeting Minutes | |||

| 4:00 PM | DE | Ifo Business Climate MAR | 85.2 | 87.0 | 89.1 |

| 6:00 PM | GB | CBI Distributive Trades MAR | -23.0 | -28.0 | -30.0 |

| 7:40 PM | US | Fed Kugler Speech | |||

| 8:00 PM | US | S&P/Case-Shiller Home Price YoY JAN | 4.5% | 4.6% | 4.5% |

| 8:05 PM | US | Fed Williams Speech | |||

| 9:00 PM | US | CB Consumer Confidence MAR | 98.3 | 94.0 | 94.4 |

| 9:00 PM | US | New Home Sales FEB | 0.657M | 0.68M | 0.66M |

| Wednesday, 26 March 2025 | Previous | Consensus | Forecast | ||

| 3:30 AM | US | API Crude Oil Stock Change MAR/21 | 4.593M | ||

| 4:00 AM | KR | Business Confidence MAR | 65.0 | 68.0 | |

| 2:00 PM | GB | Inflation Rate YoY FEB | 3.0% | 2.9% | 3.0% |

| 2:00 PM | GB | Core Inflation Rate YoY FEB | 3.7% | 3.6% | 3.5% |

| 2:00 PM | GB | Inflation Rate MoM FEB | -0.1% | 0.3% | |

| 7:30 PM | US | Durable Goods Orders MoM FEB | 3.1% | -0.7% | -1.2% |

| 9:00 PM | US | Fed Kashkari Speech | |||

| 9:10 PM | US | Fed Musalem Speech | |||

| GB | Spring Economic Statement | ||||

| Thursday, 27 March 2025 | Previous | Consensus | Forecast | ||

| 7:30 PM | US | GDP Growth Rate QoQ Final Q4 | 3.1% | 2.3% | 2.3% |

| 7:30 PM | US | GDP Price Index QoQ Final Q4 | 1.9% | 2.4% | 2.4% |

| 7:30 PM | US | Goods Trade Balance Adv FEB | $-153.26B | $-134.6B | $-136.0B |

| 7:30 PM | US | Initial Jobless Claims MAR/22 | 223K | 225K | 225.0K |

| 7:30 PM | US | Wholesale Inventories MoM Adv FEB | 0.8% | 0.4% | 0.6% |

| 9:00 PM | US | Pending Home Sales MoM FEB | -4.6% | 2.9% | |

| 9:00 PM | US | Pending Home Sales YoY FEB | -5.2% | -3.7% | |

| Friday, 28 March 2025 | Previous | Consensus | Forecast | ||

| 3:30 AM | US | Fed Barkin Speech | |||

| 6:50 AM | JP | BoJ Summary of Opinions | |||

| 12:00 PM | JP | Housing Starts YoY FEB | -4.6% | -0.8% | |

| 2:00 PM | DE | GfK Consumer Confidence APR | -24.7 | -22.2 | -22.0 |

| 2:00 PM | GB | Retail Sales MoM FEB | 1.7% | -0.3% | -0.2% |

| 2:00 PM | GB | Current Account Q4 | £-18.1B | £ -16.7B | £ -16.5B |

| 2:00 PM | GB | Goods Trade Balance JAN | £-17.45B | £-16.8B | £-17.1B |

| 2:00 PM | GB | Retail Sales YoY FEB | 1.0% | 1.2% | |

| 3:55 PM | DE | Unemployment Change MAR | 5K | 10K | 6.0K |

| 3:55 PM | DE | Unemployment Rate MAR | 6.2% | 6.2% | 6.2% |

| 7:30 PM | US | Core PCE Price Index MoM FEB | 0.3% | 0.3% | 0.4% |

| 7:30 PM | US | Personal Income MoM FEB | 0.9% | 0.4% | 0.3% |

| 7:30 PM | US | Personal Spending MoM FEB | -0.2% | 0.6% | 0.5% |

| 7:30 PM | US | PCE Price Index MoM FEB | 0.3% | 0.3% | 0.4% |

| 9:00 PM | US | Michigan Consumer Sentiment Final MAR | 64.7 | 57.9 | 57.9 |

| 11:15 PM | US | Fed Barr Speech | |||

| Saturday, 29 March 2025 | Previous | Consensus | Forecast | ||

| 2:30 AM | US | Fed Bostic Speech | |||

Source: BI, CNBC Indonesia, Bloomberg, Investing, Trading Economics, KSEI, Cermati, Artha Investa Teknologi (AIT)

Disclaimer:

Dokumen ini dibuat hanya untuk memberikan informasi. Isi dokumen ini tidak boleh ditafsirkan sebagai suatu bentuk penawaran untuk membeli/menjual/dijadikan dasar dari atau yang dapat dijadikan pedoman sehubungan dengan suatu perjanjian atau komitmen apa pun atau suatu nasehat investasi.

Baca Juga Cermati Invest Weekly Update Sebelumnya:

- Cermati Invest Weekly Update 17 Maret 2025

- Cermati Invest Weekly Update 10 Maret 2025

- Cermati Invest Weekly Update 3 Maret 2025

- Cermati Invest Weekly Update 24 Februari 2025